How DePINs Can Upend Centralized Industries

02 September 2023

Share with a Friend

All fields required where indicated (*)Please note that VanEck may have a position(s) in the digital asset(s) described below.

Key takeaways

- Decentralized physical infrastructure projects are proliferating.

- GIANT Protocol aims to bootstrap a marketplace for mobile bandwidth.

- VanEck analysis reveals a $5.4B+ revenue opportunity at 1% global MVNO market share.

What are DePINs?

A new and potentially groundbreaking concept has emerged in the ever-evolving landscape of blockchain and decentralized technologies: "decentralized physical infrastructure" (DePIN) protocols. These networks use tokenization to coordinate and incentivize their bootstrapping phase, allowing individuals to build up the supply of the infrastructure in a decentralized manner and get rewarded with token incentives. This flips the traditional model - where corporations in telecommunications or energy invest a lot of time and money into building and maintaining infrastructure – on its head. With DePINs, Web3 companies try to outsource this build-up and maintenance process to a token-incentivized army of volunteers and monetize later once the coverage rate is high enough. DePIN protocols can empower individuals and small entities to participate, transact, and even compete with traditional centralized infrastructure giants by redefining how we think about and utilize physical infrastructures such as communication networks and energy grids. It's a shift from monopolistic and centralized control to a more democratized and distributed model, ensuring greater access, flexibility, and transparency for users worldwide.What is GIANT Protocol?

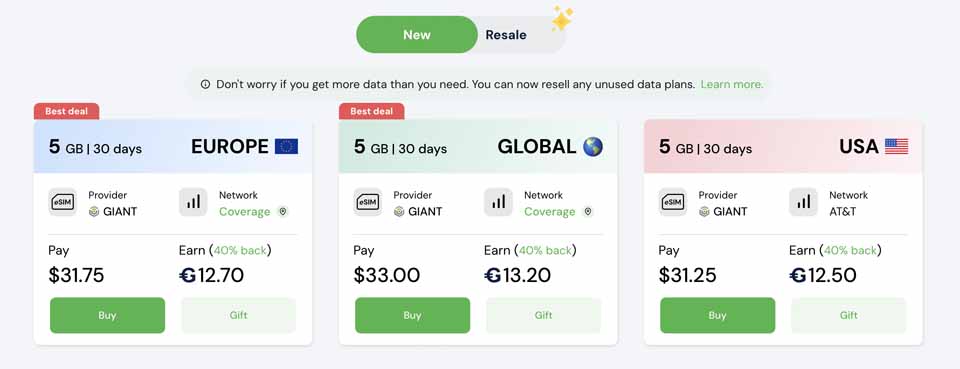

One such recent entry into this space is GIANT Protocol, which is creating a decentralized internet access layer (DIAL) that allows users and service providers to connect on a two-sided marketplace to buy and sell data plans. In its initial offering, GIANT focuses on cell phone data service and allows mobile phone users to purchase eSIMs that enable access to cellular networks across the globe. To fill in the marketplace, providers of mobile data services offer prepaid, time-based data plans. Anyone can be a provider so long as they can create an eSIM that a buyer of a data plan can use. Initially, the two providers on the network are Airola and GIANT, who both operate as Mobile Virtual Network Operators (MVNOs) and buy network coverage from Mobile Network Operators (MNOs) such as AT&T, Verizon, and others.

Source: GIANT Protocol’s Website as of 8/24/2023.

The plans offered on the marketplace are inexpensive, easy to use, and available across the globe. All that a user needs to do is buy a plan, download the application and open it up, select a plan, purchase it, and start their plan by utilizing a QR code that links their eSIM-capable smartphone. To sweeten the deal, users can trade unused portions of their plan by listing it on a marketplace for others to purchase. While GIANT is created on a substrate-built blockchain (the same tooling that builds Polkadot blockchains), credit card payments are also accepted alongside crypto to simplify the user experience. To bootstrap the ecosystem, both providers and plan purchasers are currently being reimbursed in GIANT tokens for 40% of the value of each plan’s purchase price. The stated target market for these plans is travelers because eSIM technology allows quick connections to any cellular network globally.

