Navigating the Markets: Fixed Income ETF Discounts

March 20, 2020

Read Time 3 MIN

Volatile market conditions have led to unprecedented discounts in fixed income ETFs. On a recent webinar, Navigating the Markets: An Open Q&A with Jan van Eck and Team, COO Adam Phillips and ETF Capital Markets Desk Director James Kim addressed several of the top questions we have been receiving about this.

We are seeing discounts that we haven’t seen before. What do you think is causing this?

Adam Phillips: We have been getting a lot of questions on bond ETFs, and we take the trading experience of our clients very seriously. While VanEck does not control the point of sale on exchange, we are keeping a very close eye on this and doing what we can.

Extremely volatile conditions and a stressed credit market led to some highly unusual dislocations in secondary market pricing and trading in fixed income ETFs. About 10 days ago, we started to see fixed income ETFs across the bond-type spectrum—from Treasuries to corporates, high yield corporates, munis, etc.— trade at significant discount to their net asset value (NAV).

As the certainty of pricing and liquidity became harder and harder to determine, especially with the very large size selling that we’re seeing, the discounts became more and more evident. Although the trading volumes of fixed income ETFs have been huge, the ETF vehicle has held up well for transferring risk during a turbulent market environment—albeit the cost to access the liquidity has been steep, as we all can see.

How is VanEck responding to this?

Adam: We here at VanEck have remained in very close contact with our market making partners to understand what they are seeing, what they are doing and what we can do to facilitate the closing of the discounts. We are having frequent dialogues with market participants to understand their price discovery process and whether there is anything we can revisit and examine in our redemption process to improve and address the current market conditions.

Rest assured, we are doing what we can to relieve the stress that is out there.

We have received perhaps the most questions about VanEck Vectors® High-Yield Municipal Index ETF (HYD®). Can you put what’s happening with HYD into context?

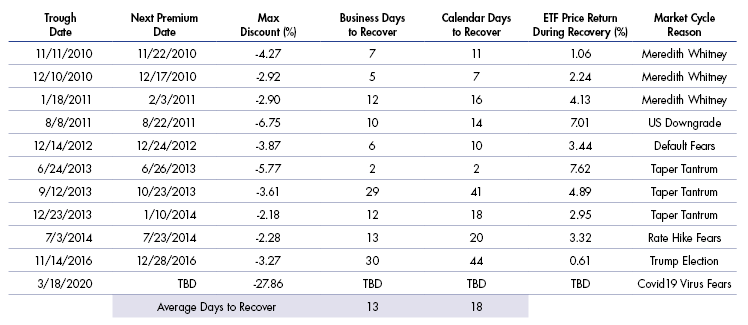

James Kim: Looking back at the history of HYD, the phenomenon that we are experiencing now, as it relates to heightened or pronounced discounts, has been seen before, albeit much more exacerbated this time around. But the root cause remains the same: wider spreads and reduced liquidity of the underlying, which is being conveyed through the secondary market price of the ETF and creating the discount that I am sure everyone has noticed.

From our standpoint, there have been no NAV issues thus far. NAV uses matrix pricing, which is done by a third-party data provider and involves assessing trades, dealer runs, quotes, etc. to come up with a price that they think a particular bond is worth on any particular given day. Because everything trades over the counter in fixed income and because, on any given day, a particular bond—and in this case a high yield muni bond—may not even trade, it’s no easy task for this third-party provider to come up with a valuation of the bond. NAVs are calculated off the back of that.

NAVs can differ from secondary market ETF prices, which are based on prices that market makers think the bonds are worth, as well as the costs associated with selling or buying those bonds. In this case, due to the cost of transacting in these bonds, as well as the level of uncertainty that the entire market is seeing, market makers are pricing these bonds lower than net asset value.

I think from a NAV return standpoint, we have been almost neck and neck with what the index has been disseminating. Through March 16, we have seen a tracking difference of 33bps.

As it relates to the primary market process for HYD, which is one of the main processes that the market maker will utilize to offset or put on risk, that has been intact. There has been no limitations on redemptions. Everything has been almost status quo from our standpoint. I think it is important to keep in mind that market prices for ETFs are a price discovery process. Regardless of the magnitude of discount that we are seeing, we believe that a secondary market price is the true price of liquidity at this point, given what is going on in the secondary market.

In previous cases, when there have been huge discounts in the bond market, how was that resolved?

James: The most recent example that we’ve seen is probably HYD and its performance, during the 2016 election. We saw pronounced discounts relative to what we were used to seeing for HYD, for an extended period of time. In that case as well, the secondary market price acted as a leading indicator of the valuation of the portfolio, and within a week or so, we saw that discount collapse.

Periods of Large Discounts in HYD

In the current situation, there are more variables at work, so I don’t think it is an apples-to-apples comparison. However, we do believe that this discount should slowly start to collapse at some point.

DISCLOSURES

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors® High-Yield Municipal Index ETF (HYD®) may be subject to risks which include, among others, municipal securities, high yield securities, credit, interest rate, call, private activity bonds, health care bond, industrial development bond, special tax bond, tobacco bond, California and Illinois, market, operational, sampling, index tracking, tax, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares and concentration risks, all of which may adversely affect the Fund. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds. A portion of the dividends you receive may be subject to the federal alternative minimum tax (AMT).There is no guarantee that the Fund's income will be exempt from federal, state or local income taxes, and changes in those tax rates or in alternative minimum tax rates or in the tax treatment of municipal bonds may make them less attractive as investments and cause them to lose value. Capital gains, if any, are subject to capital gains tax.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Insights

April 02, 2024

February 21, 2024

February 02, 2024