Will Real Sports Lift Esports to the Next Level?

13 May 2020

Share with a Friend

All fields required where indicated (*)With the world in lockdown, there’s a void to fill. Esports, including digitized real sport, is already plugging some of the gap. And it could be that the crisis proves the catalyst for digital sport – backed by TV and celebrity endorsement – taking esports as a whole to the next level.

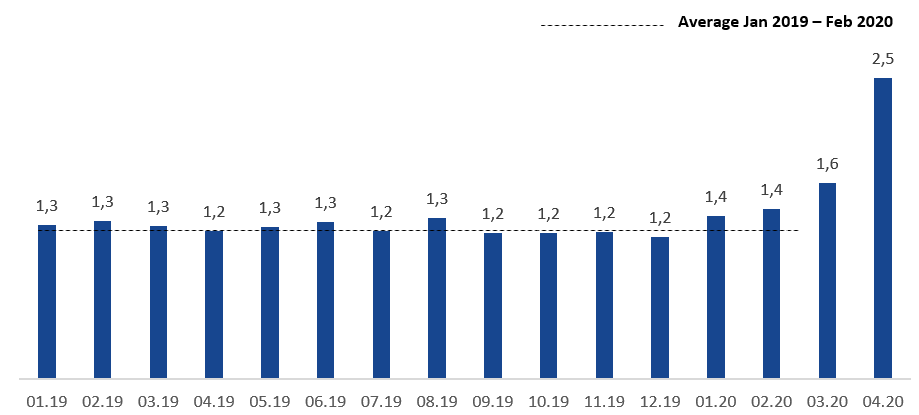

In the last few months, daily viewings of “multiplayer online battle arenas” (MOBAs) and “shooters” esports on the Twitch esports platform have soared, rising from 1.4 million daily in February 2020 to 2.5 million in April (see figure 1).

But sports games, too, have surged in popularity. Motor racing has led the way, with the eNASCAR iracing in the US recording 1.4 million viewers in late March. And in the UK, nearly 5 million people tuned in to a digitally simulated Grand National, Europe’s most valuable jump race, at the beginning of April.

Figure 1 – Esports viewing has surged during lockdown

Source: Twitchtracker.com. Data as of 24 April 2020.

Even before the pandemic, the world of physical sport was gradually spreading into digital. Many football clubs have launched esports teams, for example, and the Formula 1 Esports Series has been attracting tens of thousands of gamers each year since starting in 2017. But the crisis has given this trend a huge push, attracting people for whom video gaming is an alien concept to participate or watch for the first time.

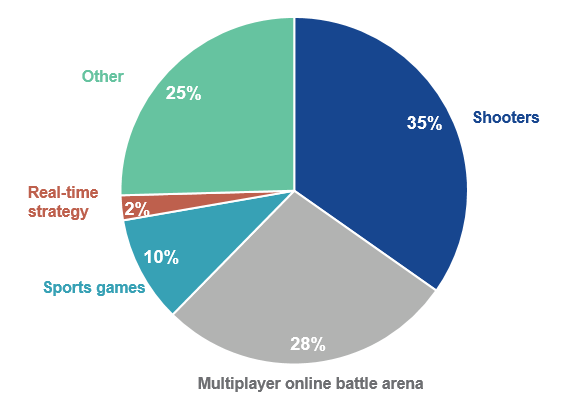

So, will the crisis make digital sport a new driver for growth in esports in general? We think so. Sports games currently only make up a relatively small part of an industry historically dominated by MOBAs or shooters, such as League of Legends or Call of Duty respectively. So there is huge room for growth (see figure 2).

Figure 2 – Sports games viewings have room to grow

Source: VanEck analysis, based on #YouTube subscribers. Note that YouTube is skewed towards European and North American viewers. In Asia the following platforms are more popular: Huya, Douyu and Bilibili. Sports games also includes racing (2% point). Data as of 23 April 2020.

