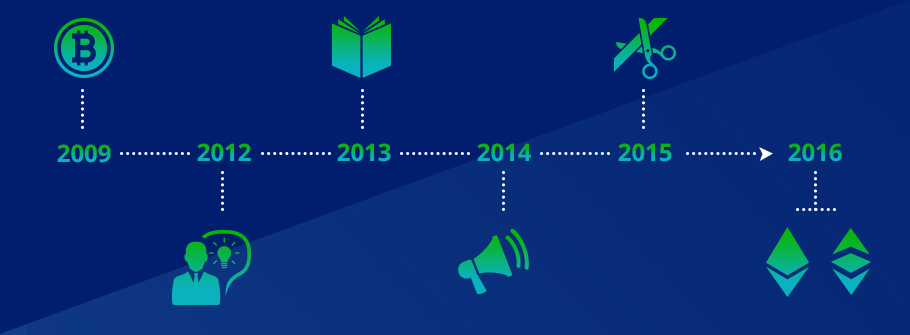

Digital assets are a new technological innovation with a limited history. There is no assurance that usage of digital assets will continue to grow. A contraction in use of digital assets may result in increased volatility or a reduction in the price of such digital assets, which could adversely impact the value of the notes. For example, Bitcoin, one of the earliest digital assets, was invented in 2009. Digital assets and their respective trading histories have therefore existed for a relatively short time, which limits a potential investor’s ability to evaluate an investment in the notes. That is one of the risk factors to take into account before making an investment in an Ethereum ETN.