2021: Semiconductors Take Over The World

06 January 2021

Share with a Friend

All fields required where indicated (*)2021 is shaping up to be a year when technology reaches even further into our lives than it did in 2020.

Since the pandemic broke out, the adoption of technology has been truly exponential. Despite lockdowns and social distancing, video communications kept the gregarious among us in touch with family and friends. Business people could talk with colleagues all over the world without the need for polluting travel.

Technology is swiftly improving our lives and in 2021 we can expect the application of inventions by business innovators to do so still further (see figure 1). Think of Waymo’s self-driving cars in the final stages of testing; the growing benefits of 5G; artificial intelligence’s (AI’s) fast-developing practical applications from medical science to factory robotics to client service.

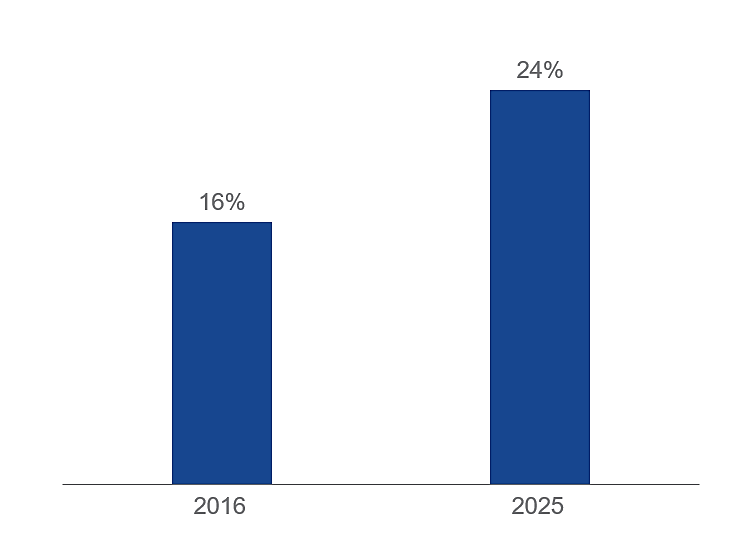

Figure 1: Digital takes a growing share of the global economy

Share of global economy which is digital

Source: Digital Spillover Measuring the true impact of the digital economy, Huawei, Oxford Economics, 2017.

Tech’s nervous system

Yet none of this could happen without the semiconductor, the material that is crucial for fabricating electronic circuits – technology’s equivalent of our nervous system. Without semiconductors, also called microchips, there would be no mobile phones or computers. We would also be without LED lights and devices such as cutting-edge toasters that use ceramic glass to heat bread more swiftly than wire. Without semiconductors, we would be the toast ;-)

There are not many semiconductor manufacturers, although they are becoming an ever more crucial commodity. Most of the companies are based in the US or Asia, among them Analog Devices, Broadcom, Intel, Micron Technology, Taiwan Semiconductor and Texas Instruments. A notable exception are ASML and NXP which have Dutch roots, something at which I as a Dutch person am proud of. Indeed, semiconductor manufacturers have become a strategic industry, even playing a part in the trade rivalry between the US and China.

These companies are among the world’s most innovative and without them most of today’s technological advances would not exist. For instance, Texas Instruments invented the first integrated circuit in 1958. And Intel created the world’s first commercial semiconductor chip in 1971. Not sure if this can be considered a sign, but coincidentally my year of birth.

Historically, the most successful innovators benefit from their ground-breaking work, and the semiconductors are no exception. Many semiconductor producers benefit from so called “economic moats”, referring to their ability to maintain competitive advantages over the long run. Their products are protected by patents. There are also substantial barriers to entry: developing a new chip is estimated to cost at least USD 100 million1, semiconductor companies employ thousands of engineers and the value of lithography machines required to produce semiconductors can be above USD 100 million2. Needless to say, the enormous capital outlays required to build manufacturing capacity go a long way to protect profit margins. It is no surprise that our two moat ETFs (VanEck Morningstar Global Wide Moat UCITS ETF and VanEck Morningstar US Wide Moat UCITS ETF) contain semiconductor producers, such as Intel, Microchip Technology and Applied Materials.

As we stand on the cusp of what commentators think is another leap forward in the digital economy, partly enabled by AI, demand for semiconductors seems set to be exponential. Most importantly, powerful chips are the key enablers for technology companies to gain a competitive advantage. To return to our nervous system metaphor, they let the intelligence of technology take a leap forward.

Europe’s first semiconductor ETF

These companies are often underrepresented in the portfolios of European investors. Which is why in our own innovation we launched the VanEck Semiconductor UCITS ETF in December 2020, which provides exposure to the most liquid companies active in the semiconductor industry. While our investment universe is global, all of the ETF’s underlying companies have a stockmarket listing in the US. I would proudly add that ours’ is the only such ETF in Europe. It is important to note that this ETF has a high level of concentration risk, as it only invests in one sector. It should therefore be part of a diversified portfolio.

Looking forward to 2021 from my home office in Amsterdam, I suspect that AI and its enabling semiconductors will play an important role in vaccine development and getting (and hopefully keeping) the world back to normal, just as technological developments will be key to the looming challenge of creating zero-carbon economies. In fact, 2021 may yet turn out to be the year of the semiconductor!

1Source: EE Times, 2004.

2Source: ELINFOR, 2019.

VanEck Asset Management B.V., the management company of VanEck Semiconductor™ UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, a UCITS management company incorporated under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland and tracks an equity index. The value of the ETF’s assets may fluctuate heavily as a result of the investment strategy. If the underlying index falls in value, the ETF will also lose value.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the local information agent details to be found on the website.

MVIS® US Listed Semiconductor 10% Capped Index is the exclusive property of MVIS (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MV Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. The VanEck Semiconductor UCITS ETF is not sponsored, endorsed, sold or promoted by MV Index Solutions GmbH and MV Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

07 January 2019

Investors can bet on future trends. The European ETF market in particular promises enormous growth potential. Special areas such as e-sports, ESG and cryptocurrencies as well as smart beta offer investors interesting investment opportunities.