Multi-Asset ETFs in Three Flavors

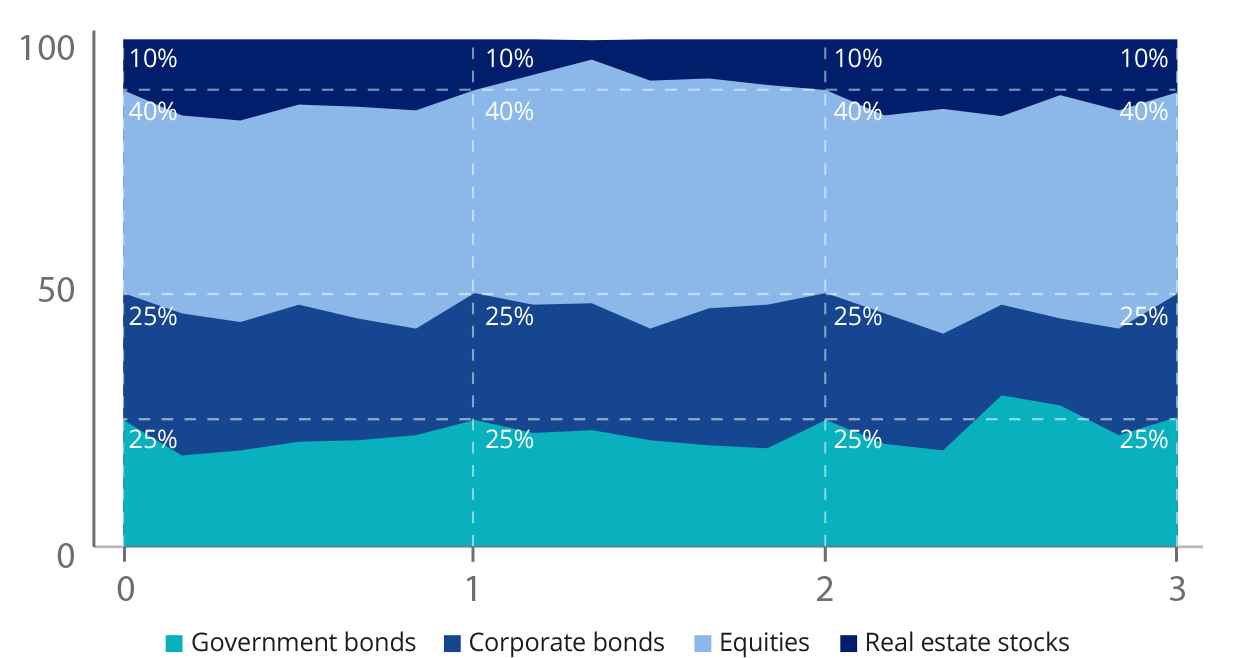

VanEck offers three Multi-Asset ETF variants, with investors having the chance to choose among different risk profiles. They represent a way to gain access, with one single purchase, to equities, corporate and government bonds as well as listed real estate.

- 35% Government bonds

- 35% Corporate bonds

- 25% Global equities

- 5% Real estate stocks

ETF Details

ETF Details

Basis-Ticker: DTMISIN: NL0009272764

TER: 0.28%

AUM: €20.3 M (as of 26-07-2024)

SFDR Classification: Article 8

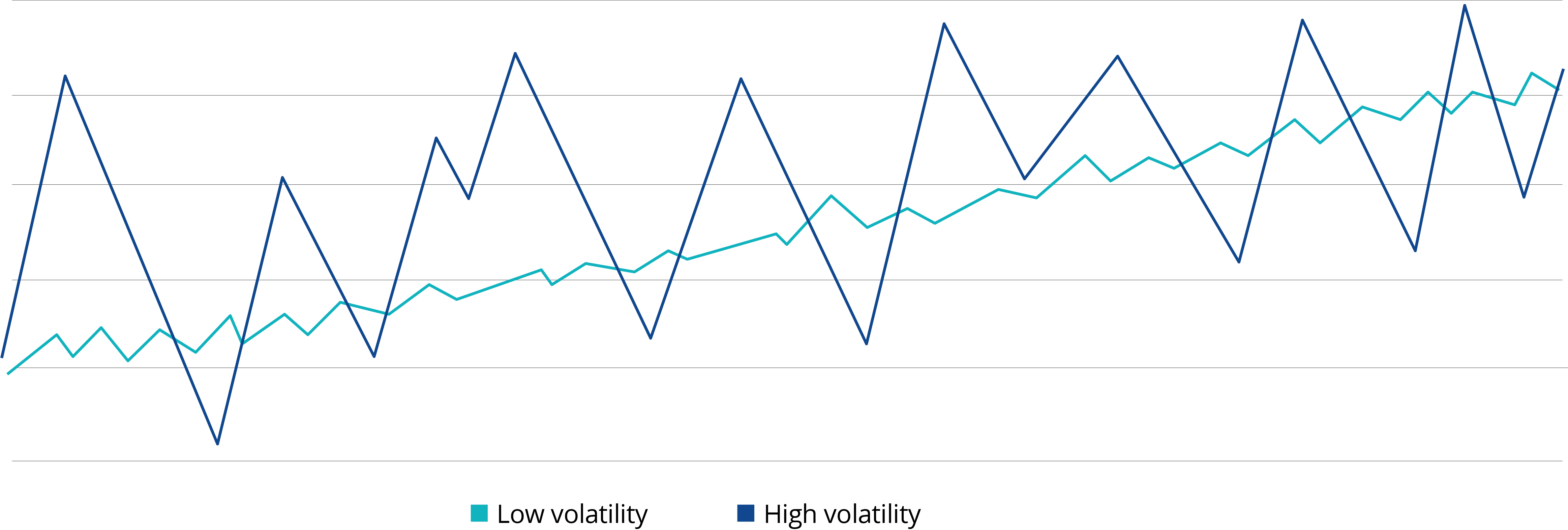

Lower risk

Higher risk

Typically lower reward

Typically higher reward

- 25% Government bonds

- 25% Corporate bonds

- 40% Global equities

- 10% Real estate stocks

ETF Details

ETF Details

Basis-Ticker: NTMISIN: NL0009272772

TER: 0.30%

AUM: €36.7 M (as of 26-07-2024)

SFDR Classification: Article 8

Lower risk

Higher risk

Typically lower reward

Typically higher reward

- 15% Government bonds

- 15% Corporate bonds

- 60% Global equities

- 10% Real estate stocks

ETF Details

ETF Details

Basis-Ticker: TOFISIN: NL0009272780

TER: 0.32%

AUM: €26.0 M (as of 26-07-2024)

SFDR Classification: Article 8

Lower risk

Higher risk

Typically lower reward

Typically higher reward