SMI ETF: Question & Answer

February 03, 2022

Read Time 6 MIN

We address frequently asked questions about sustainable municipal bonds including suitability, ratings, how sustainable munis fit into a portfolio and the VanEck HIP Sustainable Muni ETF (SMI).

- What kind of projects are sustainable municipal bonds issued to fund?

- How does SMI screen for suitability?

- Who is HIP Investor?

- Are less affluent municipalities more likely to rate lower or higher?

- Why do NY and CA represent such large weightings?

- Is impact measured and if so, how?

- How does SMI fit into a portfolio?

- How to buy VanEck ETFs?

What kind of projects are sustainable municipal bonds issued to fund?

Sustainable muni bonds support many desired outcomes: to produce healthier patients at hospitals, to educate our students for a meaningful life journey, to generate clean power, and more.

Muni bond sectors include: cities, counties, states, hospitals, schools, water utilities, energy utilities, transportation, and affordable housing. The VanEck HIP Sustainable Muni ETF (SMI) seeks out those bond issuers and issuances that are achieving their missions effectively, consistent with expectations of high performance and accountability of tax-advantaged public sector funds and projects.

Thus, examples of sustainable muni bonds in SMI can fund:

- Public transportation buses and trains, efficiently moving groups of citizens via environmentally beneficial modes.

- Eco-efficient buildings and real estate, which can use less water and energy, reducing waste and emissions.

- Classrooms and teachers for lower-income students, accelerating their learning, and increasing the rates of college matriculation and graduation.

- Clean-energy infrastructure, including solar on schools, as well as lower-emissions power production.

- Water quality and delivery to ensure health and wellness of citizens, agriculture, and productive commerce.

How does SMI screen for suitability?

Suitability for SMI relates to four types of impact, as rated by our HIP Investor, the ratings and data provider for VanEck:

- HIP’s rating of outcomes for each type of entity, like healthy patients at hospitals or graduating students of schools, which map to Environmental, Social, and Governance (ESG); bond issuers must rate 50 or above (on HIP’s 100 point impact scale).

- HIP’s rating of outcomes related to the United Nations Sustainable Development Goals (SDG) 9, 11, and 12 - focused on sustainable cities and communities, and innovation and infrastructure; bond issuers must rate 50 or above (on HIP’s 100 point SDG scale).

- HIP’s rating of climate threats and expected resilience of the related geographic county; bond issuers must rate 33 or above (on the 100 point climate scale).

- The existence of one or more designated Opportunity Zones, which enhances the likelihood of positive impact in economically distressed communities.

HIP Investor’s Ratings described above are based on comprehensive data covering 5 million data points annually across 122,000 entities that can issue muni bonds. The ratings measure actual results of municipal entities, and thus connote beneficial positive impact on people, planet, and trust.

Who is HIP Investor?

Founded in 2006, HIP (Human Impact + Profit) Investor Inc. is an impact-ratings agency, tracking 8 million data points annually to grade how well investments across all asset classes achieve positive (or negative) outcomes for people, planet, and trust. HIP’s methodology, inspired by Maslow’s hierarchy of needs, was developed 15 years ago, before the term ESG was coined, or the field of impact investing emerged. Today, HIP serves VanEck and fund managers worth a combined AUM of $7 trillion.

HIP initiated ratings of 122,000 muni-bond issuers, obligors, and “impact entities” nearly a decade ago to spur more transparency, performance, and accountability in the $4 trillion muni market. As of January 2022, HIP has graded 180,000 issuances on achieving (or failing) the desired mission, along with evaluating the use of proceeds towards positive impact. HIP also rates 11,000 corporates, covering equities and bonds, as well as nearly 200 sovereigns and mortgage backed securities.

HIP’s founder and CEO R. Paul Herman authored The HIP Investor: Make Bigger Profits by Building a Better World (Wiley 2010) and co-authored and co-edited the Global Handbook of Impact Investing (Wiley 2021), available in the VanEck merchandise store.

