Deep Dive into Pyth Network

05 November 2024

Read Time 10+ MIN

What are Oracles?

Blockchains in and of themselves are useful already, for trustless and permissionless transactions without censorship. No trust or verification from the user is required because it is stored on a decentralised ledger with global consensus. What if certain transactions require reliable and real-time data from external sources that do not necessarily have a global consensus or can be stored on the same ledger? For example:

- Products that rely on price feeds of assets from other blockchains or real-world markets: Many decentralized finance (DeFi) applications, like decentralized exchanges or lending platforms, need accurate and timely information about asset prices (e.g., stocks, cryptocurrencies, commodities). Since these prices are continuously changing in real-world markets, blockchains need a way to securely access this off-chain data.

- Products that require verifiable and secure random numbers: Randomness is crucial for a variety of blockchain use cases, such as lotteries, gaming, and even secure cryptographic protocols. However, generating truly random numbers on-chain is challenging without introducing bias or predictability. Off-chain randomness, when provided by a reliable source, is often needed.

- Products dependent on historical price data: Some DeFi platforms and financial products might need access to archived price data for risk assessment, backtesting trading strategies, or offering historical analysis. Since blockchains primarily focus on storing current state information, they need external sources to provide this historical data efficiently.

To address these challenges, Oracles were introduced. Oracles serve as bridges between blockchains and the external world, providing smart contracts with access to off-chain data. They connect external data providers—such as market data owners, web APIs, or IoT devices—to decentralized applications across multiple blockchains. Oracles enable these applications to securely and reliably obtain real-time data, execute transactions based on external events, and interact with data that cannot be directly stored on-chain.

Why can this data be trusted? Oracles provide a robust mechanism for ensuring the integrity and reliability of off-chain data before it is used on the blockchain. An oracle network verifies the:

- Authenticity: To ensure that the data is genuine and comes from a legitimate source, oracle networks source data from multiple trusted providers or verifiable APIs. This process reduces the risk of malicious or false information being introduced into smart contracts.

- Accuracy: Accurate data is crucial for smart contracts to function correctly. Oracles achieve this by aggregating data from several independent sources. Instead of relying on a single provider, an oracle network will query multiple data sources and compare their responses.

- Reliability: Oracle networks enhance reliability by using decentralized nodes, which increases resilience against failures or malicious activity. If one data source or node fails or provides incorrect information, the other nodes in the network can continue to operate and provide valid data.

Source: VanEck Research

The demand for accurate and reliable off-chain data is growing as the number of real-world use-cases and adoption of blockchain increases. Users of applications are more than willing to pay for an oracle service that is accurate and reliable and covers a large variety of use-cases.

Pyth Network versus Other Oracles

Read the blog post of Battle of the Oracles to learn more about the different oracles solutions. To recap, Pyth Network is a high-frequency oracle leveraging Solana's technology, offering a robust solution for off-chain data sharing for primarily decentralized finance applications (DeFi). It provides services like real-time price feeds and benchmarks, accessible to a wide range of financial service providers. PYTH is the governance token and utility token of the Pyth Network. Supply and demand for the PYTH token is directly related to level of usage and total demand of Pyth’s services and Pyth Network’s Tokenomics.