How Does GIANT Work?

Source: GIANT Protocol White Paper as of 8/24/2023.

On the back end, GIANT’s eSIMs are powered by tokenized data contracts (DCTs) created by cellular service providers. Each DCT must contain all the data within it to access each network that is offered. To sell DCTs on Giant’s marketplace, service providers must back their offerings with GIANT tokens to ensure the DCT’s data service obligations are fulfilled. To further insulate service plan buyers, the payments for DCTs are held in an escrow account. Providers can access the account’s funds over time relative to the remaining time on their DCTs, their assessed “quality of service,” and the value of GIANT they stake behind their DCTs. If the service provider of a DCT meets the specifications of the data contract, the escrowed funds used to purchase the DCT and the backing GIANT can be seized. That “slashed” value will be returned to the data plan purchaser, ensuring the buyer has an ironclad economic recourse to poor service or fraud.

If a service provider does not want to deal with tokens or is short of GIANT tokens, it can borrow GIANT from a pool funded by token stakers at an interest rate relative to supply and demand. Consequently, holders of GIANT tokens can earn yield by lending their currency to providers. As both the providers of data services and users of data plans receive GIANT tokens, each party can utilize their excess tokens to lend to providers or stake the protocol to secure the network to receive additional rewards. Suppliers and purchasers are each allocated 5% of the total supply of GIANT tokens, and the emission of tokens will decrease over time. It is expected that GIANT token holders will gradually be rewarded with increasing cashflows from the growth of platform users as token rewards decline. This is because the cashflow split of DCT sales is 5% to the GIANT protocol, 5% to staking token holders, and 90% to the provider.

Problems GIANT Protocol Solves

- Create cheaper internet access

- Allow consumers to participate financially in data provision

- Improve lack of trust with internet access providers fulfilling consumer obligations

To say achieving GIANT’s goals will be an ambitious endeavor is an understatement. However, as we did work on the initial business model, we got some conviction that the project’s vision may be achievable. If so, the value accrual to token-holders could be significant. However, GIANT Protocol is an early stage project and the value of its tokens is highly speculative.