Below we explain why we think traditional sport is likely to prove a lasting driver of growth in the virtual world of esports:

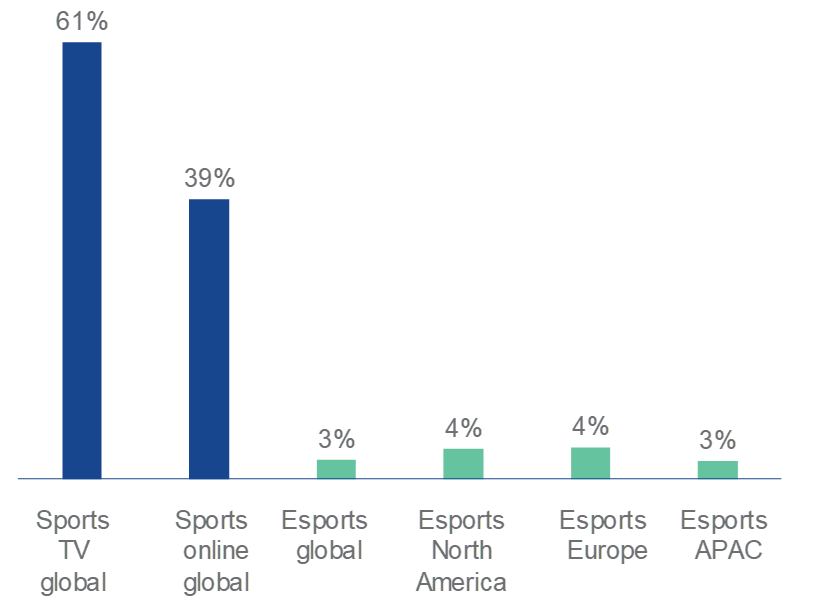

- There is enormous untapped potential. A very large proportion of the world’s population watch sport. That number is almost two thirds (61%) on TV and over a third (39%) online, according to Statista, (see figure 3). However, only a few percent watch esports. If just a third of the people who currently watch sport on TV started to watch esports, the esports market would increase ten-fold1.

Figure 3 – Share of population watching sports and esports

Source: VanEck analysis based on NewZoo data, Statista. Sports data for 2017. Esports data for 2019.

- The frontier between esports and traditional sports is increasingly blurring. Big name sports clubs are launching esports teams. For example, 13 out of the 18 German Bundesliga football clubs already have their official own esports team (see figure 4). Often these esports teams are fully embedded in the club’s infrastructure, with players having access to fitness facilities, coaching, marketing apparatus, etc. In the US, for instance, the San Francisco-based Golden State Warriors, one of the most successful teams in the National Basketball Association, has hired a traditional basketball coach to train its newly set up esports team.

Figure 4 – Germany’s Bundesliga goes digital

| Team | Own Esports Team? |

| FC Augsburg | Yes |

| Hertha BSC | Yes |

| Union Berlin | - |

| Werder Bremen | Yes |

| Borussia Dortmund | - |

| Fortuna Düsseldorf | - |

| Eintracht Frankfurt | Yes |

| SC Freiburg | - |

| 1899 Hoffenheim | Yes |

| 1. FC Köln | Yes |

| RB Leipzig | Yes |

| Bayer Leverkusen | Yes |

| Mainz 05 | Yes |

| Borussia Mönchengladbach | Yes |

| Bayern Munich | Yes |

| SC Paderborn | - |

| Schalke 04 | Yes |

| VfL Wolfsburg | Yes |

It is also interesting to note that esports is increasingly played by real sports professionals. In April 2020, the UK Premier League launched its ePremier League, starring real football players and for broadcast live on terrestrial TV (beyond YouTube and Twitch). As sports people typically retire young, between the ages of 30 and 40, esports could offer a second career (see figure 5).

Figure 5 – ePremier League starring real footballers

Source: YouTube.

- Real sports are easier to understand. You might find the rules of cricket or rugby hard to comprehend, but they’re more familiar to people than the complexities of shooters or MOBA games. The latter are only understandable for the fans, deeply immersed in their fantasy worlds. But real sports have simpler rules (for example, in a NASCAR stock car race whoever finishes the nearly circular laps first wins). By contrast, the rules of cricket are already known by a significant share of the global population, even if they were dreamt up English eccentrics hundreds of years ago.