Visit the fund page for the fact sheet, holdings, performance and more.

Are less affluent municipalities more likely to rate lower or higher?

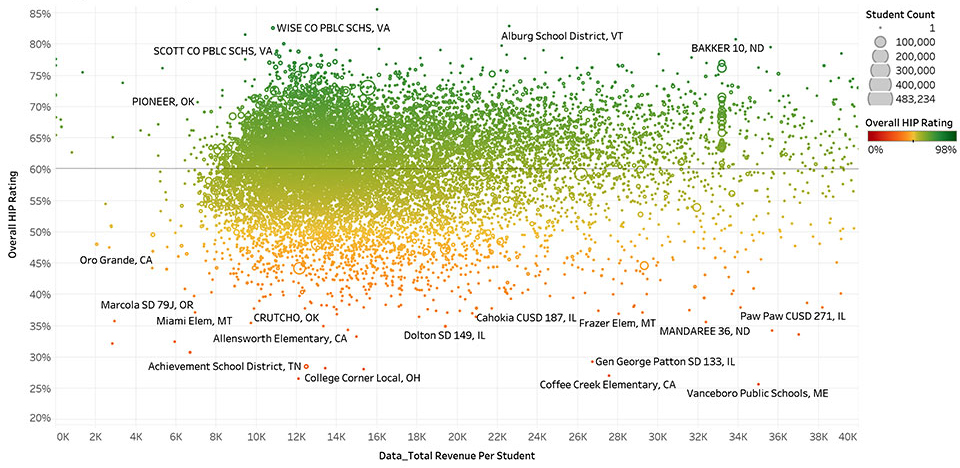

While wealthier communities can invest more to benefit citizens, customers, and communities, the actual outcomes can vary quite widely. Lower-income geographies can operate high-performing school districts, and rural hospitals can serve the region with positive health outcomes. The value of a HIP rating of ESG, SDG, and climate helps to distinguish the leaders from laggards, especially related to the intended mission.

HIP rates 16,000 school districts in the USA. When plotting the HIP Rating of schools versus the revenue-collected-per student (from tuition, taxes, and other fees), each of the quadrants has thousands of schools, including lower-income, higher performing districts.

Thus, there can be a mix of more - and less- affluent educational environments, but the quality of education, student performance, and access to educational programs for learning disabilities and second-languages all can point to higher-impact muni-bond opportunities.

Also, credit ratings can discriminate against lower-income communities, presuming that lower incomes could put repayment at risk. The HIP Ratings point out investable opportunities to provide necessary funding for education leaders.

Revenue Per Student

Source: HIP Investor

Why do NY and CA represent such large weightings?

The states of California and New York can be large weights in any muni portfolio, as these states have higher income taxes and thus the tax-exempt characteristics support a continuous pipeline of new muni bond issuances.

In SMI, munis across multiple sectors can aggregate to higher weights in the fund, as the climate risks in New York and California face fewer threats than those faced by other large state issuers, such as Florida and Texas. The threats of hurricanes, extreme heat, and sea level rise combine with the relative lesser climate action and lagging climate governance in many Southern states.

In addition, leaders of municipal issuers in California and New York tend to focus on advancing the health, wealth, and equality of the citizens they serve more than the corresponding issuers in some other states. Some muni issuers are challenged with lesser revenue from lower tax rates or limited tax bases, which can result in lesser impacts and lagging outcomes of muni issuers not investing enough to build up their communities.

Is impact measured and if so, how?

HIP seeks to measure overall net positive impact – calculated by assessing the mission and outcomes sought. Affordable housing entities need to show proportions of citizens below median incomes and near or below poverty levels. Energy utilities need to show how their power mix and associated emissions are better for nature than burning fossil fuels. Transportation entities need to show multiple modes that move groups of people efficiently, as well as safe, well-maintained roads.

