A Hot Take on Crypto “Hot Wallets”

May 11, 2022

Read Time 3 MIN

First thing’s first: what exactly is a crypto wallet? For a full explanation, read this blog: What is a Crypto Wallet?

The short answer is that a crypto wallet acts as a method for proving ownership of cryptocurrencies on the blockchain, and includes tools that allow you to transact in the various digital asset marketplaces.

There are two types of crypto wallets: hot and cold. In short, a hot wallet is connected to the blockchain via the internet, whereas a cold wallet is a form of hardware that is completely disconnected from the internet. We’ll focus on hot wallets here.

Think of a hot crypto wallet as the one you use to make daily transactions. Perhaps you use it to transfer crypto to a friend or to buy artwork or other digital assets. Specific to assets on the Ethereum blockchain, I tend to stick with the following three “hot” crypto wallets:

- Trust Wallet

- MetaMask

- Rainbow.me

Why Use Trust Wallet?

All three wallets are extremely easy to set up. With Trust Wallet, I also like the overall interface and the ease of creating additional wallets within the app. The NFT portion of the wallet gives you a small display of NFTs owned, and also provides the option to connect with many decentralized applications (dApps) via Wallet Connect.

A dApp is an application built on a decentralized network (like Ethereum) and has the easy-to-use interface you would expect from any normal app you use on your phone or tablet. Since COVID began, we’ve grown accustomed to using QR codes for reading restaurant menus. But QR codes are also a way for your wallet to connect with dApps so that you can transact when needed. For example, to connect your Trust Wallet with Opensea.io, simply visit the wallet you wish to use, connect via Wallet Connect and your mobile device will transform into a “remote control” for signing and confirming transactions you make while browsing through the website.

From Opensea.io.

If you would like a guide for how to set up a Trust Wallet, check out this blog, How to Set Up Your Crypto Wallet, which was created for holders of our VanEck Community NFT.

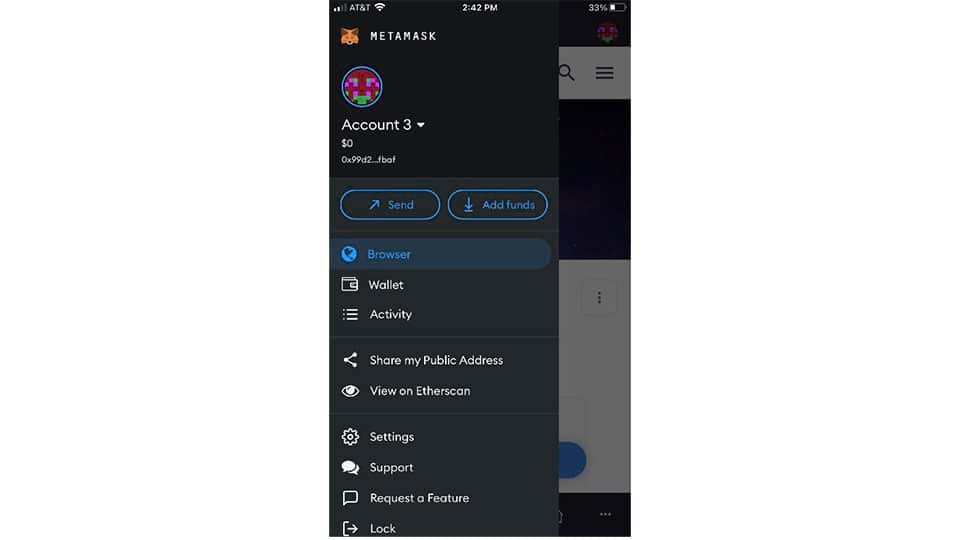

Why Use Metamask?

Metamask offers many of the same features as Trust Wallet. The Metamask browser is one feature that is particularly handy. Sometimes you don’t have access to your home PC, and the Metamask app has a built-in browser that allows you to surf the internet, just as you would with any other browser interface. The browser also allows you to connect directly with the sites you’re visiting.

Additionally, for when you do have access to your personal computer, Metamask.io has a powerful Chrome Extension that makes it easy to connect with hardware devices or cold storage wallets such as Ledger Nano X.

Why Use Both Trust and Metamask?

For a few reasons:

- For certain transactions, one app may be more preferred than the other. For example, if you’re travelling with only your mobile device and wish to claim an NFT airdrop (i.e., a free NFT from a project you follow), Metamask may be preferred.

- Sometimes apps act up and the application fails. It’s helpful to have a back-up wallet ready to go if you are in a time crunch.

- Having two hot wallets with the same address (remember, “hot” = connected to the Internet) means you have a back-up for your 12-Seed words* (private key).

*Public service announcement: You should have your seed phrase backed up in a secure location and never take a photo of them with your mobile device.

Why Use Rainbow.me?

This is one of the better wallet apps to become familiar with. It has much of the same functionality as the above wallets, but also includes one really important and nifty feature: you can paste the public address of any wallet into the interface and see what that person owns, including recent transactions!

Remember, since Ethereum is built using distributed ledger technology (i.e., a database that is consensually shared and synchronized across multiple sites), all transactions on the Ethereum network are viewable, including owned assets and transactions of a particular address. In some cases, I use this app to simply follow other crypto enthusiasts to see what they buy and own without even needing to create or utilize the actual wallet feature.

This wallet has an iOS app and a general website at www.Rainbow.me. Feel free to give it a try.

Lastly, if you were lucky enough to receive an airdrop of the VanEck Community NFT, then simply paste your public wallet address into Rainbow.me to get a closer look at your NFT and its respective traits.

To receive more Digital Assets insights, sign up in our subscription center.

Related Topics

Related Insights

DISCLOSURES

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Van Eck Associates Corporation

Related Funds

DISCLOSURES

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Van Eck Associates Corporation