Bitcoin Price Approaches All-Time-Highs as Demand Surges

November 25, 2020

Read Time 7 MIN

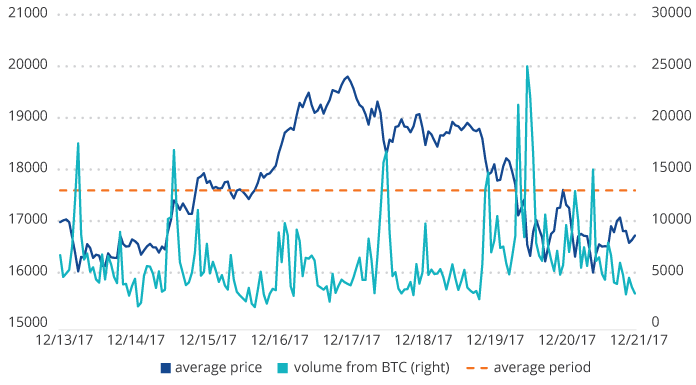

The price of bitcoin is undergoing a parabolic price rally. As bitcoin nears its all-time high—$19,800, reached on December 17, 2017—we took a closer look at how the current rally compares to the days leading up to its previous peak, and we believe that there are notable differences. While the 2017 bitcoin rally was driven by higher volumes, likely due to retail demand, the 2020 price rally so far has been driven by lower volume. We believe the 2020 rally is driven more by institutional allocation and that investing in bitcoin has become less speculative in nature, which indicates bitcoin’s increasing status as a store of value and suggests further potential adoption.

Bitcoin Price’s All-Time High—2017 and Now

We believe that an analytical framework focusing on volume-weighted average price is a good way to study past and future all-time-highs for bitcoin. We studied the hourly volume-weighted average prices four days before and four days after bitcoin reached its all-time-high of $19,800. The average price with the four-day buffer was $17,595.

Bitcoin Price Around 2017 Rally

Source: CryptoCompare. Data as of November 24, 2020.

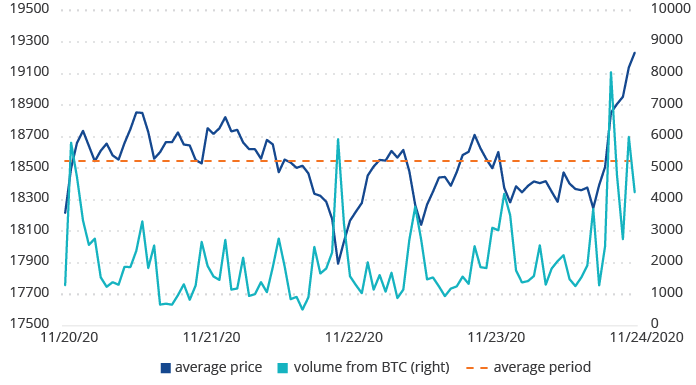

We then created a similar chart for 2020 using bitcoin price data for November 24 and the four days preceding. While bitcoin is getting close to its all-time-high, we remark that the four-day average price of $18,547 has already surpassed the comparable 2017 average of $17,595. While the volumes so far seem somewhat lower than in 2017, we believe that one may consider the 2020 November four-day average price a new all-time-high.

Bitcoin Price in Its 2020 Rally

Source: CryptoCompare. Data as of November 24, 2020.

We further note that in 2017, there were many trading platform outages around the all-time-high, and trading platforms were less scalable and mature. Therefore, we believe that the four-day average period approach is a suitable way to determine an all-time-high. In 2020, trading platforms, market integrity and execution capacity have generally evolved due to institutions entering the asset class and demanding higher quality services.

This Time Is Different: An Institutional Bitcoin Rally

We believe that the 2020 bitcoin price rally is likely more institutionally driven. There have been several significant institutional developments and adoption in bitcoin this year:

- On the fund front, the VanEck Vectors Bitcoin ETN is now listed on Deutsche Börse Xetra and available to investors in limited countries. It features a 100% collateralized physical bitcoin exposure vehicle with no extreme premium or discounts to NAV.

- On the regulatory front, the Office of the Comptroller of the Currency (OCC) published a letter in late July, clarifying the authority of national banks and federal savings associations to provide cryptocurrency custody services for customers. The OCC letter significantly de-risks interaction with digital assets for banks and institutions.1

- On the treasury front, a number of public and private companies started investing in bitcoin as an alternative to holding cash on their balance sheet. Microstrategy announced the purchase of 21,454 bitcoins at an aggregate purchase price of $250 million on August 11, 2020.2 On October 8, 2020 Square announced that it has purchased approximately 4,709 bitcoins at an aggregate purchase price of $50 million.3

- On the payments front, we note that the current rally is supported by PayPal’s launch of a new service enabling bitcoin and digital asset buying and selling to its network. PayPal services 26 million merchants and 346 million clients globally. SoFi, Robinhood and other major financial companies offer similar solutions. Banks are also looking to offer bitcoin exposure to compete with fintech offerings in order to retain and grow client-base.4

To conclude, we believe that the 2020 bitcoin price rally is institutional, rather than retail, driven. In our view, investing in bitcoin is now less speculative due to its increasing status as a store of value, and we believe that there is potential for further adoption.

We would like to thank Quynh Tran-Thanh and Jimena Leon from CryptoCompare for the data and discussion on the matter.

Related Topics

Related Insights

DISCLOSURE

1Source: https://www.occ.gov/news-issuances/news-releases/2020/nr-occ-2020-98.html

3Source: https://squareup.com/us/en/press/2020-bitcoin-investment

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURE

1Source: https://www.occ.gov/news-issuances/news-releases/2020/nr-occ-2020-98.html

3Source: https://squareup.com/us/en/press/2020-bitcoin-investment

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.