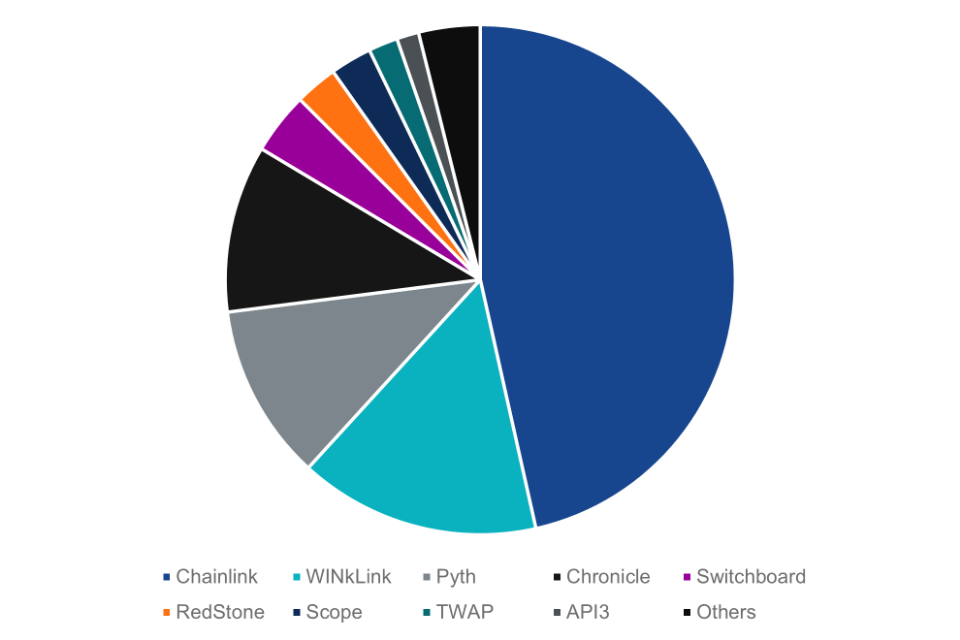

Total Value Secured by Oracles

Source: Defillama.com, Data as of 19/08/2024. Historical performance is no guarantee for future results. This should not be understood as financial advice for any of the digital assets mentioned in the figure.

While Chainlink holds the lion’s share of the total value secured by oracles, Pyth has shown by far the largest growth in terms of TVS, number of protocols supported and number of DApps. Pyth is expanding rapidly, across different networks and protocols, supporting more DApps, data providers and integration partners every day. In the same time frame, Chainlink’s marketshare has decreased. Comparing the main metrics of MCAP/TVS ratio and MCAP/TTV ratio, we notice that based on market capitalization (circulating supply), Pyth is undervalued whereas the TVS ratio based on fully diluted value paints a different picture. This is because only 37% of PYTH tokens are unlocked, the next significant PYTH token unlock takes place in May of 2025 and happens yearly thereafter on the same date until the full amount of tokens has been unlocked by 2027.

|

|

Chainlink |

Pyth |

|

|

Market Capitalization (circulating supply) |

$6.715B |

$1.221B |

|

|

Market Capitalization (fully diluted) |

$10.758B |

$3.397B |

|

|

Total Value Secured (TVS) |

$24.788B |

$4.740B |

Potential growth (in %) if Pyth would have Chainlink’s MCAP/TVS ratio |

|

MCAP/TVS (circulating) |

0.271 |

0.248 |

+5.2% |

|

MCAP/TVS (diluted) |

0.434 |

0.717 |

-39.4% |

|

Total Transaction Volume (TTV) |

$31.679B |

$34.846B |

Potential growth (in %) if Pyth would have Chainlink’s MCAP/TTV ratio |

|

MCAP/TTV (circulating) |

0.212 |

0.0350 |

+504.9% |

|

MCAP/TTV (diluted) |

0.340 |

0.0975 |

+248.4% |

Source: Defillama, Coingecko, data as of 05/11/2024. Historic performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the table above.

Pyth’s Unique Advantages

|

Data providers publish directly |

Transparant & easily auditable aggregation |

Sub-second updates |

Confidence intervals |

All symbols on all chains |

Crypto assets |

Tradfi assets |

|

|

Pyth |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Chainlink |

❌ |

❌ |

❌ |

❌ |

❌ |

✔️ |

❌ |

|

Uniswap TWAP |

❌ |

N/A |

❌ |

❌ |

❌ |

✔️ |

❌ |

|

Band Protocol |

❌ |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

|

API3 |

✔️ |

N/A |

❌ |

❌ |

❌ |

✔️ |

❌ |

|

Switchboard |

❌ |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

Source: Pyth, Data as of 19/08/2024. This should not be understood as investment advice for any of the digital assets mentioned in the table above.

Use-cases Enabled by Pyth

Products and Services:

- Price Feeds: real-time market data for smart contracts, blockchains, and applications

- Benchmarks: historical market data for smart contracts, blockchains, and applications

- Express Relay: smart contracts or protocols that need protection against MEV (Express Relay)

- Express Relay is one of a kind product that offers developers to auction off valuable transactions directly to MEV searchers without validator interference

- Entropy: smart contracts that require secure on-chain random numbers. Secure and verifiable random numbers are incredibly important for creating a fair and unpredictable on-chain actions (e.g., for games)

- Pyth DAO Governance model

Examples:

- Decentralised Exchanges (DEXs) require reliable real-time price feeds to provide users accurate trades.

- Pyth’s data pull model provides data directly from the source, such as exchanges, market makers or DeFi protocols. Because data is pulled only on demand and not pushed at a given interval, it scales efficiently, and costs are offloaded to users where updates are demand-based.