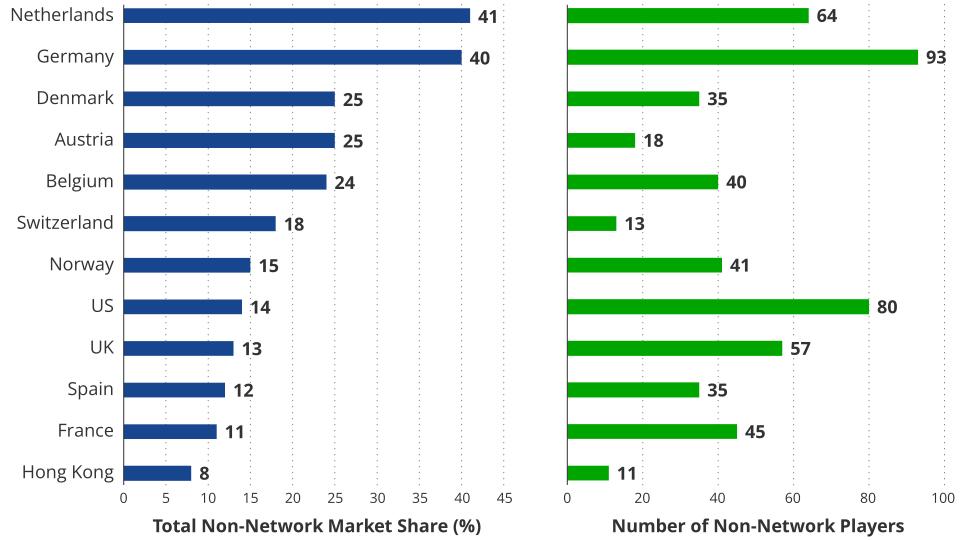

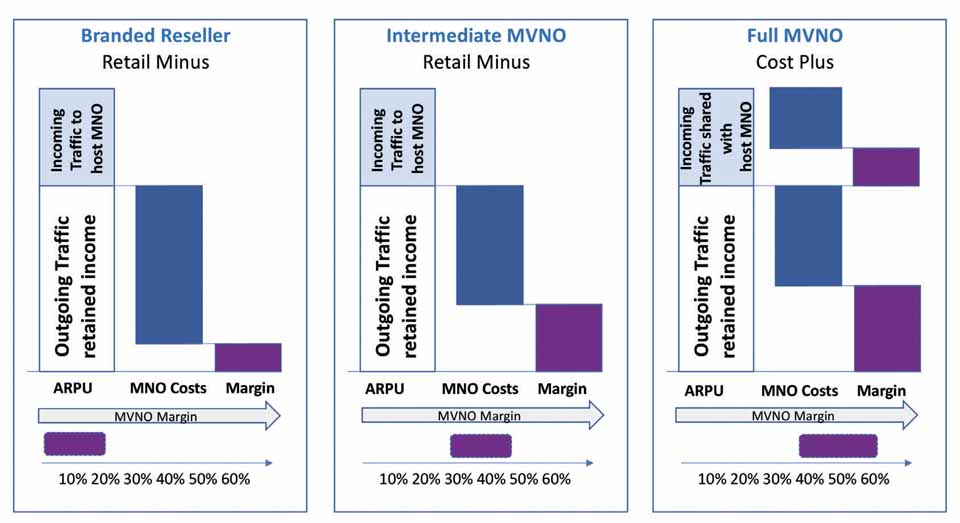

Opening the MNVO Business

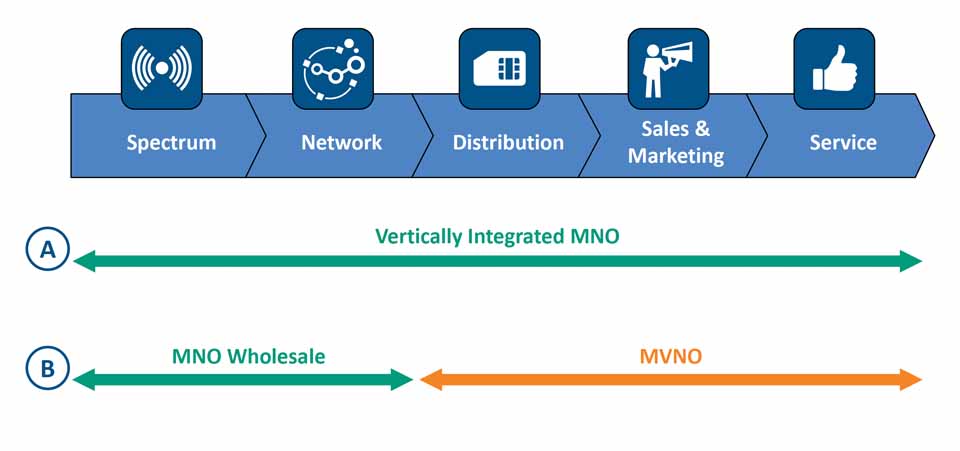

Source: Cartesian as of 8/24/2023.

GIANT’s initial target is the data plan market for cellular phones, and GIANT is currently best described as a Mobile Virtual Network Operators (MVNOs) platform. MVNOs buy unused, inexpensive cellular capacity from MNOs to re-market that cellular capacity through cheaper user plans. This entails offering consumers price tradeoffs where users get less roaming coverage, slower download speeds, or specific geographic coverage (within a regional area). MVNOs will typically create a brand image to appeal to a target demographic - students, travelers, urban users, etc. Essentially, they are stripping away the frills of a one-size-fits-all, expensive mobile network operator like AT&T and repackaging limited service through marketing and advertising to appeal to a new customer base with a la carte pricing. The initial focus of GIANT is the travel market, and to accomplish this, it has partnered with MVNO Airola, which has data plans with hundreds of MNOs across 200 countries and regions. At the time of writing, GIANT has sold 822 DCTs worth $12.9k on its online platform.

Source: Cartesian as of 8/24/2023.

