Exploring Sui: The Layer-1 Ready for Mass Adoption

07 November 2024

Sui stands out by aiming to make blockchain as fast, user-friendly, and affordable as platforms like Facebook, Twitter, and Robinhood, creating a user experience familiar to most internet users.

Marketing Communication

The User-Experience Issue in Crypto

Cryptocurrencies promise a "be your own bank" experience by enabling people to send and store assets without intermediaries like banks. However, for many non-tech-savvy users, using crypto remains challenging due to complex interfaces and risks of asset loss. Developers also face high costs and risks when building blockchain applications due to the need for specialized skills to ensure security and efficiency.

Current blockchains haven’t sufficiently addressed these challenges. To onboard a billion users, blockchains must be cheaper, more flexible, and, crucially, as easy to use as an iPhone. This requires a fundamental design that prioritizes user simplicity alongside scalability to support billions of transactions.

Sui stands out by aiming to make blockchain as fast, user-friendly, and affordable as platforms like Facebook, Twitter, and Robinhood, creating a user experience familiar to most internet users.

Sui represents enormous progress towards this ultimate waypoint because it has the following traits:

- Remarkable Speed:

- Transactions on Sui process in as little as 400ms

- High Throughput:

- Sui has demonstrated the ability to process up to 297k transactions per second; can potentially scale to millions of transactions per second

- Low Cost:

- Transactions on Sui cost fractions of a cent

- Logical Asset-Centric Design:

- Sui’s architecture makes it easier for developers to create simple user experiences

- Dedication to Safety

- Many errors in application design are rejected by Sui’s software and are impossible due to Sui’s application guardrails

- Simple Developer Experience

- The programming language of Sui, called Move, is as flexible as the popular Rust language but honed to make developing applications faster and safer

In this article we explore how Sui differentiates itself from Ethereum, Solana and other alternatives and may be the first blockchain to achieve mass adoption.

Sui's transaction costs are less than 1/10th of Solana's

Source: Artemis XYZ. Data as of 10/28/2024. Historical performance is no guarantee for future results. This should not be understood as financial advice for any of the digital assets mentioned in the figure.

