Esports ETF

VanEck Video Gaming and eSports UCITS ETF

Esports ETF

VanEck Video Gaming and eSports UCITS ETF

Fund Description

At a time when the video gaming industry is growing meteorically, the VanEck Video Gaming and eSports UCITS ETF provides exposure to the sector’s innovators. They are disrupting traditional media and sport, bringing together entertainment, video gaming, sports and media.

-

NAV$38.36

as of 24 Apr 2024 -

YTD RETURNS5.94%

as of 24 Apr 2024 -

Total Net Assets$523.7 million

as of 24 Apr 2024 -

Total Expense Ratio0.55%

-

Inception Date24 Jun 2019

-

SFDR ClassificationArticle 8

Overview

Fund Description

At a time when the video gaming industry is growing meteorically, the VanEck Video Gaming and eSports UCITS ETF provides exposure to the sector’s innovators. They are disrupting traditional media and sport, bringing together entertainment, video gaming, sports and media.

- Fast-growing, cutting-edge industry

- Young fans and new technologies look set to support future expansion

- Disrupting traditional media and sport

- First UCITS ETF to offer investors access to a diversified portfolio of esports and video gaming companies

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco

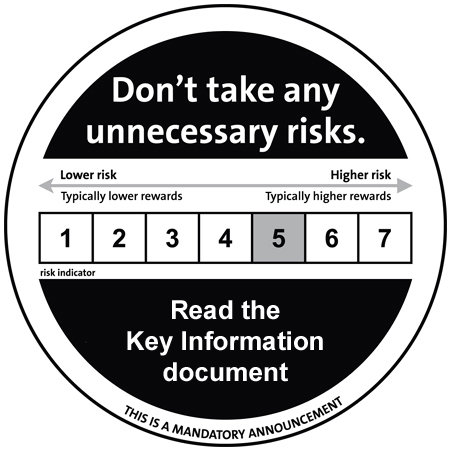

Risk Factors: Equity market risk, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MarketVector Global Video Gaming and eSports ESG Index (MVESPGTR)

Fund Highlights

- Fast-growing, cutting-edge industry

- Young fans and new technologies look set to support future expansion

- Disrupting traditional media and sport

- First UCITS ETF to offer investors access to a diversified portfolio of esports and video gaming companies

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco

Risk Factors: Equity market risk, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MarketVector Global Video Gaming and eSports ESG Index (MVESPGTR)