VanEck Defense UCITS ETF

- Exposure to companies at the forefront of global defense industry

- Diversified access to the market leaders

- A transparent, convenient investment

Amid global uncertainty, the topic of security and defense returned to the financial investors’ minds. VanEck‘s Defense ETF provides investors with an opportunity to invest in the leaders of defense technologies, large-scale cybersecurity and providers of relevant services.

Risk: Investors in the Defense ETF may lose money up to the total loss of their investment due to the Main Risk Factors such as Industry or Sector Concentration Risk and Liquidity Risks as described in the KID and prospectus.

Traditionally, defense investments have been a sensitive topic in the Developed World. The share of EU Defense Spending dipped below 2% after the fall of the Berlin Wall and the USSR and has not recovered since. However, due to the recent geopolitical conflicts and global security worries, the paradigm started shifting. The Western European governments, perennial violators of NATO’s 2% military expenditure rules, announced serious investments into defensive infrastructure and stockpiles as well as the intent to stick to the 2% rule going forward. The ongoing war in Ukraine showed deficiencies in countries lack of ammunitions capacities and put a spotlight on a chronic underinvestment in maintenance.

In May 2022, German government passed a bill allocating €100bn to a special fund for armaments in a so-called „Zeitenwende“ - a change of a long-standing defensive policy. The government also announced its intention to increase its yearly defense by €10bn in 2023.

The government of the Netherlands has approved an additional €5bn in defense investments in a structureal policy shift. This will bring a 40% increase to the defense budget in 2023.

Traditionally neutral Sweden faced a drastic public opinion shift, which encouraged the country to pursue a NATO membership. The incoming government announced their plans to ramp up the defense investments to reach the 2% target by 2026.

Defense companies often invest heavily in research and development to create cutting-edge technology and products. This focus on innovation can lead to advancements that spill over to areas beyond just military use.

Jet engines were developed by the military in the 1940s for the jet fighters and have since been adapted for use in commercial aircraft, which have revolutionized air travel.

Global Positioning System, which is now commonly used in mobile devices for navigation, was originally developed by the US military for navigation and targeting purposes.

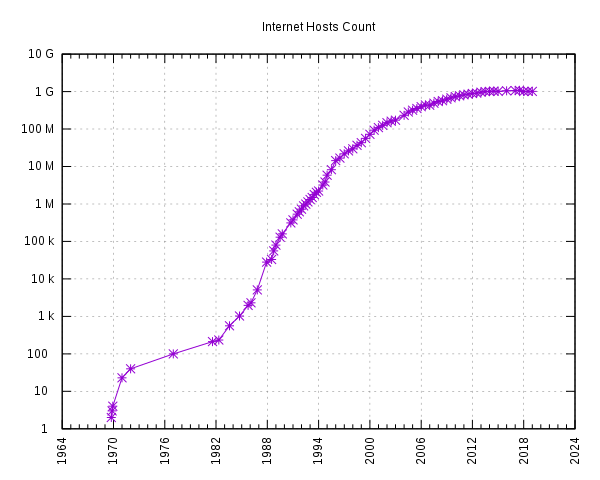

ARPANET, the precursor to the modern internet was developed by the US Department of Defense in the 1960s as a way to facilitate communication and information sharing between military installations.

Internet hosts count (IPv4) – log scale

Source: Internet Systems Consortium.

In 1937 a group of UK physicists built a first multi-cavity magnetron, an instrument capable of producting short waves, for the British and American military radar installations in World War II. In 1940, as the need in more precise measurments arose, English scientists invented a valve that for the first time could produce pulses of microwave radio energy at a wavelength of 10 cm – so-called microvawes. In 1945, the heating effect of a high-power microwave beam was accidentally discovered by Percy Spencer, an American engineer employed by Raytheon at the time. Raytheon later licensed its patents for the first home-use microwave oven produced in 1955.

VanEck‘s Defense ETF adopts a robust approach to select and screen the companies included in the investment strategy, based on its long-standing experience in ETF construction. Only “pure play” companies (i.e., companies with at least 50% revenues in defense) are eligible to enter the Fund.

Click on the following buttons for more info:

The Fund’s assets may be concentrated in one or more particular sectors or industries. Defense ETF may be subject to the risk that economic, political or other conditions that have a negative effect on the relevant sectors or industries will negatively impact the Fund's performance to a greater extent than if the Fund’s assets were invested in a wider variety of sectors or industries.

Liquidity risks exist when a particular financial instrument is difficult to purchase or sell. If the relevant market is illiquid, it may not be possible to initiate a transaction or liquidate a position at an advantageous or reasonable price, or at all. This is one of the risk factors of Defense ETF.

The prices of the securities in Defense ETF are subject to the risks associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.