Investing in Oil Stocks in a De-Carbonizing World

January 06, 2020

Read Time 7 MIN

While the VanEck Global Hard Assets Strategy ended the year with approximately 8.9% of its portfolio invested in alternative energy stocks, we still see fundamental and company-specific reasons to remain optimistic about traditional oil and gas equities over the near term.

Oil Demand Keeps Growing

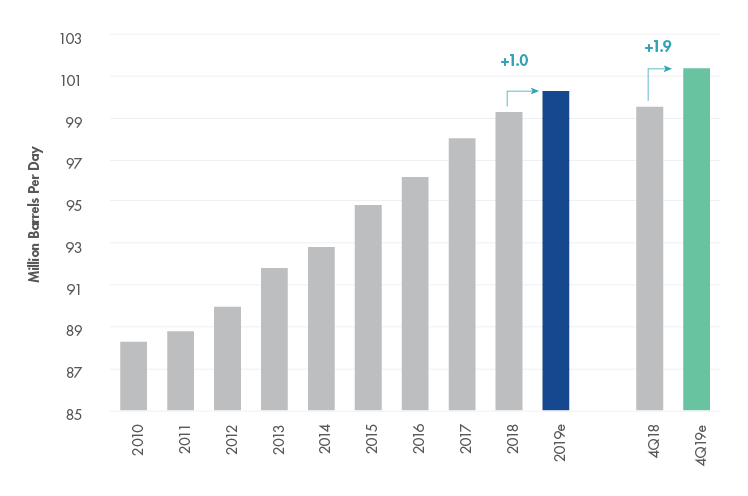

According to the International Energy Agency (IEA), oil demand in 2019 is estimated to have averaged an all-time record high of 101.3 million barrels per day (mbd)—1 mbd greater than 2018. Perhaps even more impressive is the growth of global consumption in the fourth quarter of 2019 alone, estimated to be 1.9 mbd greater than in the fourth quarter of 2018.

Global Oil Demand Remains Persistent

Source: IEA. Data as of December 2019. Annual demand values represented by the average over the prior four quarters.

This is quite a ramp up relative to the 0.5 mbd year-over-year growth in the first half of 2019. Not surprisingly, markets were, and remain, focused on the health of the global economy, particularly early in the year as the U.S. Federal Reserve committed to quantitative tightening and a likely increase in rates. A clear cyclical slowing of the Chinese economy, exacerbated by the impact of the trade war with the U.S., further squashed prospects of global oil demand growth. Despite these headwinds, Chinese demand growth was also exceptional, up 0.6 mbd in 2019 compared to 0.5 mbd in 2018 and 2017.

As we look to 2020, we think the 1.2 mbd growth in demand forecasted by the IEA seems conservative as trade war headwinds dissipate and global GDP is expected to improve relative to 2019.

Demand Drivers Are Shifting

An ancillary but also important part of the crude demand picture is the implementation of the United Nations’ International Maritime Organization (IMO) 2020 regulation limiting the sulfur content of marine fuel to 0.5% from 3.5%. We believe this should lead to greater demand for low-sulfur crudes.

Approximately 60% of the global crude slate has a greater than 1% sulfur content, while less than 30% has 0.5% or lower. In fact, of the top 15 global crude streams, only four have a sulfur content below 0.5%, two of which are Permian and Bakken crudes. Refining margins for high-sulfur crudes are very weak, which suggests that demand for low-sulfur crudes will remain strong. Interestingly, all of Saudi Arabia’s major crude streams have sulfur content well above 0.5% and this may help to explain their recent willingness to further reduce their OPEC quotas.

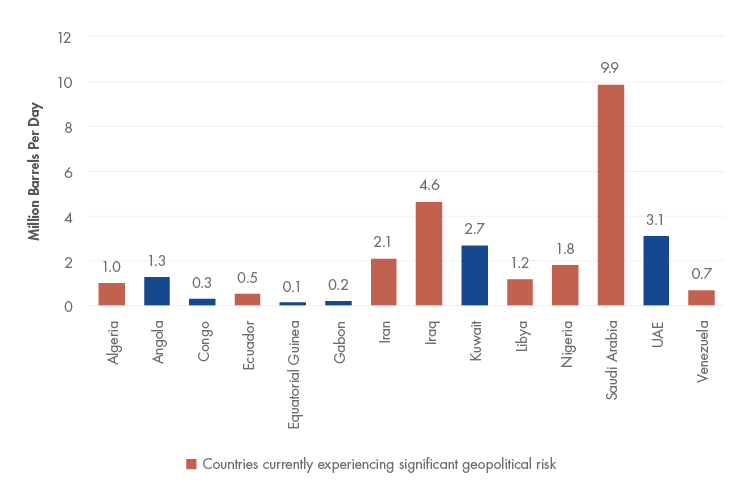

Geopolitical Disruptions Are Not Over

In our view, following the dramatic escalation of violence in Iraq, it is clear that the risk of geopolitically driven disruptions in oil supply has ratcheted up substantially. However, this is not limited to a U.S./Iran conflict.

OPEC nations representing nearly 75% of the organization’s November 2019 production and approximately 22% of global output are in the throes of existential crises. Saudi Arabia, Iraq, Iran, Nigeria, Libya, Algeria, Venezuela and Ecuador have all suffered significant disruptions to their production and almost all continue to face the threat of future physical interruptions due to political disarray.