Anyone can list data plans on GIANT’s marketplace so long as they can guarantee network access. This opens up the MVNO business space to new firms and individuals who can find unique ways to corral users. In 2019, Ryan Reynolds became an equity owner in Mint Mobile and used his fame to boost the company to a $1.35B sale in 2023. Now, using GIANT, today’s influencers could set up their own MNVOs and resell network coverage through their own entity.

Source: Blazar Capital, Emma Chamberlain’s Chamberlain Coffee Raised $7M in funding in June 2023.

This harkens back to the mid-2000s era of non-telecom-related entities becoming MVNOs, such as Disney Mobile and ESPN MVP, to cross-sell their customer bases. Today, however, the realities of information saturation combined with the explosion in cult-like following of influencers and overall media fragmentation have motivated young consumers to patronize influencer businesses like KKW Beauty/SKKN (Kim Kardashian), Chamberlain Coffee (Emma Chamberlain), and MrBeast Burgers (MrBeast). We could see one of them entering the mobile market, perhaps using smart contracts to offer unique pricing and access to superfans.

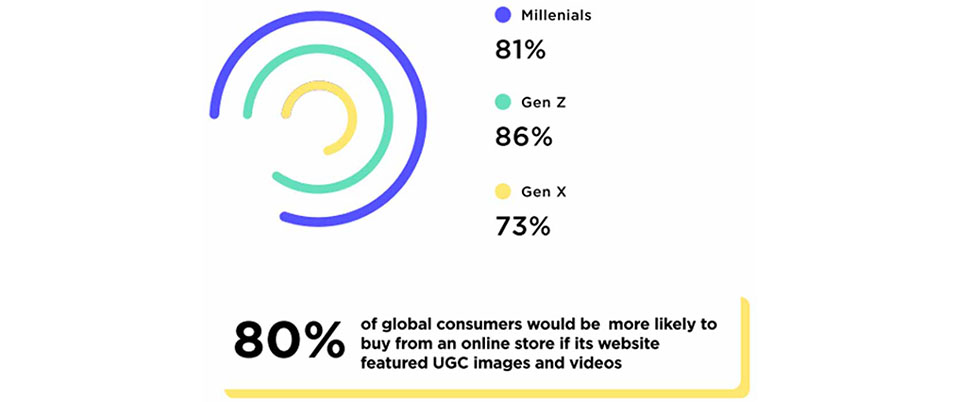

How GIANT Tokens Incentivize

The key innovation enabled by crypto-economic protocols like GIANT is to give users and providers of services in the two-sided marketplace a stake in the platform's success. This is accomplished by providing rewards of GIANT tokens to providers and consumers. In turn, GIANT token holders not only receive additional token rewards by participating in network security or provider financing but also cash flows from the network. The GIANT token captures value from the protocol, and as activity on GIANT’s platform grows, the users’ tokens also appreciate. Imagine if Uber offered equity shares to both the drivers and the users for participating in Uber’s ride-share economy. In such a dynamic, system users would be incentivized to bring in new participants as it increases the value of their Uber stock. The same concept applies to the GIANT Protocol and its GIANT token.Furthermore, providers can now attract users by sharing their GIANT tokens with users of their cellular services. As the heart of the MVNO business is targeted marketing, the most effective mechanism for persuading the onboard of user-generated content (UGC). What better way to incentivize consumers to create media than to give service providers the means and mechanism to award grassroots marketers?

Source: Stackla as of 8/24/2023.

Reducing Data Providers Churn

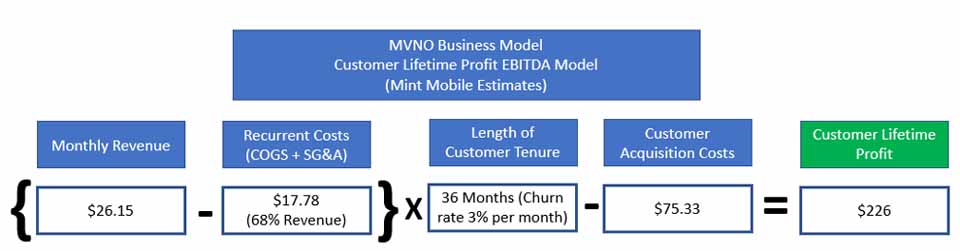

Source: VanEck Research, Cartesian as of 8/24/2023.

