Muni Bond Market December 2020 Recap

December 11, 2020

Read Time 1 MIN

During this time, I am reminded of the old, but popular, crime show "Dragnet" of the 1950's. The signature saying "just the facts, ma'am, just the facts" seems a cheeky but appropriate response when asked what to make of the municipal bond market in this, the final month of the year. I could offer some nuanced response, which overlooks the fundamental fact that the broadly discussed imbalanced dynamic of demand over supply is again driving positive performance for the year.

The value for the tax- exempt coupon has been a consistent theme throughout the peaks and valleys of the past two years. Now, with a Democratic electoral victory in place, there are expectations for higher taxes. The positive news on effective vaccines may lead to a medical win over the Corona Virus. These developments have the potential to lead to a broad based economic recovery, and are possible reasons for continued strong demand for municipals. These are the facts. Further, despite some downgrades of issuers’ credits by the ratings agencies, those same entities have also suggested that most States and municipalities are well positioned (i.e., have the tools and resources) to weather further economic malaise, and are expected to regain their footing in the latter half of 2021.

So, final facts: issuers are continuing to find strong demand in our markets. Manufactured low U.S. Treasury rates will keep municipal rates low, at least in to the first quarter, and the market will remain an attractive place to raise capital. The resilience of municipals puts the months of March and April in the rearview mirror, and takes the year to a happy conclusion, where I believe positive returns for the year may put smiles on investor faces.

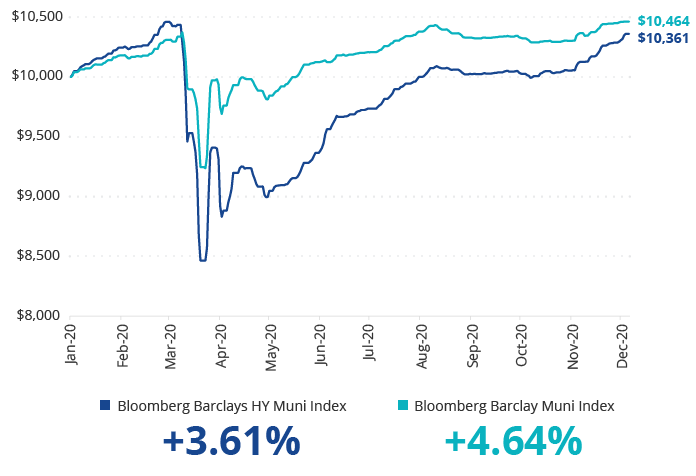

Municipal Indices: Growth of $10K YTD 2020

Source: Morningstar. As of 12/6/2020.

Related Insights

April 02, 2024

February 21, 2024

February 02, 2024

DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

Municipal bonds are subject to risks related to litigation, legislation, political change, conditions in underlying sectors or in local business communities and economies, bankruptcy or other changes in the issuer’s financial condition, and/or the discontinuance of taxes supporting the project or assets or the inability to collect revenues for the project or from the assets. Bonds and bond funds will decrease in value as interest rates rise. Additional risks include credit, interest rate, call, reinvestment, tax, market and lease obligation risk. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds.

The income generated from some types of municipal bonds may be subject to state and local taxes as well as to federal taxes on capital gains and may also be subject to alternative minimum tax.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

Municipal bonds are subject to risks related to litigation, legislation, political change, conditions in underlying sectors or in local business communities and economies, bankruptcy or other changes in the issuer’s financial condition, and/or the discontinuance of taxes supporting the project or assets or the inability to collect revenues for the project or from the assets. Bonds and bond funds will decrease in value as interest rates rise. Additional risks include credit, interest rate, call, reinvestment, tax, market and lease obligation risk. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds.

The income generated from some types of municipal bonds may be subject to state and local taxes as well as to federal taxes on capital gains and may also be subject to alternative minimum tax.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.