Why is Bitcoin Volatile? An Overview of Bitcoin Price Fluctuations

26 February 2024

Explore the drivers of Bitcoin's volatility, from market trends to regulatory impacts, and understand the future of its price fluctuations.

Explore the drivers of Bitcoin's volatility, from market trends to regulatory impacts, and understand the future of its price fluctuations.

Introduction: Understanding Bitcoin's Price Volatility

Bitcoin, since its inception, has been synonymous with volatility. Its prices can swing wildly over short periods, drawing in traders and investors attracted by the potential for significant returns but also exposing them to substantial risk. Understanding Bitcoin's price volatility is not just a curiosity but a necessity for cryptocurrency market participants. The cryptocurrency's unpredictable price movements can have wide-reaching implications, from influencing investment strategies to affecting the broader financial market's stability.

Background of Bitcoin: A New Era of Digital Currency

marked the beginning of a new era in digital currency when it was introduced in 2009. As the first decentralized cryptocurrency, it operates on —a digital ledger that records all transactions across a network of computers. This backbone of Bitcoin's structure is what gives it its unique value proposition: security, transparency, and independence from traditional banking systems.

Why Is Bitcoin's Price So Volatile?

To fully grasp Bitcoin's price movements, one must consider various factors that can influence its value. Below are key dynamics that contribute to Bitcoin's notorious price volatility.

Supply and Demand Dynamics

Bitcoin's design comes with a fixed supply, capped at 21 million coins, making it a deflationary asset. This limitation can lead to significant price swings as demand fluctuates. The process of reaching the 21 million bitcoin cap is governed by a mechanism called halving. Approximately every four years, the reward for mining a block of Bitcoin transactions is halved. Initially, miners received 50 bitcoins per block. This reward has halved several times and will continue to do so until the last fraction of a bitcoin is mined. There are approximately 19.6 million bitcoins in circulation today, and the cap of 21 million is not expected to be hit until 2140.

Increased demand from investors, particularly during times of economic uncertainty, often leads to price surges, while lower demand can quickly result in price declines.

Market Sentiment

The influence of media and news on investor sentiment cannot be overstated. Positive news can lead to hype, driving up prices, while negative news can trigger panic selling. This cycle of news and investor reaction contributes to the high volatility seen in Bitcoin trading.

Regulatory Impact

Regulatory announcements from various parts of the world have historically triggered immediate and often unpredictable effects on Bitcoin's price. While some regulatory news can create short-term volatility, it's important to consider the broader, more constructive impact of these developments. Globally, regulatory frameworks are evolving to accommodate and govern the use of Bitcoin and other cryptocurrencies, reflecting a growing recognition of their potential.

In the European Union, for instance, the introduction of the Fifth Anti-Money Laundering Directive (5AMLD) has brought cryptocurrency exchanges and custodian wallet providers into the fold of regulated entities. This has enhanced the legitimacy of Bitcoin, encouraging mainstream financial institutions to engage with cryptocurrency markets and products.

Similarly, in Canada, the regulatory environment has become more conducive to cryptocurrency innovation and investment. The Ontario Securities Commission (OSC) has approved several Bitcoin exchange-traded funds (ETFs), making it easier and more secure for Canadians to invest in Bitcoin.

These regulatory milestones have significantly contributed to the increasing adoption of Bitcoin worldwide. They provide a legal framework that protects consumers, combats illegal activities, and establishes cryptocurrency as a legitimate financial asset. As regulatory clarity improves, more investors—from retail to institutional—are likely to participate in the market, potentially leading to greater stability and a reduction in speculative trading.

Bitcoin Volatility Index: Gauging Market Movements

The Bitcoin Volatility Index (BVIX) serves as a measure of Bitcoin's expected volatility based on options market data. It's an essential tool for investors, as it provides insights into market sentiment and risk. Understanding the BVIX is crucial for anyone looking to gauge Bitcoin's market movements accurately.

Investor Behavior and Market Dynamics

Bitcoin's market is influenced by a mix of individual and institutional investors, each bringing different behaviors and impacts on price. The emergence of various investment platforms has made trading Bitcoin more accessible, adding to market liquidity and, consequently, volatility.

