The Club of Reckless Investors

28 July 2020

Share with a Friend

All fields required where indicated (*)“I don’t want to belong to any club that will accept me as a member”, Groucho Marx, US actor and comedian, 1949.

The Covid-19 crisis has had an unexpected side effect: many people have stepped into the world of investing for the first time. I would have liked to welcome them to our growing “Club of Long-Term Investors” for people who invest patiently but profitably over time. But after reading about their speculative investing behavior, I reckon some might belong to the new “Club of Reckless Investors,” recently established for thrill seekers.

Was it depressed equity prices? Or a growing consciousness that interest rates will remain low for a long time? Were people bored on their sofas during the lockdown, looking for more exciting ways to spend their leisure? Whatever the reasons, Europe has seen an upsurge in new retail investors during the Coronacrisis. This has alarmed the European Securities and Markets Authority, so much that it issued a public statement on 6 May warning investors that investing can be risky and urging investment firms to conduct business responsibly.

Promoting investing

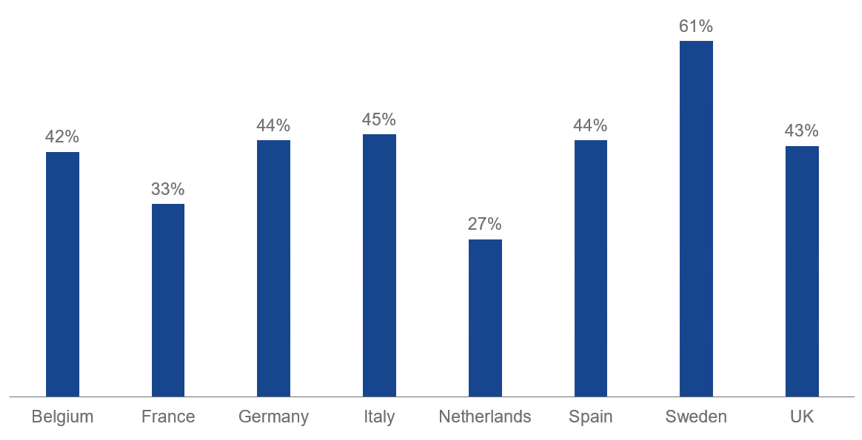

I should be happy about this upsurge. A self-confessed investment evangelist, one of my missions is convincing people to start investing. Taking a patient approach, it can build up your capital, create a cushion for the future and provide investment capital for the economy, helping to create jobs and prosperity. As we can see in figure 1, there is still a lot of evangelizing for me to do. In most European countries only a minority of households invests.

Figure 1 – A minority of Europe’s households invest (2017)

Share of households which invests in any type of financial product

Source: European Commission - Distribution systems of retail investment products across the European Union (2018).

A youthful contingent of investors

But let’s have a look at 2020’s new group of investors we welcome among us. Firstly, there are a lot of them. According to the French financial regulator, Autorité des Marchés Financiers (AMF), in March alone France welcomed 150.000 new equity investors1. Turning to the Netherlands, ABN AMRO, the country’s largest retail bank, reports that the number of people opening brokerage accounts in the first five months of 2020 is up three times on last year.2

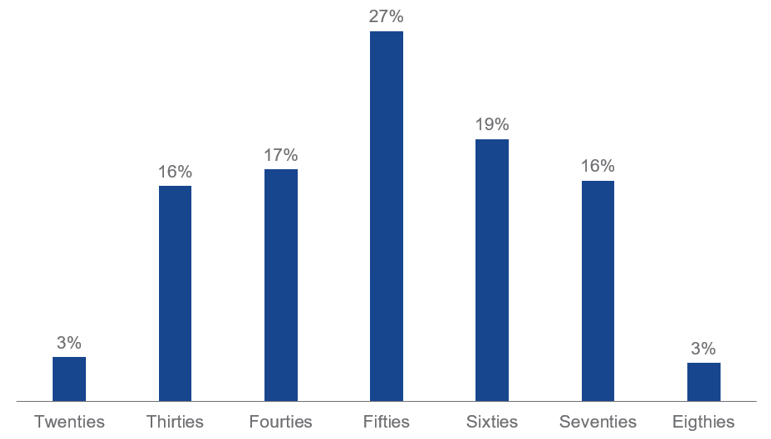

Secondly, they’re relatively young. As we see in figure 2, the average investor is normally in his 50s (55 to be exact). Yet 2020’s new investors are far younger.

According to the largest online Dutch broker, Binck Bank, 45% of new investors are in their 20s or 30s. Other countries tell similar stories. E.g., the AMF indicated that this year’s new investors are on average 10 – 15 years younger than regular investors.