In addition, HIP’s ratings cover the “impact entity,” frequently the issuer and obligor are the same, but can map to the beneficiaries of the muni bond.

HIP also grades the use of proceeds, including those specifically aspiring to UN SDGs, green bonds, social bonds, and sustainability linked bonds. HIP calls out use of proceeds that can negatively affect communities as well, like private prisons, which are excluded.

Issuer, Obligor and Impact Entity

| ISSUER Recipient of Proceeds |

OBLIGOR Guarantor of Bond |

IMPACT ENTITY Producer(s) of Impacts |

|

| SINGLE ISSUER | City of Chicago | City of Chicago | City of Chicago |

| MULTI-ISSUER e.g. "double barrel" of 2 or more issuers |

Multiple hospitals affiliated with a health system | Cleveland Clinic | Weighted avg. of multiple hospitals (by bed capacity) |

| Multiple campuses of a University system | University of California | Weighted avg. of multiple campuses (by students) | |

| Multiple water utilities in a state | State of New York | Weighted avg. of multiple utilities (by H2O volume) | |

| PROXY IMPACT ENTITY | SFO: San Francisco Airport Authority | City and County of San Francisco | City and County of San Francisco |

| HIGHER IMPACT | New wind power turbine | Energy district | Factors include: Percentage use of proceeds implied or estimated impacts |

| Energy efficiency system | K12 school district | ||

| TRACKING ID | Issuer names | Typically "CUSIP-6" | HIP-ID for each category |

How does SMI fit into a portfolio?

SMI is fixed income and muni bonds in particular, so any muni allocation is a good candidate. SMI can be a substitute for broad-based municipal market exposure.

In addition, as SMI purposefully seeks out higher impact, climate resilient, SDG-friendly muni entities that can ripple results into lower-income areas like Opportunity Zones, any impact-related allocation can fit with SMI.

The VanEck Green Bond ETF (GRNB) is only focused on green bonds from corporates, sovereigns, and taxable munis, and also a fit with fixed income allocations. GRNB and SMI are complementary in a portfolio - and helpful as green bonds have some supply constraints in current markets.

Place-based investing is another theme of impact-oriented portfolios. As SMI invests across sectors in multiple communities, SMI can complement the equity allocations of portfolios, especially those seeking income plus impact.

Screening for impact (including ESG, SDGs, and climate) provides a more complete solution to addressing community-level climate adaptation and social stability drawn from a large universe for pursuing optimal risk-return financial performance.

How to buy VanEck ETFs?

To receive more Municipal Bonds insights, sign up in our subscription center.

Related Topics

Related Insights

April 10, 2024

April 09, 2024

April 02, 2024

March 22, 2024

Important Disclosures:

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices.

Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

The Fund relies on the Data Provider for the identification of issuers that promote sustainable development based on their HIP Ratings; however, there can be no guarantee that the Data Provider’s methodology will align with the Fund’s investment strategy or desirable issuers can be correctly identified. Moreover, the United Nations Sustainable Development Goals (“SDGs”) 9, 11 and 12 may be modified or abandoned in the future and there can be no guarantee that the Fund will be able to continue to use HIP Ratings or find an appropriate substitute ratings system.

The Fund's strategy of investing in municipal debt securities of issuers promoting sustainable development may limit the types and number of investments available to the Fund or cause the Fund to invest in securities that underperform the market as a whole. As a result, the Fund may underperform funds that do not have a sustainable investing strategy or funds with sustainable investing strategies that do not employ HIP Ratings. In addition, the Fund relies on the Data Provider for the identification of issuers that promote sustainable development based on their HIP Ratings; however, there can be no guarantee that the Data Provider's methodology will align with the Fund's investment strategy or desirable issuers can be correctly identified. Moreover, the United Nations Sustainable Development Goals (“SDGs”) 9, 11 and 12 may be modified or abandoned in the future and there can be no guarantee that the Fund will be able to continue to use HIP Ratings or find an appropriate substitute ratings system.