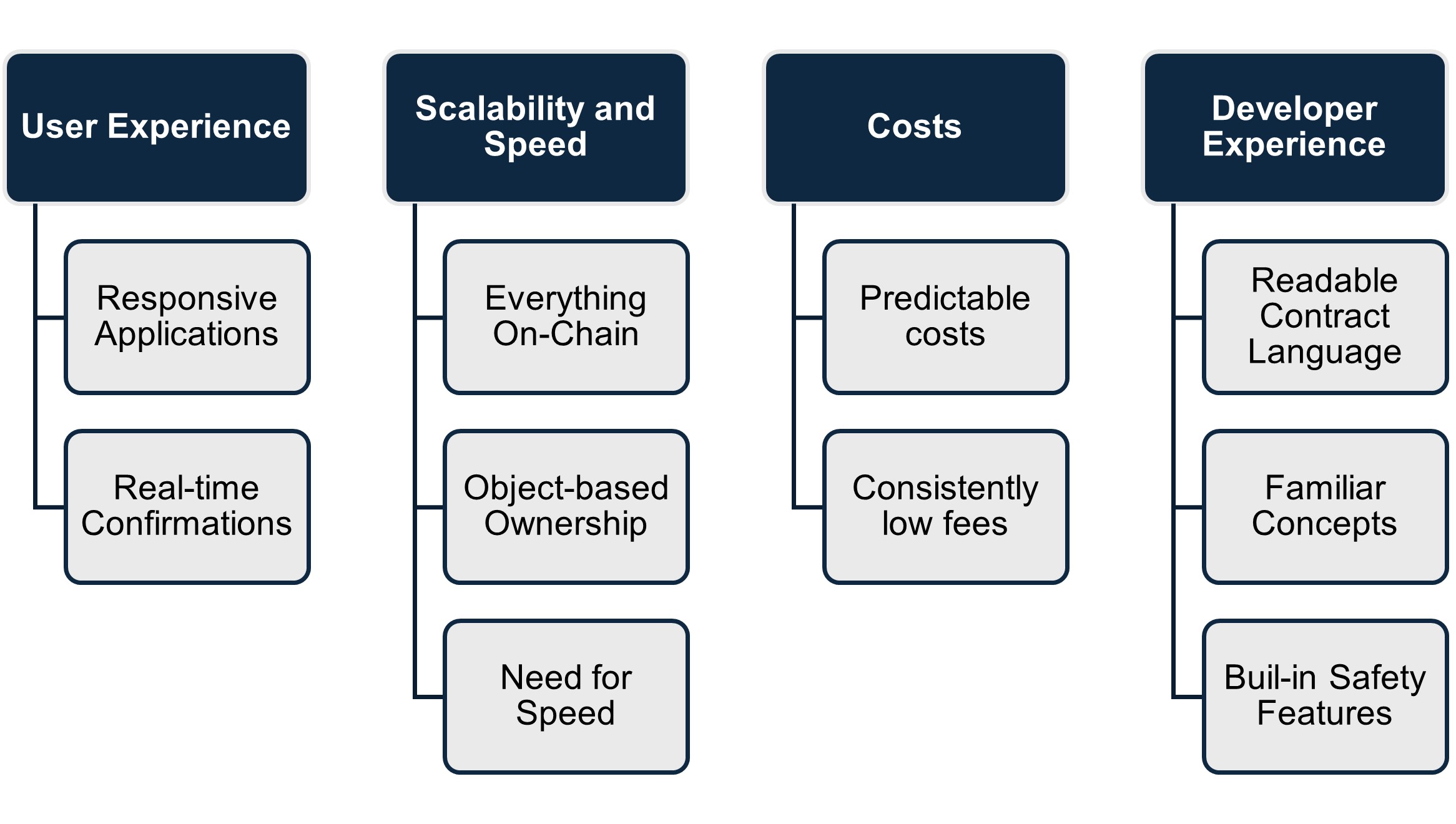

Demand for a Web2-like Experience is Growing

Developers are seeking solutions that allow for straightforward application deployment, with code that can be readily secured for handling high-value transactions. At the same time, users are looking for a Web3 experience that feels like an enhanced version of the familiar Web2 environment. This includes features such as seamless onboarding processes, responsive and real-time applications, and the ability to use human-readable credentials or social login options. Additionally, developers are in search of a contract language that provides them with built-in security features that help them safeguard their users from making mistakes or their applications from being exploited.

Source: VanEck Research

Sui’s Unique Blockchain Design

Sui’s novel innovation is to move from a blockchain design that revolves around “accounts” to one that revolves around “objects.” One way to think about the “accounts” model is to consider every asset on Ethereum as an excel sheet ledger. For a token like USDC, to transfer USDC to someone you do not actually “send” their account USDC. This is because all balances of USDC are kept in a smart contract ledger on the blockchain, similar to an excel sheet. To transfer someone USDC, the account unlocks its ledger entry on the USDC contract and then reduces its balance by the transfer amount to then credit the other account in that smart contract. In this dynamic, a user’s wallet controls the ability to change the ledger entry of their balance on the USDC smart contract.

The account-based model is far from ideal because it is less safe and does not allow for parallel processing of transfers. On the first point, if the smart contract that powers USDC is hacked, infinite coins can be minted and given to the hacker. On the second point, if multiple people each want to send USDC, they each must separately tell the USDC “excel sheet” to transfer the items. The problem this causes is that the ledger can only process one request at a time because it must ensure someone does not send more USDC than they have on the ledger. To ensure there is no “double-spend,” those multiple requests must be processed one-at-time.

By contrast, Sui runs an “object-based” model where each asset is a distinct object that exists outside of an account. User wallet balances are not ledger entries on USDC’s smart contract, they are distinct entries specific to their wallet. As a result, when an asset is transferred between users, Sui’s blockchain tracks the ownership on a central ledger, not on a smart contract. From the standpoint of the blockchain, each asset having a distinct owner means that Sui can parallelize the different transactions. In the case of the earlier USDC send, since each of the multiple users owns their own USDC as objects, Sui can process the sending of that USDC across those users at the same time. This empowers Sui to process more transactions in a given period of time than account-based blockchains like Ethereum.

