Emerging Markets High Yield Bond ETF

VanEck Emerging Markets High Yield Bond UCITS ETF

Emerging Markets High Yield Bond ETF

VanEck Emerging Markets High Yield Bond UCITS ETF

Fund Description

The VanEck Emerging Markets High Yield Bond UCITS ETF offers the potential for higher returns than developed-market bonds, while also having the advantage of higher credit quality. The EM bond universe has grown substantially in the last years, and is now an attractive alternative to the developed world’s high yield markets.

-

NAV$112.85

as of 17 Apr 2024 -

YTD RETURNS2.62%

as of 17 Apr 2024 -

Total Net Assets$24.5 million

as of 17 Apr 2024 -

Total Expense Ratio0.40%

-

Inception Date20 Mar 2018

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck Emerging Markets High Yield Bond UCITS ETF offers the potential for higher returns than developed-market bonds, while also having the advantage of higher credit quality. The EM bond universe has grown substantially in the last years, and is now an attractive alternative to the developed world’s high yield markets.

- Potential for higher returns than developed market high-yield bonds

- Currently higher average credit rating than developed-market high yield

- Tracks a well-diversified index of corporate bonds

- Underlying bonds issued in USD

Risk factors:

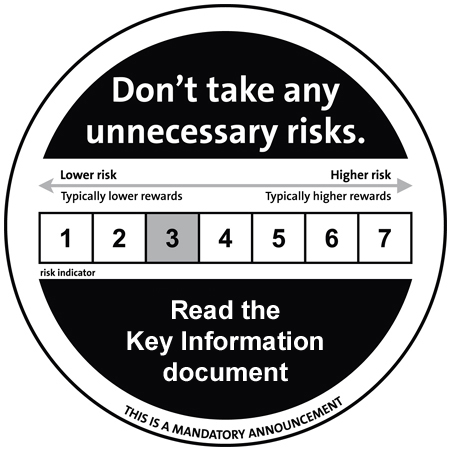

Emerging Markets Risk, High Yield Securities Risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index

Fund Highlights

- Potential for higher returns than developed market high-yield bonds

- Currently higher average credit rating than developed-market high yield

- Tracks a well-diversified index of corporate bonds

- Underlying bonds issued in USD

Risk factors: Foreign Currency Risk, Emerging Markets Risk, High Yield Securities Risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index