Stay Informed on Esports

Sign up for periodic updates in our ETF Insights category.

VanEck is a global investment manager with offices around the world. To help you find content that is suitable for your investment needs, please select your country and investor type.

Sign up for periodic updates in our ETF Insights category.

From home consoles to sold-out stadiums, watch a short video about the growth and evolution of video games and esports.

Competitive video gaming audience1 expected to reach 495 million people globally in 2020, driven in part by rising population of digital natives2

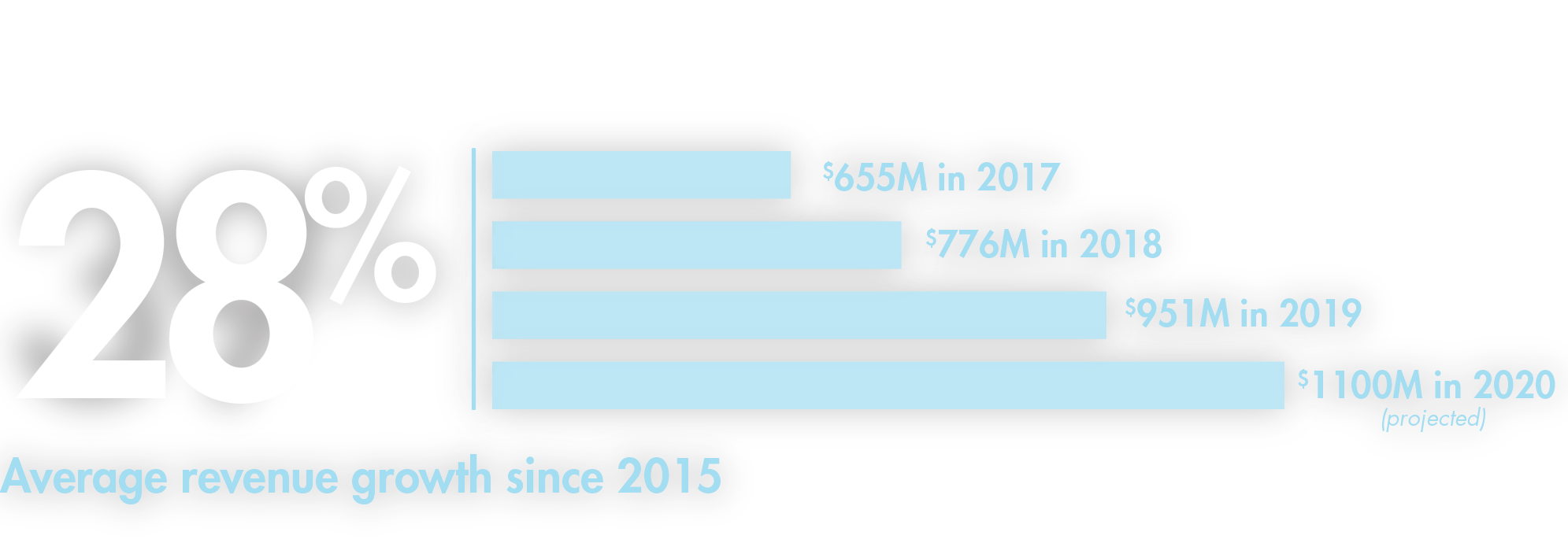

Esports revenue growth has increased on average 28% yearly since 20153

Reflects convergence of entertainment, video gaming, sports, and media businesses

1Including all ways of watching esports: streaming, television, live events etc.

2Newzoo Global Esports Market Report, 2020.

3Newzoo Global Esports Market Report, 2017, 2018, 2019, 2020.

Index captures the largest companies that primarily generate revenues from video gaming and esports

Targeted index allows for high relative exposures to pure-play companies driving transformation in the industry, with top 10 names comprising over 60% of the portfolio weight

May offer portfolio diversification away from Apple, Google, and Microsoft through targeted and pure-play exposure

Top 10 Players* |

Index Weighting |

|

NVIDIA Corp |

9.4% |

|

Tencent Holdings Ltd |

8.6% |

|

Advanced Micro Devices Inc |

7.7% |

|

Activision Blizzard Inc |

5.9% |

|

Sea Ltd |

5.2% |

|

Electronic Arts Inc |

5.1% |

|

Ncsoft Corp |

5.0% |

|

Nintendo Co Ltd |

4.9% |

|

Nexon Co Ltd |

4.9% |

|

Netease Inc |

4.9% |

|

*Top 10 holdings of ESPO as of 29/02/2020. |

|

These are not a recommendation to buy or sell any security. |

|

Security and holdings may vary. |

Learn more about ESPO and the high growth potential of the global video gaming and esports industry.

For informational and advertising purposes only.

This information originates from VanEck Switzerland AG which has been appointed as distributor of VanEck products in Switzerland by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck Switzerland AG is registered in Churerstrasse 23, CH-8808 Pfaeffikon, Switzerland.

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck Switzerland AG and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. All indices mentioned are measures of common market sectors and performance. It is not possible to invest directly in an index.

VanEck Asset Management B.V., the management company of VanEck Vectors™ Video Gaming and eSports UCITS ETF (the "ETF"), a sub-fund of VanEck Vectors™ UCITS ETFs plc, is a UCITS management company incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland and tracks an equity index. The value of the ETF’s assets may fluctuate heavily as a result of the investment strategy. If the underlying index falls in value, the ETF will also lose value.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com or from the Management Company.

Swiss Representative of the ETF is First Independent Fund Services Ltd, Klausstrasse 33, 8008 Zurich. Paying Agent of the ETF in Switzerland is Helvetische Bank AG, Seefeldstrasse 215, 8008 Zurich. The Prospectus, Key Investor Information Document, Articles and annual and semi-annual reports of the Company may be obtained free of charge from the Representative

All performance information is historical and is no guarantee of future results. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KID before investing.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Switzerland AG

Management Company

VanEck Asset Management B.V.

Barbara Strozzilaan 310

1083 HN Amsterdam

The Netherlands

Web Access Notice: VanEck is committed to ensuring accessibility of its website for investors and potential investors, including those with disabilities. If you have difficulty accessing any feature or functionality on the VanEck website, please feel free to email us at info@vaneck.com for assistance.

© 2021 VanEck®, VanEck Vectors®, VanEck Access the opportunities®, and the stylized VanEck design® are trademarks of Van Eck Associates Corp.