Strengthen Your Core with Dividends During Volatility

March 10, 2020

Read Time 6 MIN

The recent volatility in the market and the uncertainty around the impact of coronavirus reinforces the need to be prepared. Tempering volatility, at the portfolio level in particular, can improve the investing experience and help investors weather bouts of turbulence. Most investors would benefit from reevaluating their core portfolio at this juncture, and we believe a dividend investing approach that considers a company’s long-term financial health and valuations may help investors strengthen their core.

Increasingly, many investors are looking to U.S. dividend strategies when constructing their core equity portfolio. They are expanding their search beyond U.S. market beta or active large cap strategies and allocating to dividend strategies for exposure to the U.S. markets with the added potential benefit of increased income levels relative to the broad market.

While core positions often fall short on the excitement factor, their dependability and resiliency create stability. Assets that help protect in down markets while still participating in up markets can deliver a more consistent return stream – one that comforts loss-averse investors and results in higher long-term returns with lower volatility and losses.

Be Selective or Beware

The power of dividends has been proven over the long term, but investors must be discerning when selecting a dividend equity strategy for their core portfolio. After all, total return includes both capital appreciation (the increase in the price or value of assets) and income (in the form of dividend payments). Whether seeking investment in the highest yielding stocks, companies that consistently pay or grow dividends, or a combination of the two, investors are susceptible to the pitfalls of dividend investing, known as “dividend traps.”

The term dividend trap refers to a company that lures investors with impressive, but ultimately unsustainable payouts. Dividends are not guaranteed and even long-time dividend paying companies are susceptible to reducing or cutting their dividends altogether. Unhealthy companies put an investor’s income stream and principal at risk. Financial distress can lead to dividend cuts or suspensions, share price depreciation and bankruptcy.

Additionally, overpaying for yield has become a serious concern. A decade’s worth of steady investor flow to dividend paying stocks paired with U.S. equity markets reaching all-time highs make valuation considerations particularly important. Current valuations do not provide much of a cushion for disappointment, but higher multiples and lower discount rates are not inconsistent with a low growth environment. Buying into stock positions at inflated prices can destroy returns when they revert back to fair value.

Retrospective financial metrics have proven to be a poor gauge of a company’s future earnings performance and dividend sustainability. However, many dividend strategies still rely exclusively on screens for historical dividend payments or historical dividend growth. Selecting companies based on their history of paying is backward-looking and does not account for future prospects.

A more prudent approach also considers business fundamentals. Companies in businesses with secular growth drivers that have clear competitive advantages, low leverage and strong management teams are better equipped to maintainable profit over time—even in a tougher macroeconomic and market environment. Carefully selecting dividend paying companies based on their dividend yields coupled with an assessment of their fair value and balance sheet strength may allow for a portfolio with more potential upside (capital appreciation) while still maintaining an attractive dividend yield (income stream).

The Morningstar Difference

Enter Morningstar’s forward-looking approach to dividend investing. Beyond selecting companies with a high dividend yield, forward-looking assessments of a company’s current valuation and financial health are key components to evaluating the long-term durability of dividend pay-outs and growth potential. The Morningstar US Dividend Valuation Index approaches dividend investing from a position of strength.

Morningstar’s 100-person equity research team assigns a fair value estimate to each company it covers by projecting cash flows well into the future—determining today’s fair value based on tomorrow’s free cash flows. Their estimate of a company’s intrinsic value incorporates an assessment of the company’s economic moat and a projection of the sustainability of its profit potential over time.

Morningstar’s quantitative distance to default score uses current balance sheet and market data to gauge a company’s probability of bankruptcy. It has historically been an effective predictor of future distress and of dividend cuts. Selecting companies with the lowest probability of default helps reduce the likelihood of future dividend cuts.

We Have Been Here Before: Fourth Quarter 2018

Many equity investors were justifiably anxious in the fourth quarter of 2018. Stocks fell sharply and by late December, the strong returns amassed year-to-date evaporated. News headlines warned of imminent recession and amid the noise, it may even have seemed sensible to reduce ones equity allocation.

However, by the second quarter of 2019, stock markets recovered their losses. Despite renewed confidence, many investors were so traumatized by the volatility at the end of 2018 that they stayed on the sidelines in 2019. This decision would prove to be costly.

Driven by high-flying technology stocks of the growth-style persuasion, the S&P 500®recorded positive returns during every quarter of 2019, gaining 31.49% for the year, in U.S. dollar terms. The fear of loss is so great that even in a rising market, the anxiety caused by large market swings can be unsettling enough to prompt investors to make emotional, financially destructive decisions.