Case Study: Drift (DEX)

Refresher: What is a DEX?

Decentralized Exchange (DEX) allows users to trade cryptocurrencies directly, without intermediaries, using smart contracts on a blockchain. DEXes operate peer-to-peer, providing greater privacy and control over assets compared to centralized exchanges.

There are two main types of DEXes:

- Order Book DEXes: These platforms match buy and sell orders using a live order book, similar to traditional exchanges. Examples include dYdX.

- Automated Market Makers (AMMs): AMMs use liquidity pools and algorithms to determine asset prices, allowing users to trade instantly without needing a counterparty. Examples include Uniswap and SushiSwap.

Context

Drift is a perpetual trading DEX built on Solana. Speed, reliability, and performance make or break a perpetual trading ecosystem. Drift is a perpetual trading platform that allows traders to create leveraged positions against the performance of synthetic assets.

Why Pyth?

Drift seeks to offer the most feature-rich, powerful perpetual DEX with lightning-fast execution. This ambition necessitates a robust Oracle solution. Legacy oracles are slow and susceptible to front and back running.

Pyth and Drift partnered to rapidly deploy a proof-of-concept. This successful relationship satisfies the ultra-fast network requirements of Drift’s execution tools and is capable of supporting thousands of users and hundreds of assets.

This is only one of many examples of an effective partnership and integration that gives Web3 users an enhanced user experience than DApps that use other Oracle solutions. There are presently over 410 integration partners supporting the transition from push to pull Oracles with Pyth Networks.

Pyth versus Chainlink

|

Pyth |

Chainlink |

|

|

Core Mission |

Pyth’s mission is to provide high-fidelity, high-frequency financial market data to end users securing their DeFi protocols. |

Chainlink’s mission is to expand the capabilities of smart contracts by enabling access to real-world data and off-chain computation. |

|

Data Providers & Source |

Pyth uses first-party data that comes from exchanges, trading firms and financial institutions. |

Chainlink’s data comes from relayers (often referred to as node operators). |

|

Availability |

74+ Blockchains 205+ Protocols Secured |

19+ Blockchains 401 Protocols Secured |

|

Performance During Black Swan Events |

During the LUNA/UST incident in May ‘22, Pyth managed to track the LUNA price very accurately during the UST de-peg. |

During the LUNA/UST incident in May ‘22, Chainlink had a “circuit breaker” that stopped updating the price of an asset if it went below 0.1 USD. This caused certain protocols to potentially receive inaccurate prices. |

Source: Pyth, Data as of 19/08/2024. This should not be understood as investment advice for any of the digital assets mentioned in the table above.

Case Study: Pyth and Chainlink on Solana

Source: Defillama, Data as of October 2024. Historical performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the figure above.

