Making Waves with Play to Earn Gaming

September 07, 2022

Read Time 5 MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

“Each owning about the value of a timber head, or a foot of plank, or a nail or two in the ship. People in Nantucket invest their money in whaling vessels, the same way that you do yours in approved state stocks bringing in good interest.” – Moby Dick, Herman Melville, Chapter 16.

The play to earn (P2E) gaming economy represents the next iteration in the ever-evolving video game ecosystem. As discussed in a prior blog, P2E holds a lot of promise for both developers and gamers by providing ownership benefits to players, while potentially increasing engagement and broadening the pool of gamers.

While researching (unreleased) GameFi platform Arcarde2Earn, we were blown away by similarities of the platform to one of the United States’ most vibrant economies in the 19th century – the whaling industry! As detailed in Herman Melville’s Moby Dick, each whaling voyage was a collection of interested parties, working closely together to harvest natural resources in search of profit. Whaling was an expensive, dangerous business, with extremely high levels of risk for all involved, and a high barrier to entry. This led to a stake holding system by which owners, investors and operators would join together to spread the risk of a single excursion.

The Metaverse’s New Bedford

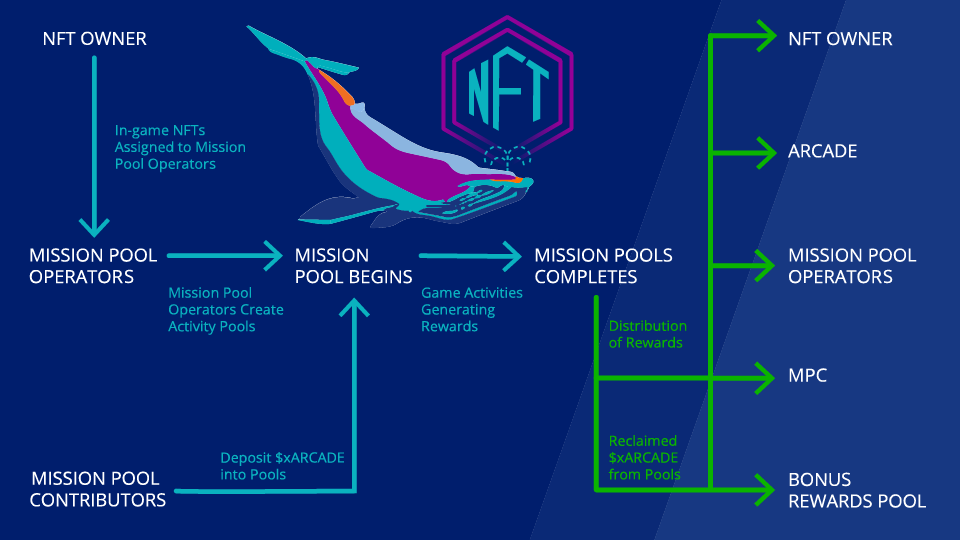

At its core, Arcade2Earn is an infrastructure platform that allows interested parties to choose terms for excursions (known as Mission Pools) in a specific P2E game. The terms can vary in amount contributed, game played, and length of mission. All terms are built into a smart contract which exists on the Solana blockchain, and both contributions and rewards are paid through Arcade’s token ($xARCADE), which is a token built on Solana.

Currently, one of the major roadblocks to mass P2E adoption is cost of entry into a game. As of August 30, 2022, a plot of land in Illuvium costs roughly $450; a Gen1 ASM brain costs $820; a plot of land in Sandbox costs $1,960. These high costs mean that a lot of traditional gamers may never play these new P2E games, or benefit economically from them. Arcade2Earn overcomes this barrier by allowing Mission Pool Contributors (MPCs) to participate in games without owning the required NFT by contributing to a specific Mission Pool using the $xARCADE token. So instead of potentially spending hundreds (or thousands) to own an NFT to be able to play a game, MPCs can stake their interest in specific Mission Pools at a lower entry price.

Motley Crew – Mission Pool Operators

Much like the whaling ships were filled with a motley crew of whalers and vagabonds who had highly specialized skills, Arcade2Earn’s Mission Pool Operators serve the same purpose. The gaming community has long had guilds, which are groups of gamers who operate as a team in games and tournaments. Arcade2Earn’s platform lets MPCs and players (Mission Pool Operators) work together to come to a specific set of terms on a Mission Pool.

Once terms are in place and the funding has been raised, the Mission Pool Operators take the game assets (NFTs) and play the game as a team. Once the mission ends, any assets/tokens raised during the Mission Pool are distributed back to Contributors, Operators and Owners based on the terms agreed upon before the mission began. It’s worth noting that any Mission Pool Operators playing games with platform assets have been vetted by Arcade2Earn.

The Risks of the High Seas

Custody, interaction and crypto signatures can present high-risk scenarios for NFT and broader crypto enthusiasts. Crypto scams can even affect so-called experts, as the author learned the hard way after losing thousands of dollars in NFTs after clicking a bad link (watch WEB3 TEA episode with Ledger).

Arcade2Earn allows members of the community to participate in economic upside in the P2E ecosystem without risking NFT assets which may be worth thousands (or tens of thousands) of dollars. In some games, NFT assets can actually be lost, stolen or destroyed within the game, meaning that just by playing, the owner is risking significant capital.