Substantial OPEC Supply Risked Due to Escalating Geopolitical Issues

Source: OPEC, VanEck. Data as of November 2019.

The record 15% jump in oil prices following the attacks on Saudi Arabia’s Abqaiq/Khurais facilities was rapidly eroded in the following weeks, but recently crude has climbed back above the $60 per barrel price. While there seem to be indications that physical markets are tightening, geopolitical risks premiums also may be seeping back into price setting mechanisms, most recently being displayed by the hostilities and bloodshed in Iraq.

We continue to see Saudi Arabia’s lack of response to the strikes on the life-blood of their economy as historically restrained, but also pragmatic and calculated. In our view, the truly shocking and anomalous outcome for 2020 would be a diminishing of aggressions in oil sensitive parts of the world.

|

A Note on Gold from Portfolio Manager Joe Foster Through 2019 geopolitical unrest escalated to new levels with trade wars, divisive politics in the U.S., rioting and upheaval in Latin America and terrorist activity in Africa. Who would have thought that Chile, the wealthiest and most stable democracy in Latin America, would come unglued over wealth disparity? |

U.S. Is the Global Oil Production Leader

The U.S. oil and gas exploration and production (“E&P”) industry has spent the last decade investing enormous amounts of capital in to domestic shale resources and this has resulted in the U.S. becoming the largest producer of oil in the world—more than Saudi Arabia, more than Russia, and more than Iraq, the U.A.E., Kuwait and Iran combined. However, more importantly, we believe the next ten years will entail many E&P companies harvesting the profits from those investments—in fact, it has already begun.

It seems hard to remember that in 2009, oil production from U.S. shale was trifling and inconsequential. It also may be difficult to recall that it took an average WTI crude oil price of nearly $92 per barrel from 2010 to 2014 in order to incentivize the capital expenditure levels that doubled the number of rigs running in the U.S. and led to a more than doubling of U.S. crude oil output. However, WTI prices over the last five years have averaged $53 per barrel, or over 40% lower, than the first half of the last decade. So it seems somewhat unwarranted, in our view, to overly criticize the industry’s return on capital profile during this period of incomparable growth (growth that has had an incredible role in supporting global economic activity).

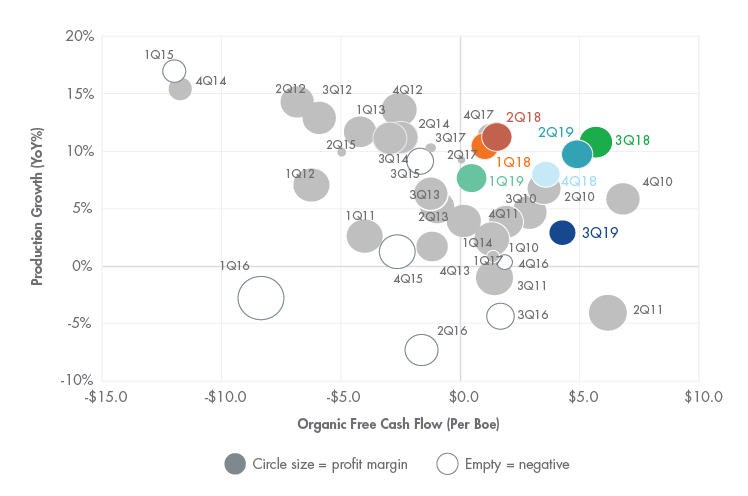

Nevertheless, it is our view that investments require an ultimate return and we see many E&P industry participants as well positioned to deliver these returns. Positive cash generation of E&P companies has been combined with continued solid growth and points to the profitability gains made over the last several years through remarkable technology innovations and relentless efficiency and optimization improvements.

North American E&Ps Remain Committed to Capital Discipline and Growth

Source: Bernstein Research. Data as of September 2019.

In fact, the free cash flow yield of the industry as a whole stands at a 10-year high, whereas almost every other industry is well below its 10-year average and many near its lows. From our perspective, this combination of proven and improving profitability along with relatively strong and flexible growth will generate a valuation re-rating more in-line with its industrial peers.

Conclusion

Despite a year when returns from traditional energy equities failed to match those of broader markets, there are several substantive, but perhaps poorly appreciated, features worth highlighting that may substantiate a more positive view of the industry. Despite the regular refrain of impeding global economic weakness, crude oil demand continues to grow steadily and hit record levels. Consumption growth is expected to strengthen in 2020. Physical crude supply has never been more disrupted due to political conflicts than it was in 2019. The underlying discord in all of these situations has not dissipated and may be a “coiled spring”. The U.S. has catapulted into being the largest oil producer in the world, creating cheap, reliable and secure energy to fuel the global economy. This has come about as the U.S. E&P sector has invested massively into shale resource development over the last 10 years. Like any new investment j-curve, where initial profitability declines as start-up costs are incurred and gradually rises during maturity, the return trajectory of the sector has inflected and the E&P industry is beginning to post positive returns. We believe that these returns are sustainable and justify a more positive valuation for many of the most successful players in the U.S. E&P space.

Related Insights

Constrained supply conditions, disruptions in the supply chain and growing interest in the global energy transition global energy transition may result in a significant upturn for global resource equities.

April 18, 2024

April 15, 2024

March 21, 2024

January 30, 2024

IMPORTANT DISCLOSURES

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) offers investments products that invest in the securities included in this commentary.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

IMPORTANT DISCLOSURES

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) offers investments products that invest in the securities included in this commentary.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.