Defensive Stance Continues

May 22, 2020

Read Time 4 MIN

The VanEck Vectors® Real Asset Allocation ETF (RAAX®) uses a data-driven, rules-based process that leverages over 50 indicators (technical, macroeconomic and fundamental, commodity price, and sentiment) to allocate across 12 individual real asset segments in five broad real asset sectors. These objective indicators identify the segments with positive expected returns. Then, using correlation and volatility, an optimization process determines the weight to these segments with the goal of creating a portfolio with maximum diversification while reducing risk. The expanded PDF version of this commentary can be downloaded here.

Overview

The VanEck Vectors Real Asset Allocation ETF (“RAAX”) returned +0.67% versus -1.54% for the Bloomberg Commodity Index and +7.21% for its custom blended benchmark.

RAAX held a safe and stable portfolio of approximately a 25% allocation to gold and a 75% allocation to U.S. Treasury bills based on the extreme risk in the market. We are in the midst of the fastest, most extreme economic contraction in modern history. U.S. unemployment is expected to reach 17% by June and a monthly Wall Street Journal survey found economists expect GDP to shrink by 6.6% this year.

| Average Annual Total Returns (%) as of April 30, 2020 | ||||

| 1 Mo† | YTD† | 1 Year | Life | |

| (04/09/18) | ||||

| RAAX (NAV) | 0.67 | -25.27 | -21.15 | -11.05 |

| RAAX (Share Price) | 0.26 | -25.39 | -21.36 | -11.12 |

| Bloomberg Commodity Index* | -1.54 | -24.47 | -23.18 | -14.76 |

| Blended Real Asset Index* | 7.21 | -22.53 | -18.66 | -8.69 |

| Average Annual Total Returns (%) as of March 31, 2020 | ||||

| 1 Mo† | YTD† | 1 Year | Life | |

| (04/09/18) | ||||

| RAAX (NAV) | -17.83 | -25.77 | -22.48 | -11.78 |

| RAAX (Share Price) | -17.54 | -25.58 | -22.37 | -11.67 |

| Bloomberg Commodity Index* | -12.81 | -23.29 | -22.31 | -14.66 |

| Blended Real Asset Index* | -17.20 | -27.74 | -24.01 | -12.10 |

The table presents past performance which is no guarantee of future results and which may be lower or higher than current performance. Returns reflect temporary contractual fee waivers and/or expense reimbursements. Had the ETF incurred all expenses and fees, investment returns would have been reduced. Investment returns and ETF share values will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. ETF returns assume that distributions have been reinvested in the Fund at “Net Asset Value” (NAV). NAV is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. VanEck Vectors ETF investors should not expect to buy or sell shares at NAV.

†Returns less than a year are not annualized.

Expenses: Gross 1.13%; Net 0.75%. Expenses are capped contractually at 0.55% through February 1, 2021. Expenses are based on estimated amounts for the current fiscal year. Cap exclude certain expenses, such as interest, acquired fund fees and expenses, and trading expenses.

The broad market bottomed on March 23 and then staged an impressive recovery led by large-cap technology stocks. Yet, many real assets are significantly below their pre-crash levels. On a year-to-date basis, the Energy Select Sector Index is down 35%, the MVIS U.S. Listed Oil Services Index is down 59%, the Dow Jones Equity REIT Index is down 16.54% and the S&P Global Infrastructure Index is down 23%.

On April 20 crude oil futures contracts for May delivery fell to -37.63 per barrel. Crude oil futures require physical settlement. The problem is that, because of the demand shock, there was a squeeze on available oil storage. That caused a rush to the exits that sent the price of the front-month crude futures contract cascading deep into negative territory.

A beneficiary of the market turmoil has been gold. Investors have flocked to the shiny metal due to its safe-haven characteristics during periods of high uncertainty and protection from currency debasement as central banks globally rapidly increase the money supply to fend off the economic consequences of COVID-19.

RAAX has maintained its defensive positioning into May. It now holds approximately a 75% allocation to U.S. Treasury bill holdings and a 25% allocation to gold bullion based on weak price trends and high volatility.