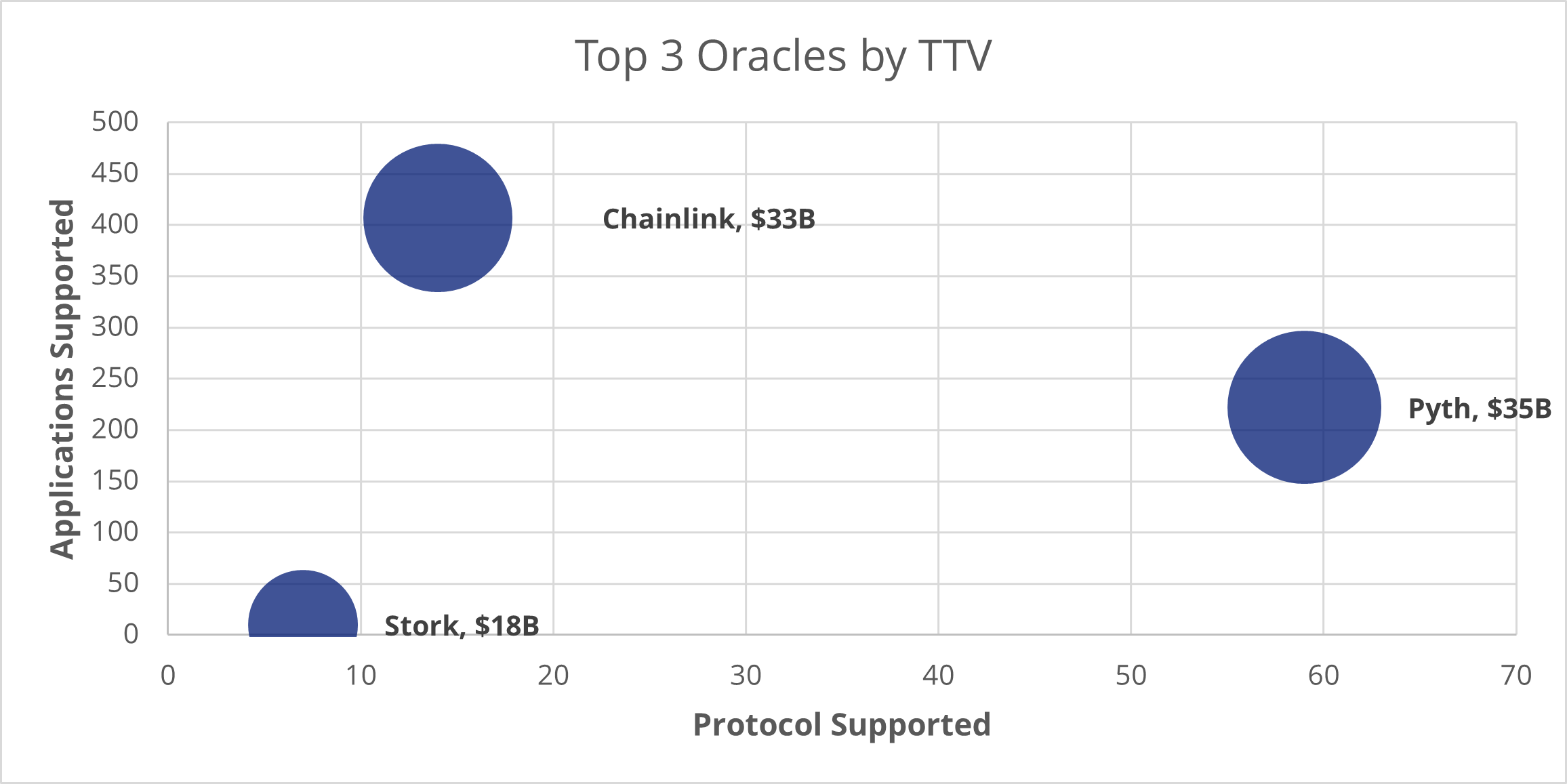

We compare Chainlink and Pyth Network with two main metrics: Total Value Secured (TVS) and Total Transaction Volume (TTV)

Total Value Secured

Pyth’s Total Value Secured (TVS) is more distributed across different blockchains and applications compared to Chainlink, offering greater resilience and diversification. Here's how the comparison breaks down:

- Blockchain Distribution: Pyth’s TVS shows a broader spread across multiple blockchains. For instance, only 61.1% of Pyth’s TVS is concentrated on the Solana blockchain, which means the remaining value is distributed across other blockchains, contributing to its decentralized footprint. In contrast, 97.1% of Chainlink’s TVS is concentrated on Ethereum, creating a higher dependence on a single blockchain. This heavy reliance on Ethereum makes Chainlink more vulnerable to network-specific issues, such as scalability concerns or market downturns affecting Ethereum.

- Application Distribution: Pyth also demonstrates a healthier diversification across different applications. Only 23.8% of Pyth’s TVS is tied to its top application, meaning the remaining value is distributed among various other applications. This broader application spread lowers the risk of one dominant app affecting the network’s overall performance. Chainlink, however, has 48.8% of its TVS tied to its top application, meaning nearly half of its secured value relies on a single application. This concentration creates a potential single point of failure, making Chainlink more sensitive to shifts in the usage or success of that key application.

Pyth's more balanced distribution of TVS across different blockchains and applications enhances its resilience. With a healthier spread of its value, Pyth is better positioned to withstand market fluctuations or downturns that may affect individual blockchains or applications, making it less exposed to risks associated with dependency on any single network or product. This diversified approach gives Pyth a structural advantage in terms of long-term stability and adaptability.