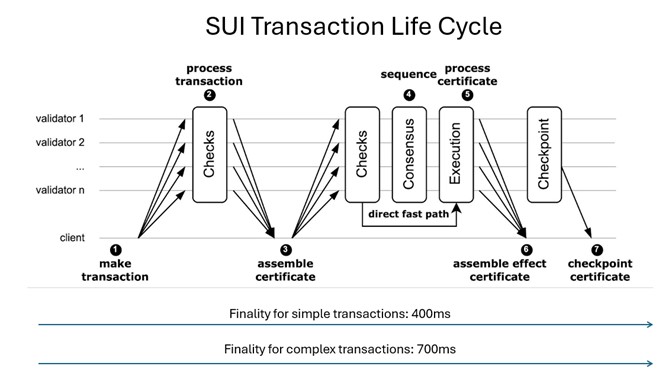

This advantage manifests itself during periods of high demand because it allows Sui to allow transactions unrelated to high demand parts of the blockchain to proceed uninhibited. Likewise, Sui’s object-based model allows it to confirm transactions much faster as well. For example, Sui can finalize a transaction in as little as 400 milliseconds (4/10ths of a second) whereas Solana takes around 5 seconds, Ethereum takes 78 seconds and Bitcoin takes 60 min.

Source: Sui data as of 10/28/2024

Furthermore, because of Sui’s ownership model, simple peer-to-peer (p2p) transfers are much less taxing of the blockchain and can finalize far faster than they can on other blockchains. Because every user “owns” the assets in their wallets as objects rather than ledger entries on a smart contract, they can send another user funds without having to go through Sui’s consensus. Sui calls this “Fast Path.” When a peer-to-peer transaction occurs, a validator simply must check the ownership rights of the assets being sent and confirm the transaction without having to put it through consensus. This saves time and enables validators to save their limited bandwidth to process more transactions while also making the transactions faster. More specifically, Sui’s “Fast Path” shaves up to 300ms off of a transaction because the number of network “hops,” the process of messaging across the network, drops from 4 to 2.

By contrast, when performing a p2p transfer on Ethereum or Solana, the results must be messaged throughout the entire network several times before the transaction is finalized. This dynamic makes applications of blockchain technology like payments on Sui fast enough to approximate the user experience found on Venmo or Zelle.

Finally, Sui’s object-based model improves the developer experience by making it easier to create applications. When developing on Sui, one does not need to specify all the various accounts its application must touch but rather only the generalized, much larger set of objects. Developers also do not have to specify all the various account dependencies which adds to the mental overhead and extra code they must create. This dynamic makes programming less error prone and allows for less redundancy in coding. Because Sui design enables high throughput and, by proxy, inexpensive transactions, developers do not need to create workarounds for their code to function properly in high usage environments to the extent that they need to on Ethereum.

In summary, Sui has evolved the blockchain design by making foundational changes that create a better product for users and dApp builders. Sui has created a safer blockchain whose framework allows Sui to process great amounts of information quickly and responsively. Quantified, Sui can process 200MB per second of information through its blockchain while enabling transaction finality of ~400ms. Comparatively, this is roughly 2x more data than Solana and finality that is 10x faster.

Sui’s Appeal

Sui's Time to Finality Exceeds Current Competition

Source: Each blockchain’s documentation. Data as of 10/28/2024.

Why do Users like Sui?

Sui allows users to experience blockchain at the speed of the internet. User transactions are much faster, particularly p2p transactions, than many other chains. Because Sui is able to parallelize transactions, Sui’s ability to process new transactions does not significantly degrade with high usage. Sui also enables users to control their wallets by logging on through SSO (Secure Sign Ons) like Facebook and Google.

What do Developers like about Sui?

The ownership model is more intuitive than comparable blockchains’ models like Ethereum’s EVM and Solana’s SVM while preventing costly errors. Programming on Sui requires as little as 60% the lines of code compared to Solana. Move, the programming language used in Sui, has numerous built-in safety features. Additionally, Sui’s blockchain software will outright reject faulty code if someone tries to deploy it to Sui. Many attacks that have cost billions of dollars are literally impossible on Sui because of the combination of Sui’s Move language and Sui’s software.

