What the Smart Money Doesn’t Know

15 September 2021

Share with a Friend

All fields required where indicated (*)Many people have been buying stocks in 2021, celebrating the partial retreat of the pandemic and reopening of economies.

ETFs tell the story well. By the end of August, net inflows reached US$834 billion globally, according to ETFGI – higher than the US$762 billion taken in all of 20201.

But with stocks near all-time highs, I detect a touch of nervousness in the air. Investors are asking me whether they should be selling. Is it time to take my profits? After all, the MSCI World index of leading stocks has nearly doubled since their March 2020 lows, when Covid-19 spooked markets.

The answer to these questions is never straightforward, and even the smartest money is often wrong footed. For much of 2021, the view has been that with interest rates so low, there is no alternative to stocks. So, high equity values are justified. In fact, there could be room for them to move still higher.

Certainly, many of the world’s biggest companies have recently reported bumper profits, vindicating the buoyant markets. And, in the past, these stock price rallies have often carried on for far longer than anyone thought possible.

Yet, there are notes of caution. Only this week, a survey of over 550 market professionals conducted by Deutsche Bank predicted a 5%-10% sell-off in markets by the end of the year.2

Dancing with bulls and bears

What this means for the average investor is, in my opinion, that you should dance with both the bulls and the bears – in other words, stay invested, do not try to time the markets and rely on the long-term upwards movement (even though, obviously, this cannot be guaranteed).

Performance of the VanEck Global Equal Weight UCITS ETF

Past performance is not a reliable indicator for future performance. Source: VanEck. Data for the period 14/04/2011 (ETF inception) – 14/09/2021.

However, with stock prices high, and some uncertainty creeping in, I believe it’s a good time to re-examine how much risk you’re taking in your investment portfolio. Indeed, when stocks rise I always rebalance my portfolio, selling some stocks and reinvesting in bonds or real estate and vice versa. In this way, I let my portfolio instead of my view on the market dictate my investment decisions.

Our ETFs offer a wide range of options. If you’re nervous about inflation, you can consider adding exposure to the VanEck Gold Miners UCITS ETF that has the eternal qualities of gold as an inflation hedge, or the VanEck Global Real Estate UCITS ETF. Real estate has also long been an inflation hedge. Do remember, as always, that investors should consider risks before investing, such as volatility risk, currency risk and sector concentration risk.

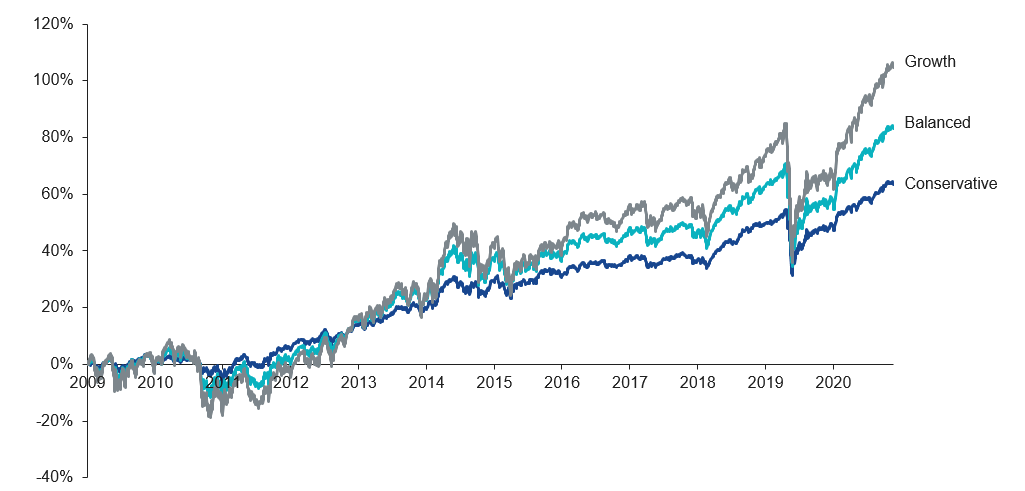

For anyone who wants an investment that rebalances automatically, dictated by the market instead of someone’s view on the market, our VanEck Multi-Asset UCITS ETFs – spread across equities, bonds and real estate companies –automatically rebalance their positions if equities rise. Since they were launched nearly 12 years ago, they have served investors well. Do note that also these ETFs contain risks, such as credit, interest rate and equity market risk.

Performance of the VanEck Multi-Asset Allocation UCITS ETFs

Past performance is not a reliable indicator for future performance. Source: VanEck. Data for the period 14/12/2009 (ETF inception) – 14/09/2021.

Indeed, the flexibility of investing in ETFs – and ease of trading between them – could give you an edge on the smart money. By being informed about the products you invest in, you can accept what you don’t know and finesse your risks at the margin, successfully dancing with both the bulls and the bears.

1Source: Wealthprofessional.

2Source: Reuters.

VanEck Global Equal Weight UCITS ETF, VanEck Multi-Asset Conservative Allocation UCITS ETF, VanEck Multi-Asset Balanced Allocation UCITS ETF and VanEck Multi-Asset Growth Allocation UCITS ETF (the “ETFs”), sub-funds of VanEck ETFs N.V., are managed by VanEck Asset Management B.V. and registered with the AFM and track an equity index. The value of the ETF’s assets may fluctuate heavily as a result of the investment strategy. If the underlying index falls in value, the ETFs will also lose value.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the local information agent details to be found on the website.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Discrete performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on.

The Dutch domiciled ETFs use a gross reinvestment index as opposed to many other ETFs and investment funds that use a net reinvestment index. Comparing with a gross reinvestment index is the purest form since it considers that Dutch investors can reclaim the dividend tax withheld. Please note that the performance includes income distributions gross of Dutch withholding tax because Dutch investors receive a refund of the 15% Dutch withholding tax levied. Different investor types and investors from other jurisdictions may not be able to achieve the same level of performance due to their tax status and local tax rules.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2024

15 April 2024

15 March 2024

14 March 2024