Because Arcade2Earn currently owns all the NFTs being used to play the game, the financial consequences of losing or destroying an NFT fall solely on the platform provider. The risks are carried by a single party (the platform owner), and the rewards are spread among the Mission Pool Contributors who invested in a single Mission Pool. As the platform matures, Arcade2Earn plans to onboard new NFT owners who will then assign their NFTs to new Mission Pools.

Will Traditional Gamers Embrace P2E?

Some Web2 gaming companies (think traditional, publicly-traded game publishers) have taken steps to incorporate NFTs within their games. However, it’s become clear that as a whole, traditional gamers and game companies have a negative view of P2E and crypto games in general, although not necessarily for the same reasons. Gamers see NFTs and crypto games as another microtransaction that increases their costs without adding much value to the playing experience (we disagree – see our blog highlighting why P2E benefits gamers).

Other currently dominant Web2 gaming organizations, like esports teams and streaming orgs, actually prohibit their players from playing or interacting with crypto games. We see this prohibitive setup as evidence that Web2 companies actually do understand the threat that Web3 presents – namely, that ownership of the ecosystem and individual assets is decentralized and the central authority no longer holds as much power. Furthermore, Web2 companies have seen a number of founders and developers leave to work on Web3 games, similar to what we’ve seen in other Web3 segments.

Final Thoughts

Our comparison of the P2E gaming ecosystem to the whaling economy of the 19th century rests upon a number of shared characteristics. Specifically, the pooling of resources among owners, players and interested backers leads to single Mission Pools, where the operators (gamers : ship crew) use a valuable asset (NFT : whaling ship) to go on excursions (P2E gaming session : journey to sea) in order to harvest resources to turn a profit (crypto assets : whale oil). Arcade2Earn represents a revolutionary way to own and operate NFT assets within the new P2E gaming ecosystem.

To receive more Digital Assets insights, sign up in our subscription center. If you want to stay up-to-date on current NFT, P2E, and other Whale related trends, be sure to check out Matt Bartlett's Blubber Notes.

Related Topics

Related Insights

IMPORTANT DISCLOSURES

Source: OpenSea.io

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

In consideration of the receipt of non-fungible tokens ("NFTs") from VanEck, you represent, acknowledge, accept and agree that you received the NFTs as a gift from VanEck. You did not pay any consideration, monetary or otherwise, for the NFTs.

You may receive an NFT as a gift from VanEck. You are not paying any consideration, monetary or otherwise, for the NFT.

The NFTs are not an investment. Rather, the NFTs are digital memorabilia intended solely for entertainment purposes. As entertainment memorabilia given to you as a gift, the NFTs have no value and are not intended by VanEck to ever have any value. Neither VanEck nor anyone else will take or not take any current or future action that is designed in any way to maintain the value of the NFTs, or to cause their value to grow or increase. You must not attempt to obtain an NFT from VanEck if you view it as an investment.

As a condition of receiving the NFTs, you shall hold the NFTs for your own personal benefit, and you shall not act, and are not acting, on behalf of any other person or entity; except that, if you are an affiliate of an entity or person whose relationship or affiliation you have made VanEck aware of prior to your receiving the NFT, and VanEck consents to your receiving an NFT, you may receive an NFT. You shall not sell, assign, alienate, lease, lend, fractionalize, re-gift, convey or transfer in any way the NFTs (or any interest therein) to any other person or entity, even an affiliate. Any sale, transfer, assignment, or other action covered in the preceding sentence shall be void. You must not attempt to obtain an NFT from VanEck if you plan to sell or transfer it.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Related Funds

IMPORTANT DISCLOSURES

Source: OpenSea.io

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

In consideration of the receipt of non-fungible tokens ("NFTs") from VanEck, you represent, acknowledge, accept and agree that you received the NFTs as a gift from VanEck. You did not pay any consideration, monetary or otherwise, for the NFTs.

You may receive an NFT as a gift from VanEck. You are not paying any consideration, monetary or otherwise, for the NFT.

The NFTs are not an investment. Rather, the NFTs are digital memorabilia intended solely for entertainment purposes. As entertainment memorabilia given to you as a gift, the NFTs have no value and are not intended by VanEck to ever have any value. Neither VanEck nor anyone else will take or not take any current or future action that is designed in any way to maintain the value of the NFTs, or to cause their value to grow or increase. You must not attempt to obtain an NFT from VanEck if you view it as an investment.

As a condition of receiving the NFTs, you shall hold the NFTs for your own personal benefit, and you shall not act, and are not acting, on behalf of any other person or entity; except that, if you are an affiliate of an entity or person whose relationship or affiliation you have made VanEck aware of prior to your receiving the NFT, and VanEck consents to your receiving an NFT, you may receive an NFT. You shall not sell, assign, alienate, lease, lend, fractionalize, re-gift, convey or transfer in any way the NFTs (or any interest therein) to any other person or entity, even an affiliate. Any sale, transfer, assignment, or other action covered in the preceding sentence shall be void. You must not attempt to obtain an NFT from VanEck if you plan to sell or transfer it.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.