AEX ETF

VanEck AEX UCITS ETF

AEX ETF

VanEck AEX UCITS ETF

Fund Description

The VanEck AEX UCITS ETF invests in the 25 most highly capitalised Dutch securities on the Euronext Amsterdam and serves as a barometer for the Dutch securities market.

-

NAV€87.67

as of 24 Apr 2024 -

YTD RETURNS11.70%

as of 24 Apr 2024 -

Total Net Assets€301.6 million

as of 24 Apr 2024 -

Total Expense Ratio0.30%

-

Inception Date14 Dec 2009

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck AEX UCITS ETF invests in the 25 most highly capitalised Dutch securities on the Euronext Amsterdam and serves as a barometer for the Dutch securities market.

- Direct access to the 25 largest listed companies in the Netherlands

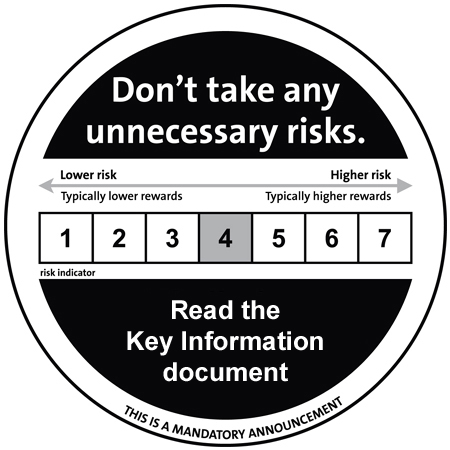

Risk Factors: Liquidity risk, equity market, limited diversification risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

AEX Index (RAEX)

Fund Highlights

- Direct access to the 25 largest listed companies in the Netherlands

Risk Factors: Liquidity risk, equity market, limited diversification risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

AEX Index (RAEX)