What do Institutions like about Sui?

Sui’s database model makes it less costly and easier to understand the history of transactions and asset balances on Sui. This helps institutions understand who has interacted with their assets, applications and wallets. It also allows institutions to better collect information for audits and taxes.

What do Investors like about Sui?

Sui’s staking mechanism has instant redemption which allows investors liquidity while also being able to earn staking rewards. Sui has explicit partnerships with premier web2 companies like ByteDance and NetMarble to build on Sui. The $SUI token is deeply liquid as it is the 9thmost traded cryptocurrency. Sui’s ecosystem also has many potential catalysts including onboarding of new stablecoins, blockchain games, and novel dePIN projects.

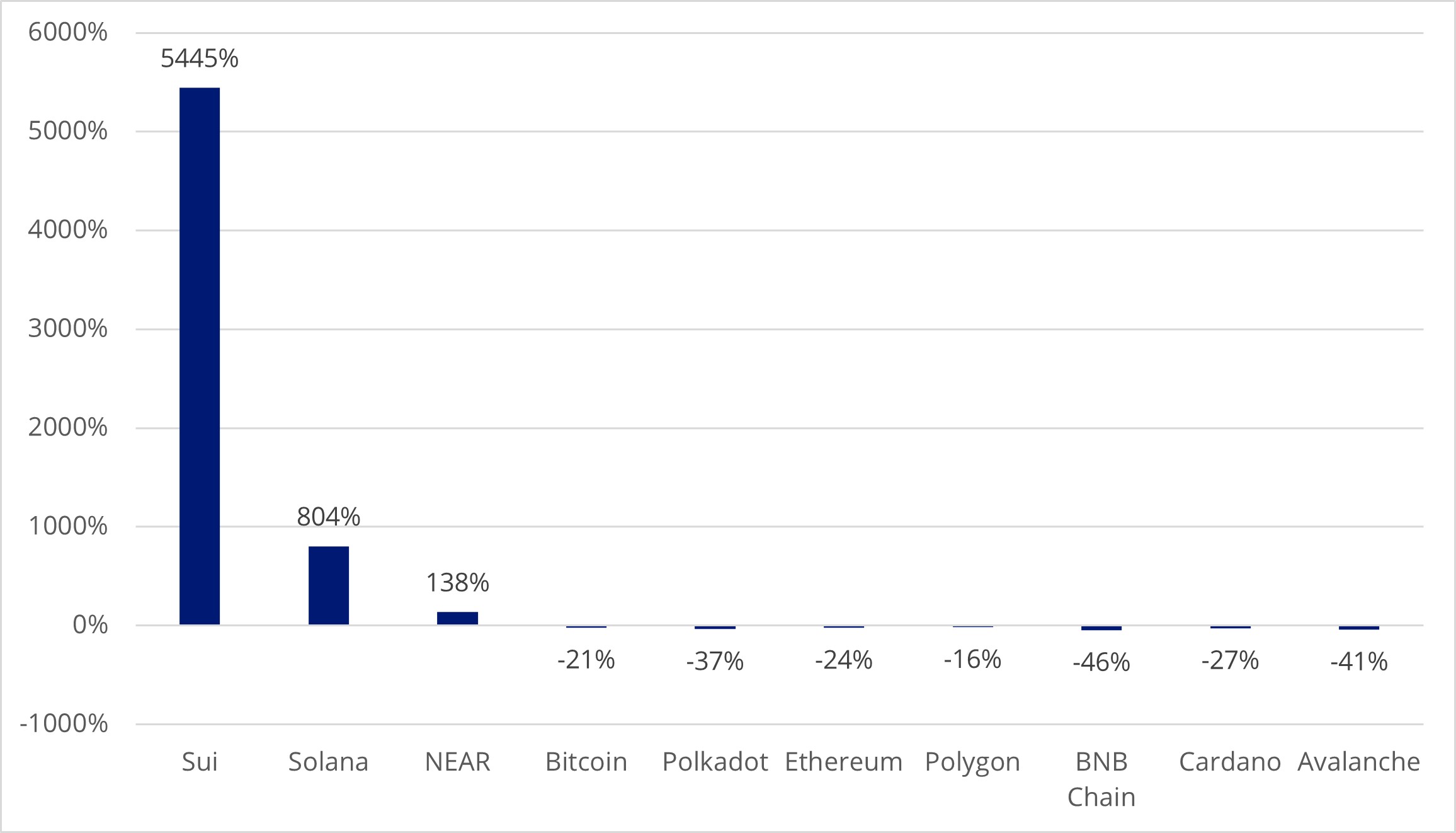

Comparing Key Adoption Metrics

Daily active addresses, daily transactions, and weekly commits are key metrics for assessing the adoption of Sui. Daily active addresses show how many unique users are engaging with the blockchain, providing insight into user base growth. Daily transactions reflect the level of activity on the platform, indicating how frequently users interact with applications. Weekly commits reveal developer engagement, indicating the pace of improvements and feature additions. Together, these metrics offer a balanced view of both user and developer adoption, helping to gauge Sui’s overall traction.

Daily Active Users (% change YTD)

Source: Artemis.xyz, data as of 29/10/2024. Historic performance is not a guarantee for future results. Daily active users is defined as the total number of daily unique on-chain wallets interacting with the protocol (senders). This should not be understood as investment advice for specific digital assets.

Daily Transactions (% change YTD)

Source: Artemis.xyz, data as of 29/10/2024. Historic performance is not a guarantee for future results. Daily transactions is defined as the number of unique on-chain interactions with the protocol. This should not be understood as investment advice for specific digital assets.

Sui's Developer Activity is Up 53% YTD

Source: Artemis.xyz, data as of 29/10/2024. Historic performance is not a guarantee for future results. Developer activity is defined as the number of weekly commits tagged to open-source repositories of the protocol. This should not be understood as investment advice for specific digital assets.