A Deeper Dive

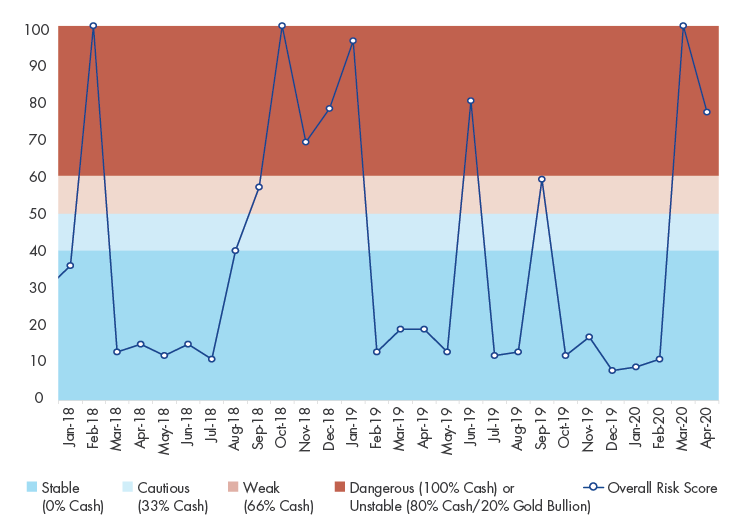

Below is the overall real asset composite. A score of 0 represents the lowest risk level and a score of 100 represents the highest risk level. A score of 60 or higher will result in our most defensive posture. The current score of 77 indicates an unstable risk regime for real assets.

Overall Risk Score

The risk score can be decomposed into key factors that drive real asset prices. These include price trends, economic activity, realized volatility and investor sentiment.

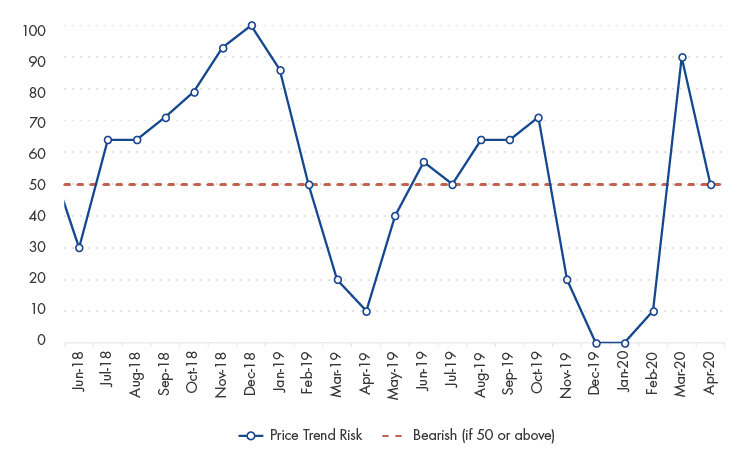

Price trends are bearish on each real asset with the exception of gold bullion and gold equities.

Price Trend Risk Score

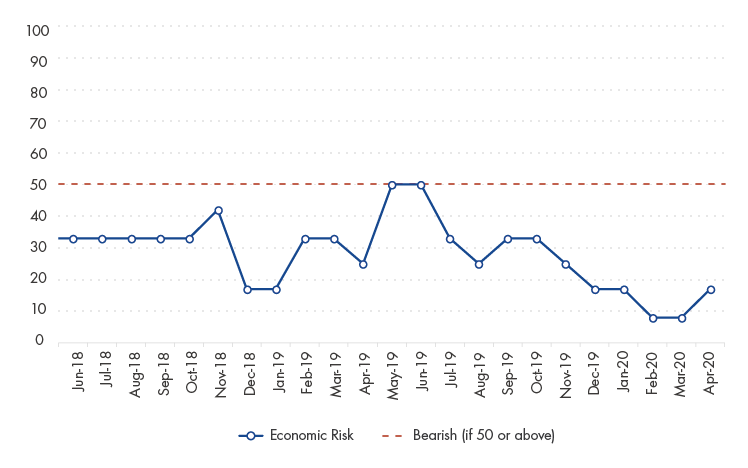

The economic composite remains bullish, but the abrupt slowdown in economic activity is being reflected.

Economic Risk Score

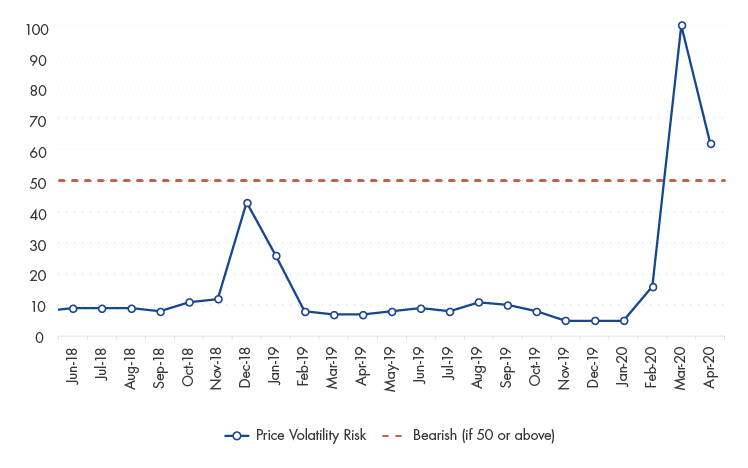

Volatility has declined, but remains extremely high.