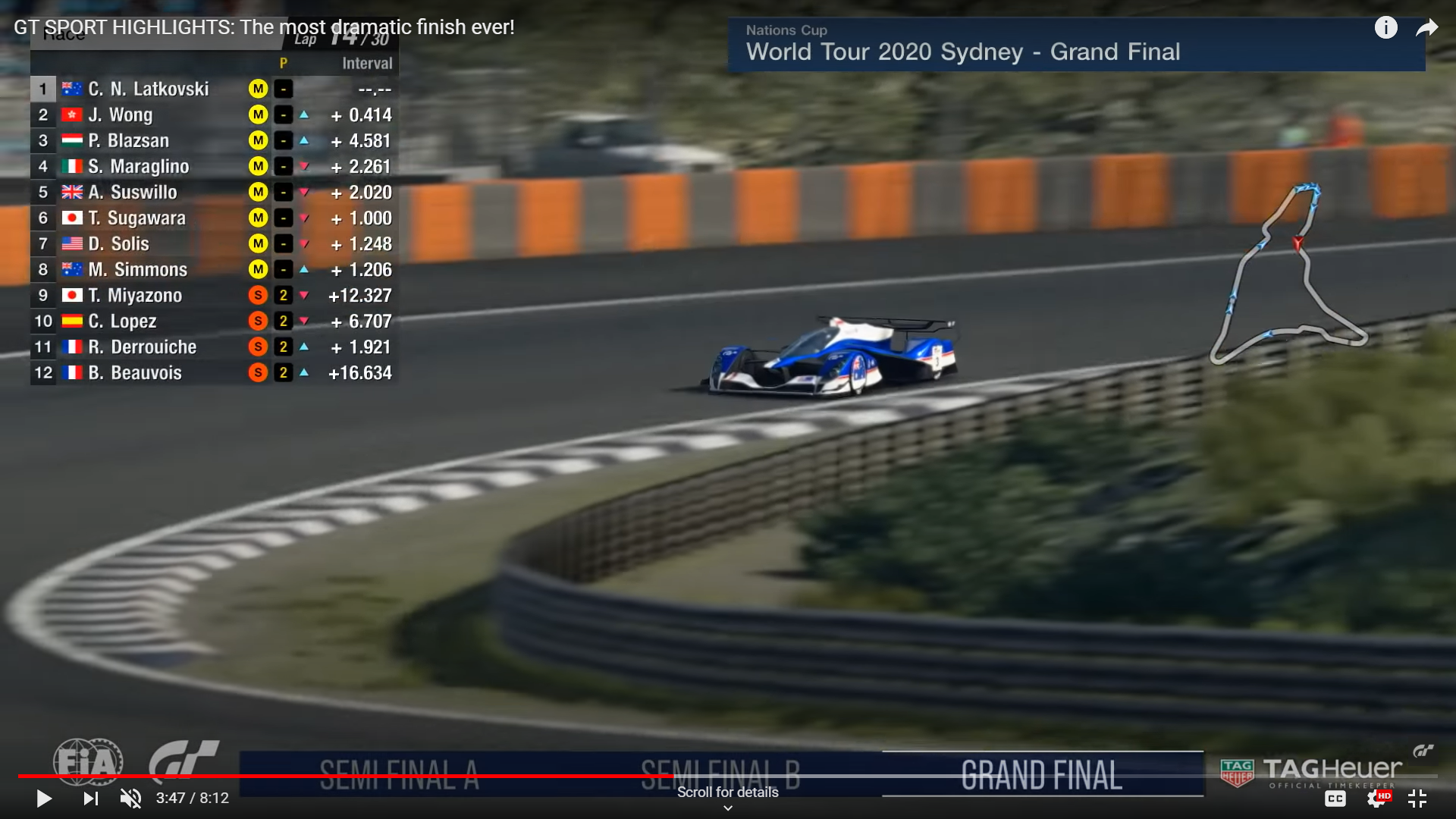

- Esports’ visuals are getting life like. For some sub-genres like motor racing, the difference from real footage is hard to detect (see figure 6).

Figure 6 – Snapshot from Gran Turismo esports

Source: YouTube.

- Financially, esports offers clubs another stream of income. Sports clubs can benefit from media and merchandising revenues, multi-million euro prizes and even packed stadiums for major events such as finals.

So, one of the legacies of the pandemic may well prove to be a shift of real sports into the digital world of esports. All the factors for an acceleration of the trend are there. Who knows how big the shift might be. But imagine how big the world of esports could be if it even approached the popularity of traditional sports…

To learn more about ESPO and the high growth potential of the global video gaming and esports industry, visit vaneck.com/ucits/esports/.

The author would like to thank John Patrick Lee for his ideas and insights.

1Currently VanEck does not possess data or research indicating that this will be the case.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 June 2023

06 September 2022

14 June 2023

06 September 2022

06 February 2022

26 March 2021

23 December 2020