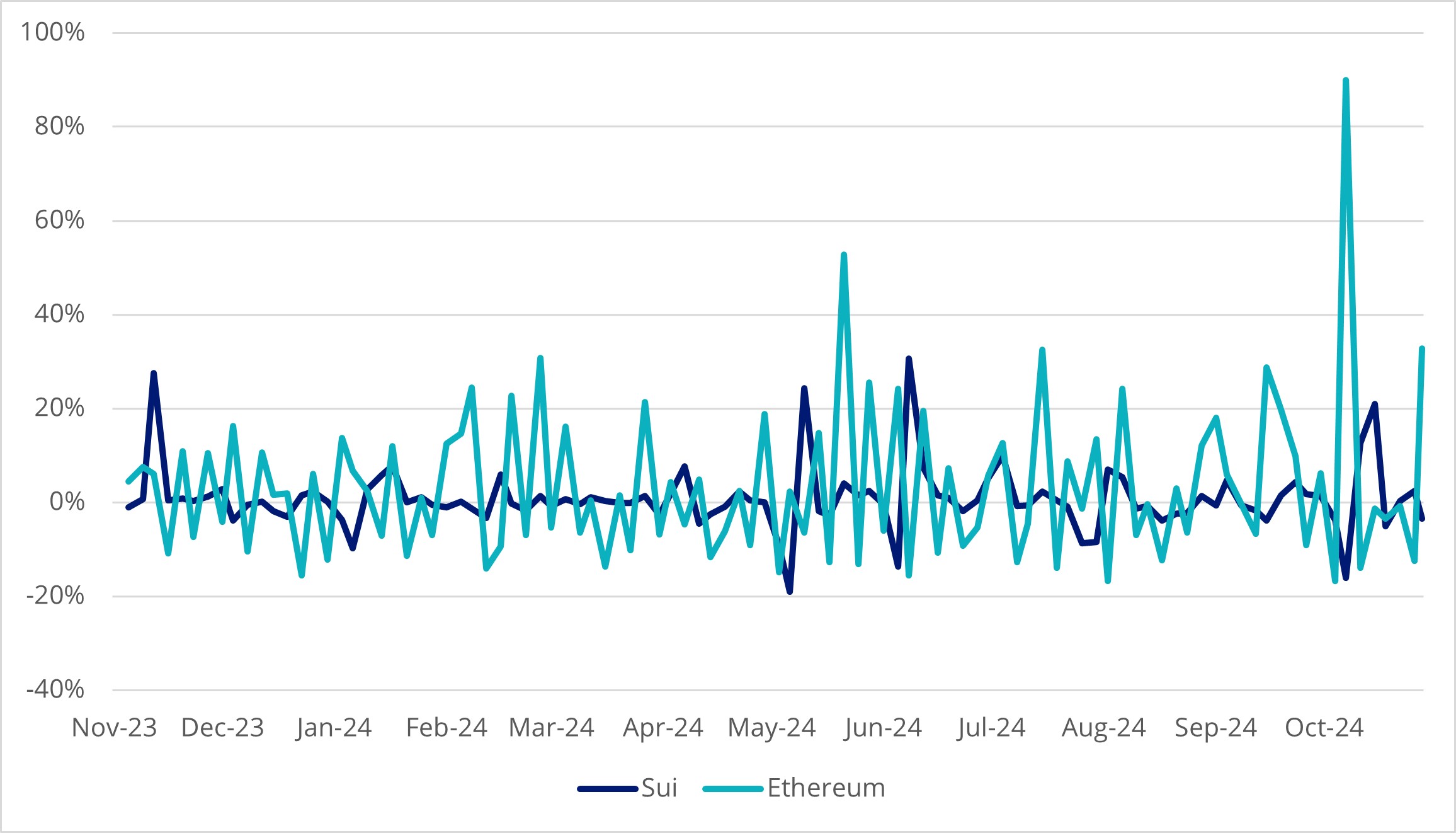

Variability in Average Daily Gas Fee (1D % Change)

Source: Etherscan.io, Suivision.xyz, data as of 29/10/2024. Historic performance is no guarantee for future results. This should not be understood as investment advice for specific digital assets.

Lower variability in transaction fees enhances user experience by providing cost predictability and stability, making it easier for users to plan transactions without concern for sudden fee spikes. This consistency can reduce hesitation around using the platform, especially for newer users unfamiliar with fluctuating fees. Stable fees also enable applications to deliver a smoother, more reliable experience, as users aren't discouraged by unpredictable costs. Overall, predictable fees make the platform more accessible and user-friendly, supporting higher adoption and engagement; Sui excels in offering a platform with consistently low transaction fees.

