Corporate Bond ETF

VanEck iBoxx EUR Corporates UCITS ETF

Corporate Bond ETF

VanEck iBoxx EUR Corporates UCITS ETF

Fund Description

Access reasonable returns from bonds in a yield-starved world. Our ETF follows an index which selects the 40 largest and most liquid euro-denominated corporate bonds with at least an investment-grade rating. The ETF incorporates Environmental, Social and Governance (ESG) factors.

-

NAV€16.76

as of 17 Apr 2024 -

YTD RETURNS-0.73%

as of 17 Apr 2024 -

Total Net Assets€35.5 million

as of 17 Apr 2024 -

Total Expense Ratio0.15%

-

Inception Date14 Apr 2011

-

SFDR ClassificationArticle 8

Overview

Fund Description

Access reasonable returns from bonds in a yield-starved world. Our ETF follows an index which selects the 40 largest and most liquid euro-denominated corporate bonds with at least an investment-grade rating. The ETF incorporates Environmental, Social and Governance (ESG) factors.

- Diversified exposure to highly liquid euro-denominated corporate bonds with an investment-grade rating and minimum issue size of EUR 750 million

- Direct access to corporate bonds from a variety of sectors (industrials, utilities, financial companies, etc.) and countries

- Higher weights to issuers with higher ESG scores while reducing weights to those with lower ESG scores

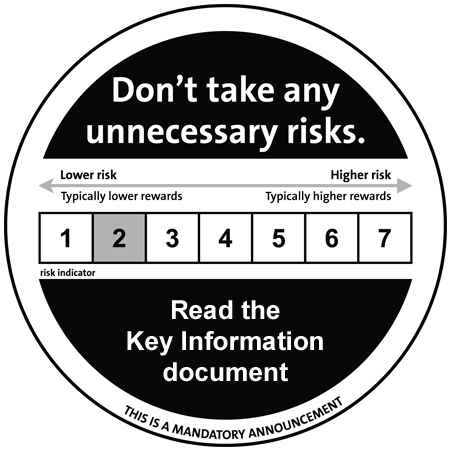

Risk factors: credit risk, liquidity risk, interest rate risk. Please refer to the

KIDand the Prospectus for other important information before investing.

For further details on the Fund and its index, please see the Index Transition Communication report on the Literature section of the Fund or the Description on the Index section.

Underlying Index

iBoxx SD-KPI EUR Liquid Corporates Index (IBXXELTR)

Fund Highlights

- Diversified exposure to highly liquid euro-denominated corporate bonds with an investment-grade rating and minimum issue size of EUR 750 million

- Direct access to corporate bonds from a variety of sectors (industrials, utilities, financial companies, etc.) and countries

- Higher weights to issuers with higher ESG scores while reducing weights to those with lower ESG scores

Risk factors: credit risk, liquidity risk, interest rate risk. Please refer to the

KIDand the Prospectus for other important information before investing.

For further details on the Fund and its index, please see the Index Transition Communication report on the Literature section of the Fund or the Description on the Index section.

Underlying Index

iBoxx SD-KPI EUR Liquid Corporates Index (IBXXELTR)