An investment in the Fund may be subject to risks which include, among others, risks related sustainable impact investing strategy, municipal securities, credit, interest rate, call, data, California, New York, education bond , health care bond, housing bond, transportation bond, management, operational, authorized participant concentration, absence of prior active market, trading issues, market, fund shares trading, premium/discount and liquidity of fund Shares, non-diversified, state concentration risks all of which may adversely affect the Fund. Municipal bonds may be less liquid than taxable bonds. There is no guarantee that the Fund's income will be exempt from federal, state or local income taxes, and changes in those tax rates or in alternative minimum tax rates or in the tax treatment of municipal bonds may make them less attractive as investments and cause them to lose value. Capital gains, if any, are subject to capital gains tax. The Fund's assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

HIP Investor, Inc. (“HIP”) is a provider to Van Eck Associates Corporation (“Van Eck”) of proprietary research products and services, including ESG ratings, Sustainable Development Goal ratings, Opportunity Zone mapping, Climate-Threat and Resilience ratings, and Human Impact + Profit ratings (collectively, the “HIP Ratings”). HIP is the exclusive provider to Van Eck of HIP ratings and similar data used in connection with any sustainable municipal-bond ETF provided by Van Eck, including the VanEck HIP Sustainable Muni ETF. HIP Investor, Inc. (“HIP”) receives certain fees related to the assets under management (AUM) of the VanEck HIP Sustainable Muni ETF, which creates a conflict of interest with actual and prospective clients of HIP, and biases the objectivity of HIP when discussing, evaluating, and recommending the VanEck HIP Sustainable Muni ETF to actual or prospective clients of HIP. The determination to purchase or utilize the VanEck HIP Sustainable Muni ETF is an important decision and should not be based solely upon HIP’s recommendation, guidance, or services. HIP is an independent contractor of Van Eck Associates Corporation, however HIP does not control or supervise the services or products of Van Eck Associates Corporation, and reference to the VanEck HIP Sustainable Muni ETF does not mean that HIP has performed any level of due diligence on the services or products of Van Eck Associates Corporation. Users of HIP’s website, as well as actual and prospective clients of HIP, are urged to perform their own due diligence on, or consult with a separate registered investment adviser with respect to, the VanEck HIP Sustainable Muni ETF. There is no obligation to purchase or utilize the VanEck HIP Sustainable Muni ETF.

VanEck Green Bond ETF:

Investing in “green” bonds carries the risk that, under certain market conditions, the Fund may underperform as compared to funds that invest in a broader range of investments. Investing primarily in “green” investments may affect the Fund’s exposure to certain sectors or types of investments and will impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. The “green” sector may also have challenges such as a limited number of issuers, limited liquidity in the market and limited supply of bonds that merit “green” status, each of which may adversely affect the Fund.

An investment in the Fund may be subject to risks which include, among others, green bonds, investing in Asian, Chinese and emerging market issuers, foreign securities, foreign currency, credit, interest rate, floating rate, floating rate LIBOR, high yield securities, supranational bond, government-related bond, restricted securities, securitized/asset-backed securities, financial, utilities, market, operational, call, sampling, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and concentration risks, all of which may adversely affect the Fund.

An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

Important Disclosures:

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices.

Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

The Fund relies on the Data Provider for the identification of issuers that promote sustainable development based on their HIP Ratings; however, there can be no guarantee that the Data Provider’s methodology will align with the Fund’s investment strategy or desirable issuers can be correctly identified. Moreover, the United Nations Sustainable Development Goals (“SDGs”) 9, 11 and 12 may be modified or abandoned in the future and there can be no guarantee that the Fund will be able to continue to use HIP Ratings or find an appropriate substitute ratings system.