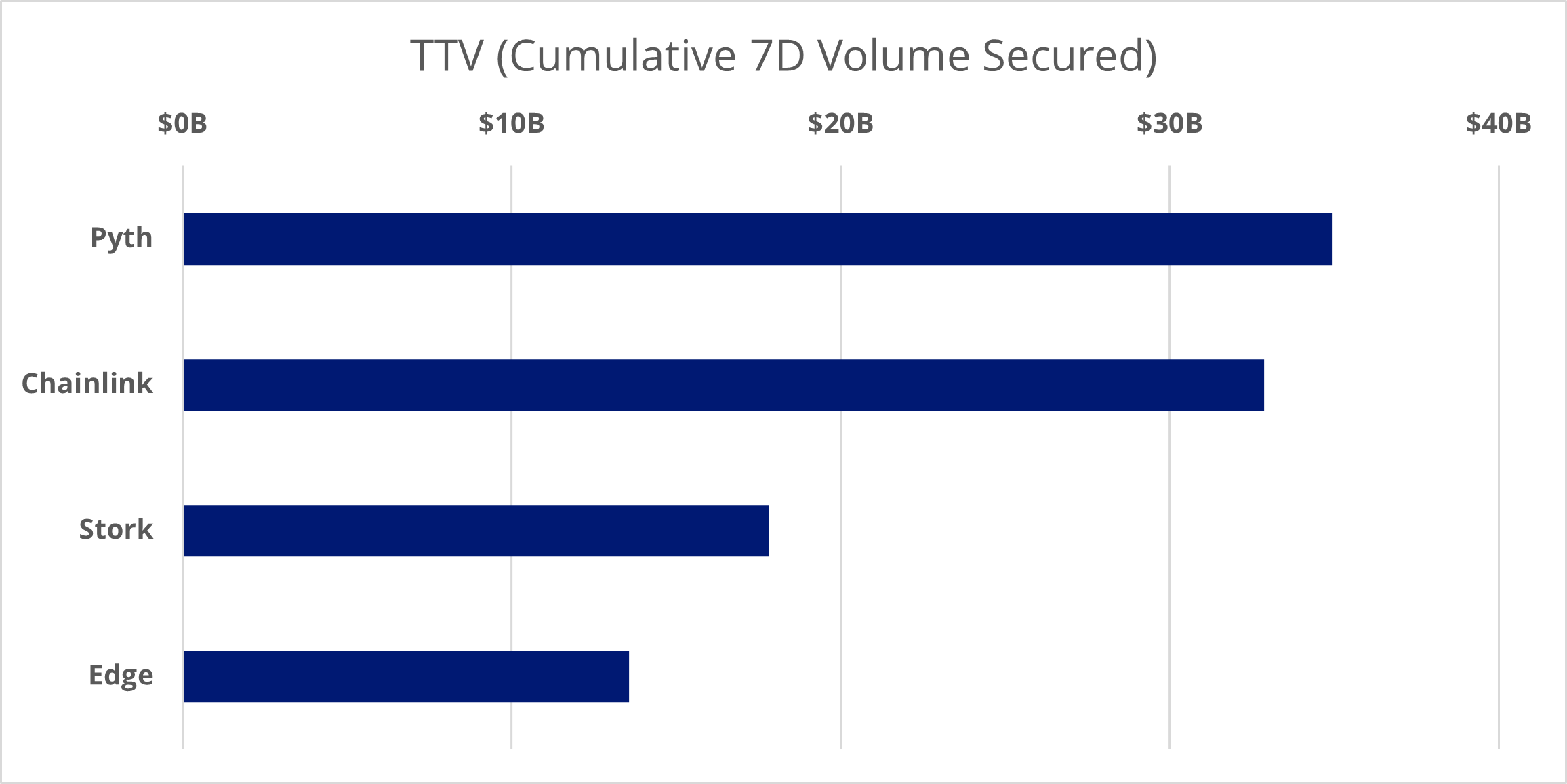

Total Transaction Volume

Another, perhaps better, metric to measure the true market share and usage of an Oracle network is TTV (Total Transaction Volume). TTV is strongly correlated with the frequency of oracle price updates and therefore oracle revenue and true demand for its products and services. TVS can overstate or understate an application’s demand for price updates, because an application could have a disproportionate amount of locked value relative to the amount of Oracle interactions one would expect to observe.

Source: Defillama, Data as of October 2024. Historical performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the figure above.

Source: Defillama, Data as of October 2024. Historical performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the figure above.

Chainlink, the traditional market leader of oracle networks, is losing ground after being slow to serve customers needing faster data updates, though they've recently launched a new high-speed service. Pyth has become a successful competitor by focusing on rapid data delivery across multiple platforms, making it easier for financial applications to access real-time price information. Large trading platforms are increasingly building their own internal price tracking systems rather than paying external providers, suggesting cost is a major factor in their decisions.