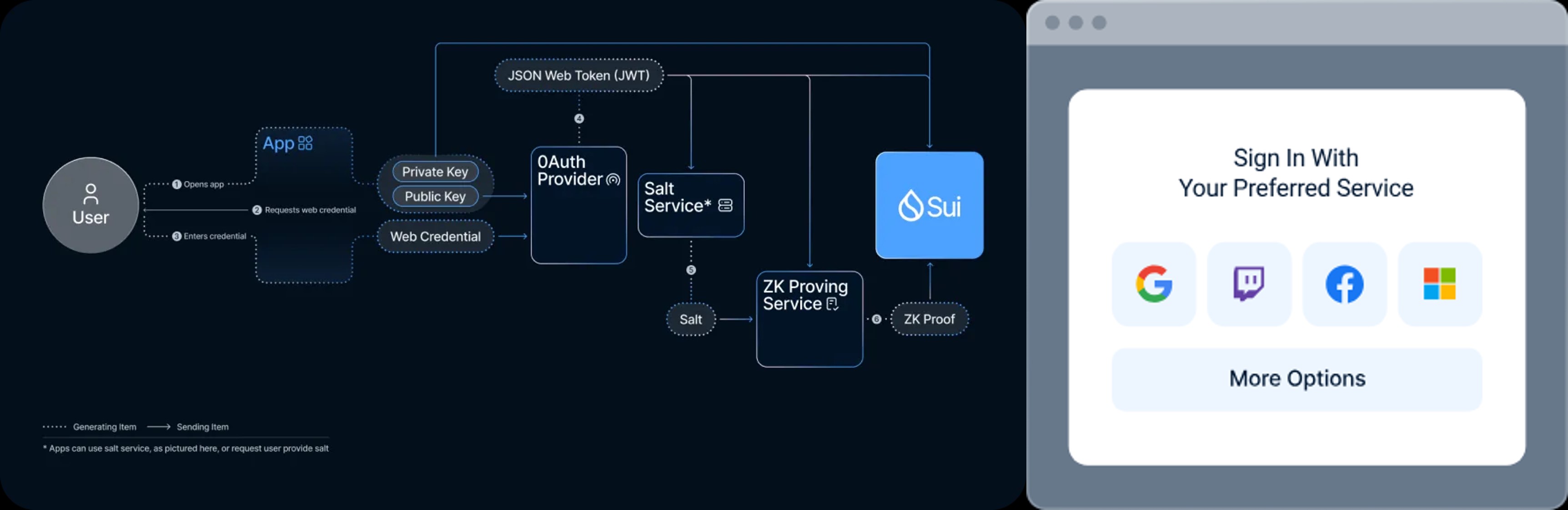

Onboarding the Next Billion Users with zkLogin

The components to onboard the next billion users into Sui’s blockchain include speed, simplicity and low cost. Sui adds to those attributes the simplicity of zkLogin. zkLogin revolutionizes user onboarding on Sui because it allows anyone to create an account on Sui using the same login credentials they use for Facebook and Google. To illustrate this potential, consider that over 1.8 billion Google account holders could seamlessly transition into the crypto space using Sui's zkLogin feature. This innovative approach enables developers to eliminate complicated and technical steps for users without compromising on security, significantly lowering the barrier to entry for newcomers to the Web3 ecosystem.

Source: Sui.

Diversify Crypto Exposure with the VanEck Sui ETN

Experience the speed and scalability of next-generation blockchain technology. Sui offers instant finality and parallel transaction processing, paving the way for more responsive and user-friendly decentralized applications. The VanEck Sui ETN is a fully-collateralized exchange traded note that invests in the SUI Token.

- Fully-collateralized by SUI in cold-storage

- Total return of SUI: Tracks the MarketVector™ Sui VWAP Close Index (MVSUIV)

Why VanEck Crypto ETNs? Here’s why:

- Crypto is only a small part of our total assets, so we can weather bear markets without drastic measures, protecting your investments.

- With nearly 70 years in asset management and a strong track record in crypto, we bring deep industry knowledge and proven reliability.

- We combine traditional financial strengths with cutting-edge crypto innovation, backed by a CEO who truly believes in crypto’s future.

- We ensure clarity in our product structures and avoid high-risk or opaque practices, with assets fully backed by cryptocurrency in secure cold storage.

- Our products, VBTC and VETH, are among the most traded on Xetra, offering you exceptional liquidity and tight spreads for seamless trading.

- Our assets are secured by a licensed European bank in Liechtenstein, providing top-tier compliance and security.

- We use the safest institutional custody setup available, prioritizing your security over cost savings.

Crypto is an asset class with high potential returns but investing in digital assets comes with great risk, why choose products that potentially introduce even more risks? Choose VanEck for a secure, transparent, and expertly managed crypto investment experience.

Main Risk Factors:

- Technology Risk: Trading and transaction systems may be hacked or malfunctioning, causing loss of digital assets.

- Regulatory Risk: Disruptions and interventions may render digital assets illegal.

- Risk of Total Loss: No guarantee regarding custody due to hacking risk, counterparty risk and market risk.

- Risk of Extreme Volatility: Trading prices of digital assets may experience extreme volatility.

Other risks specific to this ETN’s Digital Assets can also be found on the VanEck Crypto Academy. For example,

- Adoption risk: Sui is an alternative layer-1 smart contract platform that utilizes the Move smart contract language. Since this language is equivalent but not fully compatible with Ethereum’s EVM it carries additional adoption risk.

To receive more Digital Assets insights, sign up to our Newsletter.

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

Important information

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Strasse 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MV Index Solutions GmbH, which has contracted with CC Data Limited to maintain and calculate the Index. CC Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MV Index Solutions GmbH, CC Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 October 2024

27 November 2024

27 November 2024

05 November 2024

11 October 2024