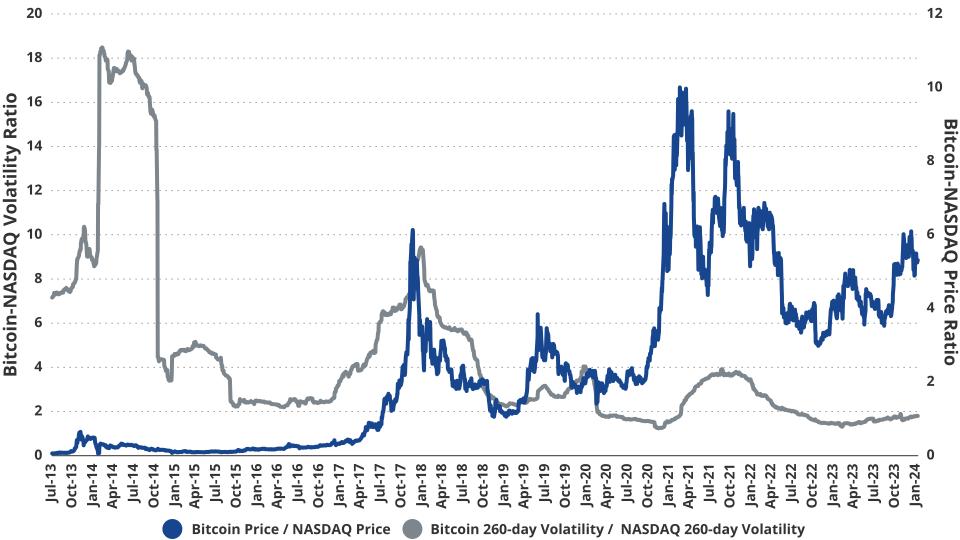

Bitcoin's Price Fluctuation: A Technical Analysis

Using charts and historical data can help identify trends and patterns in Bitcoin's price. However, the limitations of technical analysis become apparent given Bitcoin's volatile nature, which often defies traditional market expectations:

Source: Bloomberg January 2024. Index performance is not illustrative of fund performance. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

Historical Perspective: Bitcoin Volatility Over Time

VanEck has been bullish on Bitcoin since 2017 when the price of Bitcoin was $3,000. Since the beginning, we've said that Bitcoin is an internet-enabled, limited-supply asset.

In the volatile yet vibrant history of Bitcoin, we've witnessed a financial phenomenon morph from a nascent digital token to a burgeoning asset class. Bitcoin's journey has been nothing short of a roller coaster ride, marked by meteoric rises, steep falls, and a resilience that continues to intrigue and reward its believers. For investors, Bitcoin has offered not just a new avenue for potential returns but a front-row seat to the evolution of an asset that has challenged traditional notions of value and investment. The maturation of an asset can provide additional returns that might be available once the opportunity has matured. With Bitcoin, there is more growing up to do.

Bitcoin 1.0 - Early days (2011-2017)

From 2011 to 2017, Bitcoin was in its proof of technology phase. It was establishing the blockchain as a workable force and was just beginning to have network effects. The volatility was immense; the swings in value were wild and unpredictable. Yet, those who recognized the underlying promise of this technology and invested in it, even amidst the uncertainty, found themselves on the cusp of a revolution.

Bitcoin 2.0 - Awkward growth spurt (2017-2021)

As Bitcoin entered its toddler years, from 2017 to 2021, it began to mature. What was once known to a few tech enthusiasts was now being adopted by millions worldwide and withstanding political bans and threats. Despite maintaining its volatile nature, Bitcoin showed us proof of principle in 2021 by reaching new all-time highs, demonstrating that it wasn't just a one-time bubble. This phase, to us, was a testament to Bitcoin's staying power, solidifying its role as more than just a digital curiosity but a genuine asset class.

Current Trends in Bitcoin's Market Behavior

Recent market conditions have both stabilized and destabilized Bitcoin's price. Analyzing these trends can provide insights into what drives Bitcoin's volatility and offer some predictive understanding of future movements.

Bitcoin 3.0 - Tests of adolescence (2021-2024)

The current journey is when technological development continues, and the asset is valued by a wider circle of investors. The beginnings of institutional adoption started to surface, although the expected smaller drawdowns turned out to be larger than anticipated. Bitcoin's resilience through these tests has been a critical part of its growth story, a phase of toughening up and proving its mettle.

Bitcoin 4.0 – Coming of age (2024-TBD)

As we approach 2024, we anticipate the advent of Bitcoin 4.0. With potential regulatory clarity and broader acceptance, we believe Bitcoin stands on the brink of its coming-of-age story. The expectation is that with the approval of a Bitcoin ETF and other investment vehicles, Bitcoin will transition to a more stable and accepted member of the financial community. This era is where we may see an influx of retail and institutional investors acknowledging the legitimacy and potential of Bitcoin as a cornerstone of modern portfolios.

Challenges in Predicting Bitcoin's Volatility

The very nature of Bitcoin's market is enigmatic, characterized by rapid shifts that often seem detached from the traditional market indicators used in other asset classes. Analysts and investors alike grapple with an array of sophisticated models and analytical tools in an effort to predict its next move, but the accuracy of such forecasts is notoriously elusive.

One of the primary challenges is the relative infancy of the cryptocurrency market. Unlike stocks and commodities, which have decades or even centuries of historical data to draw upon, Bitcoin has just over a decade. The limited historical context makes it difficult to apply time-tested models based on long-term data.

Furthermore, Bitcoin operates within a market that is highly sentiment-driven. The sentiment is influenced by a diverse set of factors, ranging from geopolitical developments and regulatory changes to technological advancements and market manipulation. Each of these factors can have a disproportionate impact on price movement.

Adding to the complexity is the decentralized nature of Bitcoin. With no central authority or governing body, movements in the market are often the result of decentralized actions by individuals across the globe, making collective mood and behavior difficult to gauge.

