Hydrogen ETF

VanEck Hydrogen Economy UCITS ETF

Hydrogen ETF

VanEck Hydrogen Economy UCITS ETF

Fund Description

Contribute to a zero-carbon future by investing in the VanEck Hydrogen Economy UCITS ETF. As the use and development of hydrogen accelerates, its emerging ecosystem looks set for growth, with a similar investment profile to early-stage technology sectors.

-

NAV$6.11

as of 24 Apr 2024 -

YTD RETURNS-22.81%

as of 24 Apr 2024 -

Total Net Assets$68.2 million

as of 24 Apr 2024 -

Total Expense Ratio0.55%

-

Inception Date26 Mar 2021

-

SFDR ClassificationArticle 9

Overview

Fund Description

Contribute to a zero-carbon future by investing in the VanEck Hydrogen Economy UCITS ETF. As the use and development of hydrogen accelerates, its emerging ecosystem looks set for growth, with a similar investment profile to early-stage technology sectors.

- Hydrogen is increasingly viewed as a key replacement for fossil fuels in a zero-carbon future

- Large-scale support from governments across the world

- Dynamic ETF, delivering access to hydrogen innovation leaders globally, reviewed every quarter

- Tracks highly liquid hydrogen companies, based on market capitalization and trading volume

- Stocks must derive at least 50% of revenues from the hydrogen economy (exceptions possible)

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.

Risk Factors: Equity Market Risk, Liquidity Risks, Limited Diversification Risk, Risk of Investing in Smaller Companies, Risk of Investing in the Energy Sector, Foreign Currency Risk

Underlying Index

MVIS Global Hydrogen Economy ESG Index (MVHTWOTR)

Fund Highlights

- Hydrogen is increasingly viewed as a key replacement for fossil fuels in a zero-carbon future

- Large-scale support from governments across the world

- Dynamic ETF, delivering access to hydrogen innovation leaders globally, reviewed every quarter

- Tracks highly liquid hydrogen companies, based on market capitalization and trading volume

- Stocks must derive at least 50% of revenues from the hydrogen economy (exceptions possible)

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.

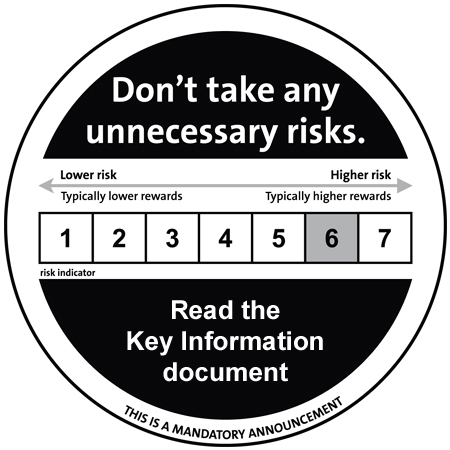

Risk Factors: Equity Market Risk, Liquidity Risks, Limited Diversification Risk, Risk of Investing in Smaller Companies, Risk of Investing in the Energy Sector, Foreign Currency Risk

Underlying Index

MVIS Global Hydrogen Economy ESG Index (MVHTWOTR)