Resiliency in Times of Stress

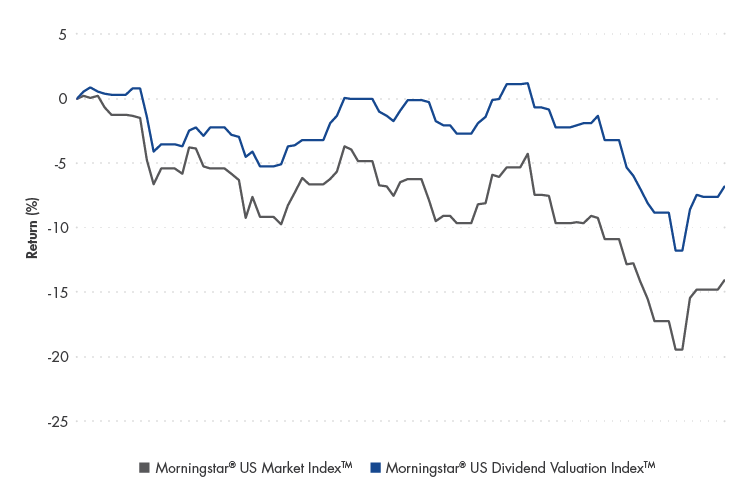

The Morningstar® US Dividend Valuation IndexSM has displayed defensive characteristics versus the U.S. market and other dividend strategies. Most notably, it was down about half of the -14.08% posted by the Morningstar US Market Index in the fourth quarter of 2018.

Case Study: Fourth Quarter 2018 Market Sell Off

10/1/2018 – 12/31/2018

| Return Data (%) Fourth Quarter 2018 | Return | Max Drawdown |

|---|---|---|

| Morningstar US Dividend Valuation Index (Gross of Fees) | -6.82 | -12.86 |

| Morningstar US Dividend Composite Index | -10.88 | -16.54 |

| Morningstar US Market Index | -14.08 | -19.65 |

Source: Morningstar®. IndexTM performance is not illustrative of Fund performance. Fund performance current to the most recent month-end is available at vaneck.com. Chart content created by Morningstar, does not necessarily reflect the views or opinions of VanEck, and is subject to change at any time based on market and other conditions. No forecasts can be guaranteed.

The possible smoother ride provided by this level of downside protection may be particularly important in the coming months, if not years. Many anticipate persistent volatility due to uncertainty around coronavirus, a potential slowing of the U.S. economy, and heightened political risks during a presidential election year.

Consider a Durable Approach to Dividend Investing

The Morningstar® US Dividend Valuation IndexSM's forward-looking approach of the assessing company valuations and financial health in conjunction with dividend yield stands out in a sea of backward-looking dividend investing methodologies. An investor can access this rigorous research through VanEck Durable High Dividend ETF (DURA®), which seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar® US Dividend Valuation IndexSM. A durable approach to dividend investing can strengthen an investor’s core portfolio and provide the stability and confidence required to stay in the market during challenging times—reaping the rewards of investing over the long term.

Related Insights

April 23, 2024

April 22, 2024

Fallen angels outperformed broad high yield by 0.24% in March and 0.10% YTD, due in part, to tighter spreads. Q1 2024 saw two fallen angels and two rising stars.

April 17, 2024

April 10, 2024

April 09, 2024

Important Disclosures

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

S&P 500® Index: consists of 500 widely held common stocks covering the leading industries of the U.S. economy.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Morningstar® US Dividend Valuation IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Durable High Dividend ETF and bears no liability with respect to the ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar US Dividend Valuation Index are service marks of Morningstar, Inc.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a fund. An index's performance is not illustrative of a fund's performance. Indices are not securities in which investments can be made.

An investment in the Fund may be subject to risks which include, among others, investing in equities securities, dividend paying securities, energy, financials, health care, and industrials sectors, medium-capitalization companies, market, operational, high portfolio turnover, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, which may make these investments volatile in price or difficult to trade. Medium-capitalization companies may be subject to elevated risks.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the it carefully before investing.

Related Funds

Important Disclosures

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

S&P 500® Index: consists of 500 widely held common stocks covering the leading industries of the U.S. economy.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The Morningstar® US Dividend Valuation IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Durable High Dividend ETF and bears no liability with respect to the ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar US Dividend Valuation Index are service marks of Morningstar, Inc.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a fund. An index's performance is not illustrative of a fund's performance. Indices are not securities in which investments can be made.

An investment in the Fund may be subject to risks which include, among others, investing in equities securities, dividend paying securities, energy, financials, health care, and industrials sectors, medium-capitalization companies, market, operational, high portfolio turnover, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, which may make these investments volatile in price or difficult to trade. Medium-capitalization companies may be subject to elevated risks.

Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading fund shares in the secondary market. Past performance is no guarantee of future results.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the it carefully before investing.