Sin Tax May Mitigate States’ Financial Shortfalls

July 10, 2020

Read Time 5 MIN

The economic impact of COVID-19 has put extreme stress on state and local municipalities, with most states facing billions of dollars in FY21 forecasted revenue losses. State governments will now have to make tough decisions in order to generate revenue or cut expenses to supplement federal aid.

Potential methods for long-term revenue growth are likely to be discussed by legislators to enable new revenue streams, such as sin taxes. For states such as New York, which according to The New York State Division of the Budget, projects a $13.3 billion shortfall in revenue in FY21 and a $61 billion decline in revenues through FY24, any potential sources of revenue growth deserve discussion. States that have not yet exhausted the maximum potential of their sin tax revenues may have more opportunities for new long-term revenue streams to mitigate, to some degree, the financial impact of the COVID-19 pandemic.

Online Sports Betting: From Handle to Revenue

One possible sin tax revenue stream is online sports betting, and we believe New York showcases an opportunity, seen by many states nationwide, for the adoption and taxation of online sports betting. The appetite for gambling within New York and nationwide is in our view strong, but it is not yet fully realized by state and local municipalities. The lottery, an aspect of gambling already providing tax revenue for public education throughout New York State, is a possible indicator of the desire to gamble within the state. In FY20, lottery revenues totaled $3.48 billion, but due to the pandemic, they are expected to fall by 20% in FY21, according to The New York State Division of the Budget.

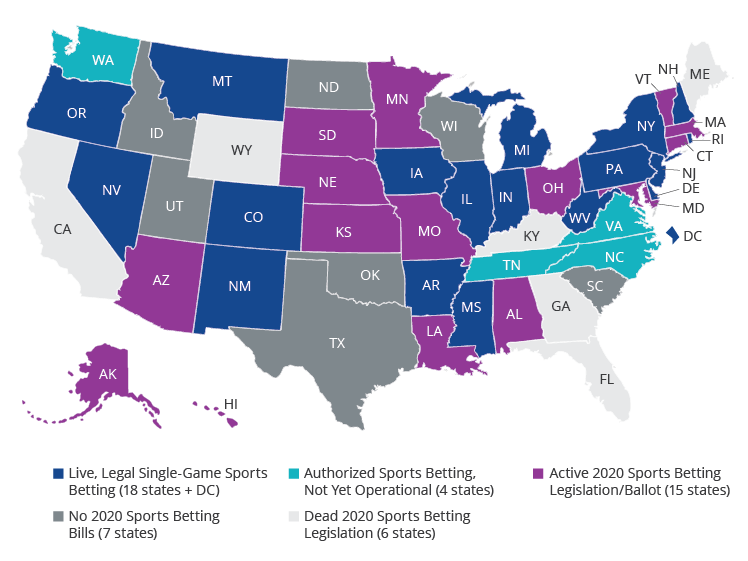

The State of Sports Betting in the U.S.

Source: American Gaming Association. Data as of June 30, 2020.

Nationwide, only 12 states are realizing tax revenues from legal sports betting’s $22.2 billion handle, totaling $210.3 million in sports betting tax revenues from June 1, 2018 to June, 29 2020, according to Legal Sports Report. However, an indicator of the sizeable nationwide appetite for sports betting is visible in the estimated handle of bets placed through bookies and legal offshore sportsbooks, totaling $150 billion annually, according to the American Gaming Association. The possibility of transferring a portion of betters from bookies to taxable, online sportsbooks indicates substantial potential for revenue growth, with nationwide adoption of online sports betting.

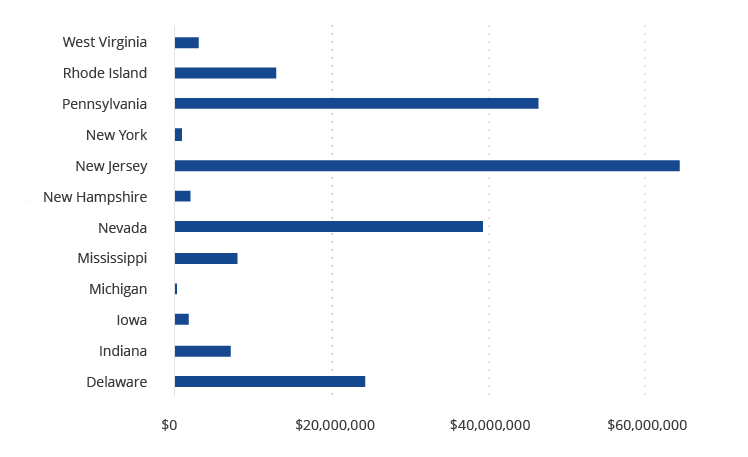

2020 Sports Betting State Tax Revenue YTD

Source: Legal Sports Report. Data as of June 29, 2020.

Can New York Regain Lost Revenue from New Jersey?

The economic environment caused by the COVID-19 pandemic could be the catalyst for online sports betting adoption within New York, as strict regulation depletes potential revenue. As of June 29, 2020, New York had only generated $964,671 in sports betting tax revenue compared to New Jersey’s $64.3 million.

With respect to the difference in population, New Jersey generates $7.24 per capita in sports betting tax revenues compared to $0.05 per capita in New York. This discrepancy can be attributed to New York’s strict gambling rules, which prohibit online betting, bets on in-state college teams, as well as bets on sporting events within the state. New York, however, does allow in-person sports betting at four upstate commercial* casinos, which generates less than 4% of the total gambling revenues at those casinos. The sports betting environment within New Jersey shows encouraging potential for New York, if fewer regulations were imposed and online sports betting was implemented.