Price Volatility Risk Score

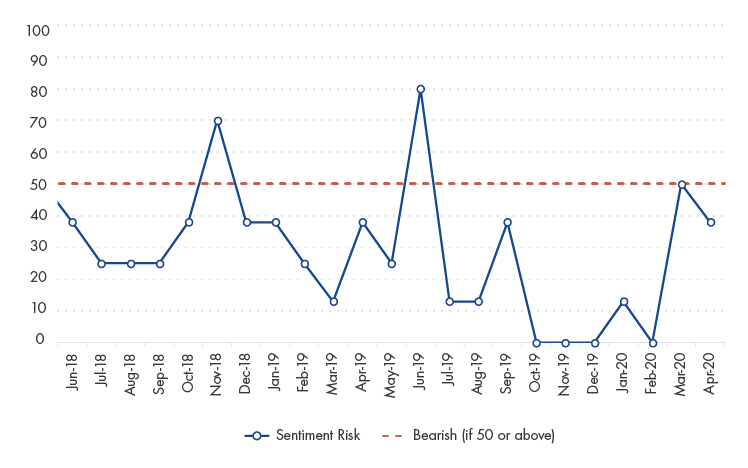

Investor sentiment within commodities is not at an extreme, which is bullish for commodity prices.

Investor Sentiment Risk Score

This is now the second month that RAAX has been in its most defensive positioning. It will continue to measure the risks within the real asset markets and, if conditions materially improve, look for an opportunity to re-invest. Alternatively, if the risk remains high, it will remain defensive.

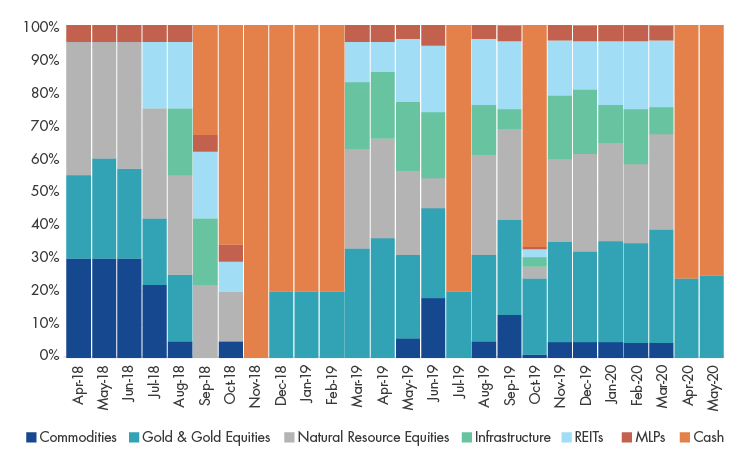

Real Asset Sector Allocations Since Inception

Real Asset Class Allocations

| May-20 | Apr-20 | Change from Previous Month |

||

| Cash | 75.2% | 76.1% | -0.9% | Decrease |

| Gold Bullion | 24.8% | 23.9% | 0.9% | Increase |

| Global Metals & Mining Equities | 0.0% | 0.0% | 0.0% | No Change |

| Unconventional Oil & Gas Equities | 0.0% | 0.0% | 0.0% | No Change |

| Steel Equities | 0.0% | 0.0% | 0.0% | No Change |

| Oil Services Equities | 0.0% | 0.0% | 0.0% | No Change |

| Energy Equities | 0.0% | 0.0% | 0.0% | No Change |

| Agribusiness Equities | 0.0% | 0.0% | 0.0% | No Change |

| Coal Equities | 0.0% | 0.0% | 0.0% | No Change |

| Low Carbon Energy Equities | 0.0% | 0.0% | 0.0% | No Change |

| MLPs | 0.0% | 0.0% | 0.0% | No Change |

| Diversified Commodities | 0.0% | 0.0% | 0.0% | No Change |

| Global Infrastructure | 0.0% | 0.0% | 0.0% | No Change |

| Gold Equities | 0.0% | 0.0% | 0.0% | No Change |

| REITs | 0.0% | 0.0% | 0.0% | No Change |

Related Insights

February 28, 2024

February 22, 2024

December 19, 2023

DISCLOSURES

Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

*The Blended Real Assets Index consists of an equally weighted blend of the returns of Bloomberg Commodity Index, S&P Real Assets Equity Index, and VanEck® Natural Resources Index. Equal weightings are reset monthly. The S&P Real Assets Equity Index measures the performance of equity real return strategies that invest in listed global property, infrastructure, natural resources, and timber and forestry companies. The VanEck Natural Resources Index is a rules-based index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services. Sector weights are set annually based on estimates of global natural resources consumption, and stock weights within sectors are based on market capitalization, float-adjusted and modified to conform to various asset diversification requirements. The S&P 500® Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation).

