Junior Gold Miners ETF

VanEck Junior Gold Miners UCITS ETF

Junior Gold Miners ETF

VanEck Junior Gold Miners UCITS ETF

Fund Description

VanEck Junior Gold Miners UCITS ETF invests in the stocks of small gold miners, some of which are in the early stages of exploration. Junior gold miners bring on new supply and are prime beneficiaries of rising gold demand. Typically they have greater sensitivity to underlying gold price movements than more established, senior gold mining companies.

-

NAV$36.39

as of 17 Apr 2024 -

YTD RETURNS8.78%

as of 17 Apr 2024 -

Total Net Assets$458.6 million

as of 17 Apr 2024 -

Total Expense Ratio0.55%

-

Inception Date25 Mar 2015

-

SFDR ClassificationArticle 6

Overview

Fund Description

VanEck Junior Gold Miners UCITS ETF invests in the stocks of small gold miners, some of which are in the early stages of exploration. Junior gold miners bring on new supply and are prime beneficiaries of rising gold demand. Typically they have greater sensitivity to underlying gold price movements than more established, senior gold mining companies.

- Potential for additional upside as premium takeover targets for larger producers

- Ideal complement to more traditional gold or gold equity allocations

- Only ETF in Europe providing exposure to junior gold miners

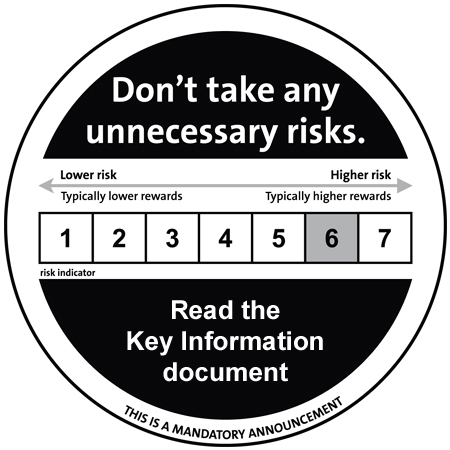

Risk Factors: Risk of investing in natural resources companies, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS Global Junior Gold Miners Index (MVGDXJTR)

Fund Highlights

- Potential for additional upside as premium takeover targets for larger producers

- Ideal complement to more traditional gold or gold equity allocations

- Only ETF in Europe providing exposure to junior gold miners

Risk Factors: Risk of investing in natural resources companies, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS Global Junior Gold Miners Index (MVGDXJTR)