Balanced Multi Asset ETF

VanEck Multi-Asset Balanced Allocation UCITS ETF

Balanced Multi Asset ETF

VanEck Multi-Asset Balanced Allocation UCITS ETF

Fund Description

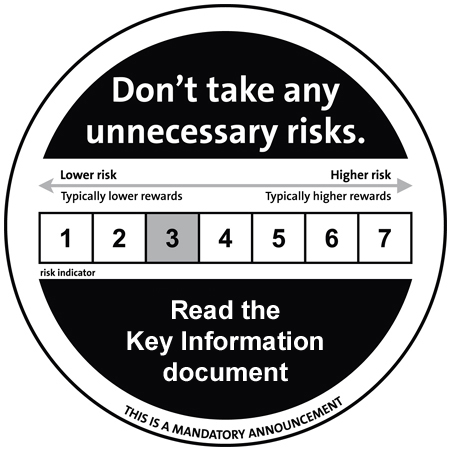

The VanEck Multi-Asset Balanced Allocation UCITS ETF makes multi-asset investing easy, bringing it within reach of the average investor. By investing across stocks, bonds and real estate, it makes investments more defensive, without necessarily eating into returns. This version of the ETF is considered medium risk.

-

NAV€66.35

as of 19 Apr 2024 -

YTD RETURNS0.90%

as of 19 Apr 2024 -

Total Net Assets€35.4 million

as of 19 Apr 2024 -

Total Expense Ratio0.30%

-

Inception Date14 Dec 2009

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Multi-Asset Balanced Allocation UCITS ETF makes multi-asset investing easy, bringing it within reach of the average investor. By investing across stocks, bonds and real estate, it makes investments more defensive, without necessarily eating into returns. This version of the ETF is considered medium risk.

- One-stop-shop for your investment portfolio

- Tailored to your risk preferences

- Diversified across stocks and bonds from roughly 250 companies and governments

- Annually rebalanced across equities, government bonds, corporate bonds and real estate stocks

- A 12-year record of delivering attractive returns for investors1

- All-in costs of just 0.3% a year

Underlying Index

Multi-Asset Balanced Allocation Index (TTMTINL)

Fund Highlights

- One-stop-shop for your investment portfolio

- Tailored to your risk preferences

- Diversified across stocks and bonds from roughly 250 companies and governments

- Annually rebalanced across equities, government bonds, corporate bonds and real estate stocks

- A 12-year record of delivering attractive returns for investors1

- All-in costs of just 0.3% a year

Underlying Index

Multi-Asset Balanced Allocation Index (TTMTINL)