Figure 2 – Age distribution of investors

Example: Netherlands

Source: Representative survey amongst Dutch execution only investors by Kantar, October 2019

Thirdly, new investors are still mainly male. In line with the existing investor population, only 20% - 25% of newcomers are female.

Investing for excitement?

The German financial regulator, BaFin, sheds some light on the new investors’ behavior, adding to my fear that many of them are seeking a diversion from enforced boredom rather than being serious long-term investors. According to a recent publication3, German retail investors during the Coronacrisis mainly bought the following:

- German Dax 30 stocks. In my experience, some investors focus just on well-known investments. Often they buy stocks that have recently dropped in price, such as Wirecard. Data from Binck Bank in the Netherlands seems to confirm this, showing that during the Coronacrisis investors favored stocks like Royal Dutch Shell, fitness chain Basic Fit and AirFrance KLM, all of which fell sharply in the crisis. But such concentrated investments are risky – like betting on the horses. Data from the AMF shows that weekly stock purchases increased fourfold compared with 2019, but also that selling more than doubled, suggesting very short holding periods. Warren Buffett’s famous quote that “calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic” comes to mind.

- ETFs. This I can only encourage, especially if ETFs are bought for long-term investment, if the decision to buy follows a thoughtful process considering both potential rewards and risks of such investment.

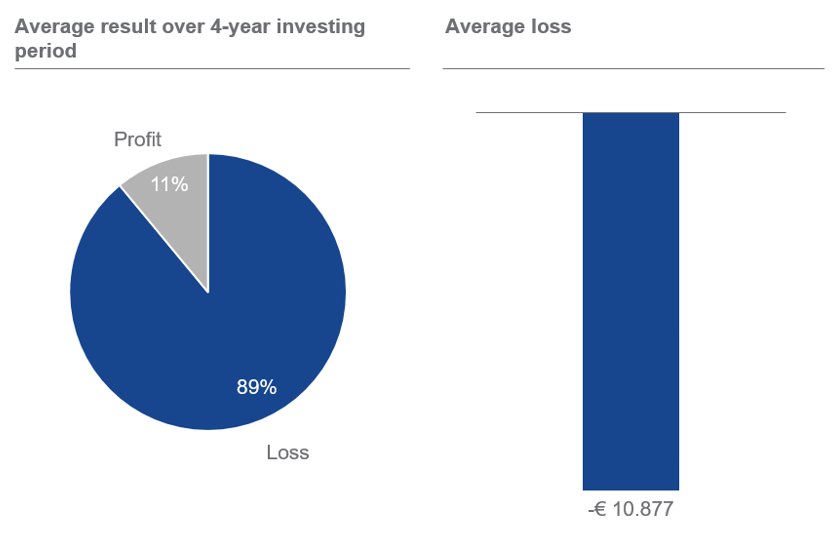

- Certificates for difference (CFDs). Here I almost fell off my chair. CFDs, for those who do not know, are highly speculative products, which bid on the rise or fall of a security. They’re the casino of the investment world, with an astronomical leverage, up to a factor 500! According to the AMF, 89% of investors lose money over a period of four years in CFDs4. The average amount lost is EUR 10,877. It’s not for nothing that France’s retail investors are banned from buying them, and marketing is restricted in other European countries

Figure 3 – CFDs: an exciting way to lose money?

Example: Data for France

Source: Étude des résultats des investisseurs particuliers sur le trading de CFD et de Forex en France, AMF, October 2014. Data is from 14799 clients in France and has been collected through multiple brokers, with a collective market share of 54%, in the period 2009 – 2013.

Which club to join?

I hope that by now you are not interested in joining the Club of Reckless Investors. If you know or meet any member of this club, please tell him or her about our Club of Long-Term Investors. A much more select club of people who invest for the long term, diversifying their portfolios across asset classes, companies, countries and regions. A club of people who are conscious of costs. People who value the importance of patience. A club which is open to everyone, including Groucho Marx if he were alive today and prepared to break his rule. But the admission process takes much longer.

1Source: Comportement des investisseurs particuliers pendant la crise COVID-19, AMF, April 2020.

2Source: Nieuwe belegger is jong en waaghals: 'Ik was gewoon aan het gokken', Financieel Dagblad 10 July 2020.

3Source: Corona-Krise treibt Verbraucher in Aktieninvestments, Bafin, 13 May 2020.

4Source: AMF’s decision of 1 August 2019 restricting the marketing, distribution or sale, in France or from France, of contracts for differences to retail investors. AMF.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2024

15 April 2024

15 March 2024

14 March 2024