The S&P Real Assets Equity Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Solactive MLP & Energy Infrastructure Index tracks the performance of MLPs and energy infrastructure corporations. The MVIS U.S. Listed Oil Services 25 Index is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling. The Dow Jones Equity All REIT Index, designed to measure all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index composed of publicly traded companies involved primarily in the mining for gold. The Index is calculated and maintained by the New York Stock Exchange. The S&P® North American Natural Resources Sector Index: a modified capitalization-weighted index which includes companies involved in the following categories: extractive industries, energy companies, owners and operators of timber tracts, forestry services, producers of pulp and paper, and owners of plantations. The S&P® GSCI Total Return Index is a world production-weighted commodity index comprised of liquid, exchange-traded futures contracts and is often used as a benchmark for world commodity prices.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

An investment in the Fund may be subject to risks which include, among others, in fund of funds risk which may subject the Fund to investing in commodities, gold, natural resources companies, MLPs, real estate sector, infrastructure, equities securities, small- and medium-capitalization companies, foreign securities, emerging market issuers, foreign currency, credit, high yield securities, interest rate, call and concentration risks, all of which may adversely affect the Fund. The Fund may also be subject to affiliated fund, U.S. Treasury Bills, subsidiary investment, commodity regulatory (with respect to investments in the Subsidiary), tax (with respect to investments in the Subsidiary), liquidity, gap, cash transactions, high portfolio turnover, model and data, management, operational, authorized participant concentration, no guarantee of active trading market, trading issues, market, fund shares trading, premium/discount and liquidity of fund shares, non-diversified and ETPs risks. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small- and medium-capitalization companies may be subject to elevated risks.

Diversification does not assure a profit or protect against a loss.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 855.281.3413 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©2020 VanEck.

Related Funds

DISCLOSURES

Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

*The Blended Real Assets Index consists of an equally weighted blend of the returns of Bloomberg Commodity Index, S&P Real Assets Equity Index, and VanEck® Natural Resources Index. Equal weightings are reset monthly. The S&P Real Assets Equity Index measures the performance of equity real return strategies that invest in listed global property, infrastructure, natural resources, and timber and forestry companies. The VanEck Natural Resources Index is a rules-based index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services. Sector weights are set annually based on estimates of global natural resources consumption, and stock weights within sectors are based on market capitalization, float-adjusted and modified to conform to various asset diversification requirements. The S&P 500® Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation).

The S&P Real Assets Equity Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Solactive MLP & Energy Infrastructure Index tracks the performance of MLPs and energy infrastructure corporations. The MVIS U.S. Listed Oil Services 25 Index is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling. The Dow Jones Equity All REIT Index, designed to measure all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. The NYSE Arca Gold Miners Index is a modified market capitalization-weighted index composed of publicly traded companies involved primarily in the mining for gold. The Index is calculated and maintained by the New York Stock Exchange. The S&P® North American Natural Resources Sector Index: a modified capitalization-weighted index which includes companies involved in the following categories: extractive industries, energy companies, owners and operators of timber tracts, forestry services, producers of pulp and paper, and owners of plantations. The S&P® GSCI Total Return Index is a world production-weighted commodity index comprised of liquid, exchange-traded futures contracts and is often used as a benchmark for world commodity prices.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

An investment in the Fund may be subject to risks which include, among others, in fund of funds risk which may subject the Fund to investing in commodities, gold, natural resources companies, MLPs, real estate sector, infrastructure, equities securities, small- and medium-capitalization companies, foreign securities, emerging market issuers, foreign currency, credit, high yield securities, interest rate, call and concentration risks, all of which may adversely affect the Fund. The Fund may also be subject to affiliated fund, U.S. Treasury Bills, subsidiary investment, commodity regulatory (with respect to investments in the Subsidiary), tax (with respect to investments in the Subsidiary), liquidity, gap, cash transactions, high portfolio turnover, model and data, management, operational, authorized participant concentration, no guarantee of active trading market, trading issues, market, fund shares trading, premium/discount and liquidity of fund shares, non-diversified and ETPs risks. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small- and medium-capitalization companies may be subject to elevated risks.

Diversification does not assure a profit or protect against a loss.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 855.281.3413 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©2020 VanEck.