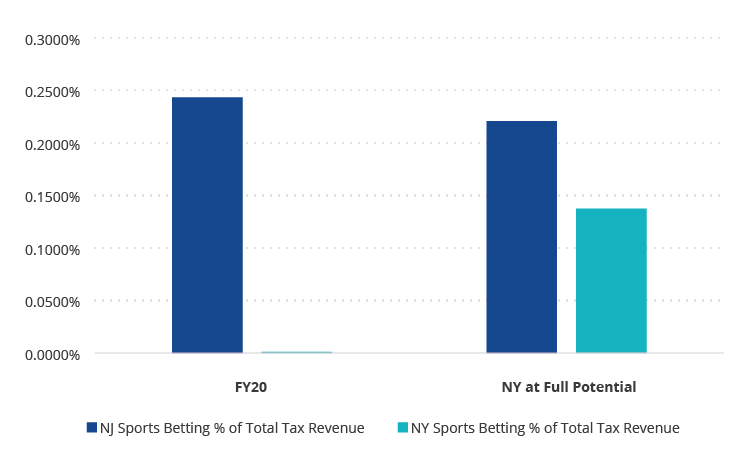

Sports Betting Tax Revenue Contributions to Total State Tax Revenue

Sources: The New Jersey Office of Legislative Services, New York State Division of the Budget, Legal Sports Report and Eilers & Krejcik Gaming. Data as of June 29, 2020

As a result of the strict rules on sports betting, the inconvenience of betting drives away potential tax revenue from New York. Eilers & Krejcik Gaming (EKG), a research firm specializing in gambling, believes New York sports betting realizes less than 5% of its true potential due to the inconvenience of not offering online sports betting. New York also misses out on potential tax revenues due to New Yorkers traveling to New Jersey to place bets.

EKG estimated New Yorkers accounted for $837 million of New Jersey’s sports betting handle in 2019, resulting in $6 million in tax revenues. In a study done by EKG, the full potential of sports betting tax revenues in New York, estimated at $119 million with current tax rates, may be achieved with the addition of downstate casinos and online sports betting. According to the study, up to 96% of sports betting tax revenue would be attained online. All else being equal, the chart above shows the full potential contributions of sports betting to total state tax revenues in New York versus New Jersey. It also accounts for New Jersey’s lost sports betting tax revenues from bets placed by New Yorkers. With 8.3 million of New York’s population living in New York City, online sports betting adoption could recapture a market that travels to New Jersey to place bets or those who are unbothered to travel at all.

Time to Bet on Sin Taxes?

The impact of the COVID-19 pandemic has put extreme stress on state and local municipalities’ budgets and forecasted revenues. As a result, potential revenue streams, some of which have been previously discarded by legislators, may likely to reappear in state government discussions. The current economic environment provides an opportunity for online sports betting to be implemented for the purpose of realizing tax revenues for activities their citizens presumably already engage in.

These sin tax revenues could provide an advantageous opportunity for states to provide public sectors the necessary funding to avoid drastic expenditure cuts. Compared to states that increase sin taxes, states that are in position to implement new sin taxes may have more opportunities for long-term, impactful revenue growth streams to help supplement federal aid and other budgetary actions taken by the state.

Related Insights

April 02, 2024

February 21, 2024

February 02, 2024

DISCLOSURES

*The New York Gaming Commission does not include revenues from sportsbooks at New York’s Indian Nation Casinos.

Sin tax is tax levied on goods and services deemed harmful to society, such as tobacco, alcohol and gambling.

IMPORTANT MUNI NATION® DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

Please note this represents the views of the author and these views may change at any time and from time to time. MUNI NATION is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck. MUNI NATION is a trademark of Van Eck Associates Corporation.

Municipal bonds are subject to risks related to litigation, legislation, political change, conditions in underlying sectors or in local business communities and economies, bankruptcy or other changes in the issuer’s financial condition, and/or the discontinuance of taxes supporting the project or assets or the inability to collect revenues for the project or from the assets. Bonds and bond funds will decrease in value as interest rates rise. Additional risks include credit, interest rate, call, reinvestment, tax, market and lease obligation risk. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds.

The income generated from some types of municipal bonds may be subject to state and local taxes as well as to federal taxes on capital gains and may also be subject to alternative minimum tax.

Diversification does not assure a profit or protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

DISCLOSURES

*The New York Gaming Commission does not include revenues from sportsbooks at New York’s Indian Nation Casinos.

Sin tax is tax levied on goods and services deemed harmful to society, such as tobacco, alcohol and gambling.

IMPORTANT MUNI NATION® DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

Please note this represents the views of the author and these views may change at any time and from time to time. MUNI NATION is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck. MUNI NATION is a trademark of Van Eck Associates Corporation.

Municipal bonds are subject to risks related to litigation, legislation, political change, conditions in underlying sectors or in local business communities and economies, bankruptcy or other changes in the issuer’s financial condition, and/or the discontinuance of taxes supporting the project or assets or the inability to collect revenues for the project or from the assets. Bonds and bond funds will decrease in value as interest rates rise. Additional risks include credit, interest rate, call, reinvestment, tax, market and lease obligation risk. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds.

The income generated from some types of municipal bonds may be subject to state and local taxes as well as to federal taxes on capital gains and may also be subject to alternative minimum tax.

Diversification does not assure a profit or protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.