We offers different Green ETFs:

- Invest in resource efficiency contributors

- Access the new economic model

- Invest in a cleaner planet

ETF Details

ETF Details

Basis-Ticker: REUSISIN: IE0001J5A2T9

TER: 0.40%

AUM: $4.7 M (as of 20-12-2024)

SFDR Classification: Article 9

Lower risk

Higher risk

Typically lower reward

Typically higher reward

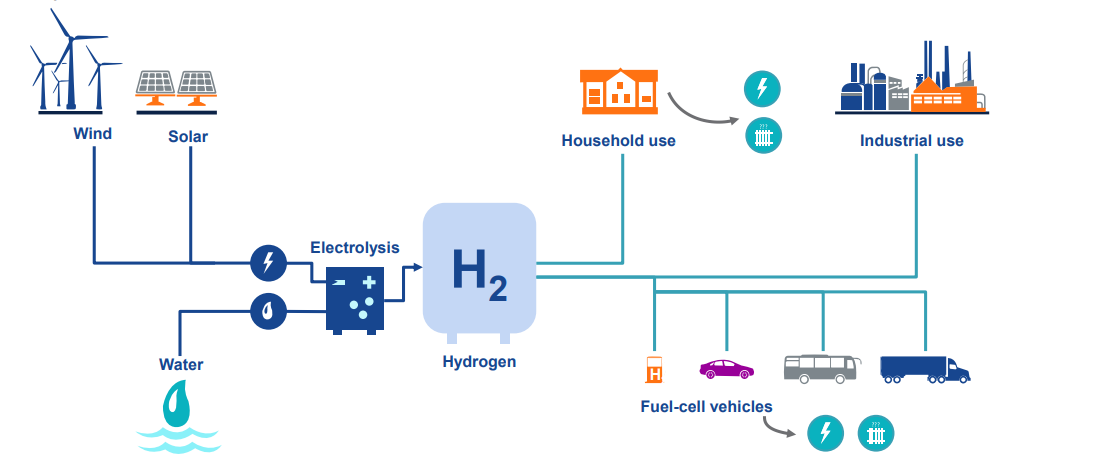

- Invest in the potential energy source of the future

- Key contributors to the hydrogen ecosystem

- Trend supported by governments around the world

ETF Details

ETF Details

Basis-Ticker: HDROISIN: IE00BMDH1538

TER: 0.55%

AUM: $62.2 M (as of 20-12-2024)

SFDR Classification: Article 9

Lower risk

Higher risk

Typically lower reward

Typically higher reward

- Invest early in the sector’s multi-decade transformation

- Pure-play exposure to companies involved in the food revolution

ETF Details

ETF Details

Basis-Ticker: VEGIISIN: IE0005B8WVT6

TER: 0.45%

AUM: $6.6 M (as of 20-12-2024)

SFDR Classification: Article 9

Lower risk

Higher risk

Typically lower reward

Typically higher reward