The Fund's strategy of investing in municipal debt securities of issuers promoting sustainable development may limit the types and number of investments available to the Fund or cause the Fund to invest in securities that underperform the market as a whole. As a result, the Fund may underperform funds that do not have a sustainable investing strategy or funds with sustainable investing strategies that do not employ HIP Ratings. In addition, the Fund relies on the Data Provider for the identification of issuers that promote sustainable development based on their HIP Ratings; however, there can be no guarantee that the Data Provider's methodology will align with the Fund's investment strategy or desirable issuers can be correctly identified. Moreover, the United Nations Sustainable Development Goals (“SDGs”) 9, 11 and 12 may be modified or abandoned in the future and there can be no guarantee that the Fund will be able to continue to use HIP Ratings or find an appropriate substitute ratings system.

An investment in the Fund may be subject to risks which include, among others, risks related sustainable impact investing strategy, municipal securities, credit, interest rate, call, data, California, New York, education bond , health care bond, housing bond, transportation bond, management, operational, authorized participant concentration, absence of prior active market, trading issues, market, fund shares trading, premium/discount and liquidity of fund Shares, non-diversified, state concentration risks all of which may adversely affect the Fund. Municipal bonds may be less liquid than taxable bonds. There is no guarantee that the Fund's income will be exempt from federal, state or local income taxes, and changes in those tax rates or in alternative minimum tax rates or in the tax treatment of municipal bonds may make them less attractive as investments and cause them to lose value. Capital gains, if any, are subject to capital gains tax. The Fund's assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

HIP Investor, Inc. (“HIP”) is a provider to Van Eck Associates Corporation (“Van Eck”) of proprietary research products and services, including ESG ratings, Sustainable Development Goal ratings, Opportunity Zone mapping, Climate-Threat and Resilience ratings, and Human Impact + Profit ratings (collectively, the “HIP Ratings”). HIP is the exclusive provider to Van Eck of HIP ratings and similar data used in connection with any sustainable municipal-bond ETF provided by Van Eck, including the VanEck HIP Sustainable Muni ETF. HIP Investor, Inc. (“HIP”) receives certain fees related to the assets under management (AUM) of the VanEck HIP Sustainable Muni ETF, which creates a conflict of interest with actual and prospective clients of HIP, and biases the objectivity of HIP when discussing, evaluating, and recommending the VanEck HIP Sustainable Muni ETF to actual or prospective clients of HIP. The determination to purchase or utilize the VanEck HIP Sustainable Muni ETF is an important decision and should not be based solely upon HIP’s recommendation, guidance, or services. HIP is an independent contractor of Van Eck Associates Corporation, however HIP does not control or supervise the services or products of Van Eck Associates Corporation, and reference to the VanEck HIP Sustainable Muni ETF does not mean that HIP has performed any level of due diligence on the services or products of Van Eck Associates Corporation. Users of HIP’s website, as well as actual and prospective clients of HIP, are urged to perform their own due diligence on, or consult with a separate registered investment adviser with respect to, the VanEck HIP Sustainable Muni ETF. There is no obligation to purchase or utilize the VanEck HIP Sustainable Muni ETF.

VanEck Green Bond ETF:

Investing in “green” bonds carries the risk that, under certain market conditions, the Fund may underperform as compared to funds that invest in a broader range of investments. Investing primarily in “green” investments may affect the Fund’s exposure to certain sectors or types of investments and will impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. The “green” sector may also have challenges such as a limited number of issuers, limited liquidity in the market and limited supply of bonds that merit “green” status, each of which may adversely affect the Fund.

An investment in the Fund may be subject to risks which include, among others, green bonds, investing in Asian, Chinese and emerging market issuers, foreign securities, foreign currency, credit, interest rate, floating rate, floating rate LIBOR, high yield securities, supranational bond, government-related bond, restricted securities, securitized/asset-backed securities, financial, utilities, market, operational, call, sampling, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and concentration risks, all of which may adversely affect the Fund.

An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.