Algorithmic trading, which uses complex models to predict price movements and execute trades at high speed, has added to the volatility. Bots can act on triggers too subtle for human analysts to detect or on pre-emptive strategies designed to capitalize on anticipated market movements, thus potentially leading to self-fulfilling prophecies.

Finally, the influx of institutional investors, each with their own strategies and thresholds for buying and selling, further complicates prediction models. These entities can move the market significantly, and their actions are often based on a mixture of proprietary signals and broader economic indicators, which are not always transparent or predictable.

In this dynamic and uncertain landscape, even the most advanced predictive analytics must contend with the reality that Bitcoin's market is influenced by a complex web of unpredictable human behaviors, emerging technologies, and global events. The result is an environment where certainty is scarce, and the ability to adapt to rapid change is among the most valuable of skills.

Conclusion: Navigating Bitcoin's Future Volatility

Demand for Bitcoin is a key driver of its returns. In its early years, Bitcoin was largely used by a small group of tech enthusiasts. It was difficult and cumbersome to obtain with limited use cases, and very few merchants accepted it as a form of payment. In 2023, Bitcoin adoption has grown substantially as it has become more mainstream. Now, more than ever, merchants and businesses are accepting Bitcoin as a form of payment, and infrastructure has been built to make it more convenient for the average person to use. The development of user-friendly wallets, exchanges, and marketplaces has removed the technical barriers to entry that existed in Bitcoin's early years.

Bitcoin interest among institutional investors has also increased. Hedge funds, asset management firms, and endowments are increasingly recognizing Bitcoin's potential as a store of value and as an effective portfolio diversifier, specifically when looking through the lens of an uncorrelated asset that has the potential to hedge against inflation. Approximately $50B worth of Bitcoin is now held by ETFs, countries, and public and private companies.

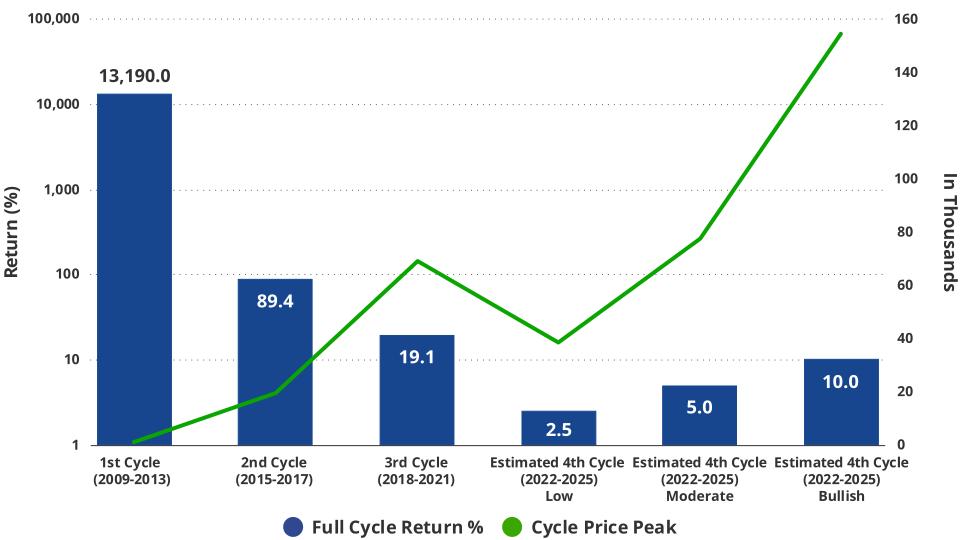

Importantly, there will only ever be 21 million Bitcoin in existence. This supply cap was designed intentionally and is one of the primary characteristics of Bitcoin. Furthermore, Bitcoin has "halvings" programmed into it. A halving is defined as a 50% block reward cut to the Bitcoin production rate, and they occur roughly every four years. This means that the rate at which new Bitcoins are introduced into circulation slows down over time until it eventually reaches zero (estimated to occur around the year 2140).

Bitcoin Halvings are Typically Associated with Explosive Returns

Source: VanEck Research December 2023. Not intended as a forecast or prediction of future results, or as any call to action. Estimates shown are for illustrative purposes only. Please see below for disclosures regarding hypothetical performance.

These halvings increase the difficulty of mining Bitcoin and will occur until the supply cap is reached. In addition, the built-in finite supply of Bitcoin means that it is not subject to inflation in the same manner that fiat currencies are. Central banks around the world have ushered in unprecedented growth in money supply, effectively eroding the purchasing value of their currencies. In comparison, Bitcoin's limited supply and increased mining difficulty over time may support the idea of Bitcoin as a long-term store of value and as an alternative to gold.

The next halving is expected to occur in April 2024. Historically, the price of Bitcoin has rallied leading up to and following a halving.

Learn more about Bitcoin and digital assets in our Crypto Academy.

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

16 January 2025

27 November 2024

27 November 2024

07 November 2024