The key to future success in digital trading will be speed - traditional exchanges currently have an advantage with their centralized systems, but new platforms are starting to close this gap by developing faster price update capabilities.

Pyth Network Governance

The Pyth Network operates a decentralized governance system that empowers the community by allowing all PYTH token holders to have a direct say in the network's development and decision-making processes. This decentralized governance model ensures that control of the network is distributed among its users, promoting transparency and inclusion.

To participate in governance, token holders must stake their PYTH tokens through the Pyth staking program. By staking their tokens, users gain the ability to vote on community governance proposals, ensuring that they have a voice in the key decisions shaping the future of the Pyth Network.

In addition to voting, any PYTH token holder has the right to submit proposals to the Pyth DAO, provided they meet the requirement of holding and staking at least 0.25% of the total PYTH tokens staked. The proposals that can be brought to the DAO are diverse and impact many critical aspects of the network's functionality, including:

- Determining the size of update fees: Proposals can influence the fees charged for updates to the network, ensuring that they remain fair and competitive.

- Reward distribution mechanisms for publishers: The community can vote on how rewards are allocated to data publishers, ensuring that those contributing accurate and reliable data are fairly compensated.

- Approving software updates across blockchains: The Pyth Network operates across multiple blockchains, and governance participants have the power to approve essential updates to on-chain programs, ensuring the network remains up to date and secure.

- Listing price feeds and determining their reference data: Token holders can vote on which price feeds are listed on Pyth, as well as set the technical parameters for these feeds, such as the number of decimal places in the prices and the reference exchanges used to determine the data.

- Selecting data publishers: The governance system allows the community to permission publishers, or select which entities are allowed to provide data for each price feed. This ensures that only trusted and verified data sources are contributing to the network.

Diversify Crypto Exposure to Decentralized Oracles with the VanEck Pyth ETN

Key features of the VanEck Pyth ETN

- Fully-collateralized by PYTH in cold-storage

- Exposure to one of the fastest growing decentralized oracle networks

- Total return of PYTH: Tracks the MarketVector™ Pyth Network VWAP Close Index (MVPYTHV)

Why VanEck Crypto ETNs? Here’s why:

- Crypto is only a small part of our total assets, so we can weather bear markets without drastic measures, protecting your investments.

- With nearly 70 years in asset management and a strong track record in crypto, we bring deep industry knowledge and proven reliability.

- We combine traditional financial strengths with cutting-edge crypto innovation, backed by a CEO who truly believes in crypto’s future.

- We ensure clarity in our product structures and avoid high-risk or opaque practices, with assets fully backed by cryptocurrency in secure cold storage.

- Our products, VBTC and VETH, are among the most traded on Xetra, offering you exceptional liquidity and tight spreads for seamless trading.

- Our assets are secured by a licensed European bank in Liechtenstein, providing top-tier compliance and security.

- We use the safest institutional custody setup available, prioritizing your security over cost savings.

Crypto is an asset class with high potential returns but investing in digital assets comes with great risk, why choose products that potentially introduce even more risks? Choose VanEck for a secure, transparent, and expertly managed crypto investment experience.

Main Risk Factors:

- Technology Risk: Trading and transaction systems may be hacked or malfunctioning, causing loss of digital assets.

- Regulatory Risk: Disruptions and interventions may render digital assets illegal.

- Risk of Total Loss: No guarantee regarding custody due to hacking risk, counterparty risk and market risk.

- Risk of Extreme Volatility: Trading prices of digital assets may experience extreme volatility.

Other risks specific to this ETN’s Digital Assets can also be found on the VanEck Crypto Academy.

- The PYTH token is an SPL token, live on the Solana mainnet as well as Pythnet (Pyth Network’s application specific blockchain based on Solana). Pyth Network can suffer from Price Manipulation Attacks. This involves attempts by malicious actors to manipulate the oracle price through various means. This can have severe negative effects on the Pyth Network and PYTH token.

- The Pyth Network can also suffer from reputation and trust issues as some level of trust is required for applications using Pyth’s services. If trust or reputation is damaged, it can negatively impact the Pyth Network and PYTH token.

To receive more Digital Assets insights, sign up to our Newsletter.

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

Important information

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Strasse 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MV Index Solutions GmbH, which has contracted with CC Data Limited to maintain and calculate the Index. CC Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MV Index Solutions GmbH, CC Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

16 January 2025

27 November 2024

27 November 2024

07 November 2024