One of the most important metrics of success for data providers like MVNOs is churn. Customer churn rate, or the likelihood of customers leaving a business, is a lever on profitability for all data provision businesses, particularly MVNOs. Compared to MNO customers, the churn rate for MNVO customers is around 2-4x higher, averaging about 3% per month. As the above graphic demonstrates, reducing the customer attrition rate by just 50bps to 2.5% increases the customer lifetime profits by 33%, which translates directly into firm equity. One of the key methods to reduce churn is to drive user stickiness by enhancing an offering or introducing financial incentives. Many telecom firms accomplish this by giving users access to higher quality phones at discount prices. Some go further, such as MVNO operators FreedomPop and Giffgaff, who offer customers additional data allowances or $5 bonuses for customer referrals. T-Mobile even tries to bundle cellular plans with bank accounts to tap into the low churn rate of the banking industry by offering a demand deposit bank account with interest rates as high as 4% in a product called T-Mobile MONEY. In the hypercompetitive cellular data provider market, anything that can better attract and retain customers is a massive competitive advantage. GIANT’s token inventive model is an entirely novel paradigm. After all, it gives users a reason to not only remain in the system but bring in new customers because its awards are proportional to the business's success. As a result, telecommunications providers who onboard to GIANT may sport customer acquisition cost and churn advantages over competitors.

Sizing GIANT Protocol’s Opportunity

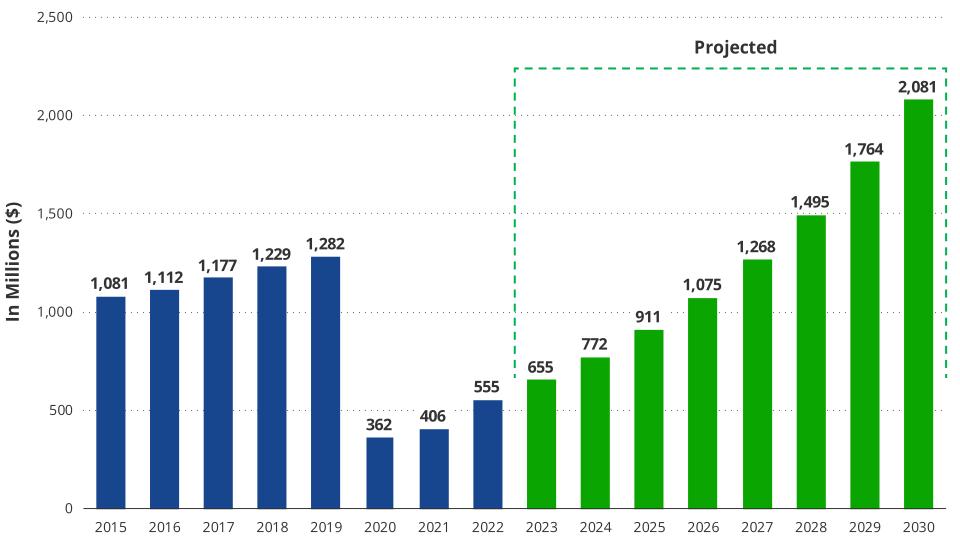

Global Past and Projected International Trips 2015 - 2030 (Ms)

Source: UNTWO, VanEck Research as of 8/24/2023.

To find the initial opportunity, we examine the market for international data plans for travelers. In 2022, the number of global overnight international traveler trips was ~550M, which was down which is down from 1.3B in 2019. Before 2020, the number had grown at a 4.5% CAGR between 2014 and 2019. If this trend re-emerges, this projects to 2.1B yearly trips by 2030. It is suggested that the average international traveler needs 5GB to cover the average international trip of 18 days. Currently, a 5G international data plan is $20 or $4 per GB. Since cellular data needs are growing at a 20% CAGR, the average user will require around 20GB of data in 2030. If data price trends persist as they did from 2018-2023, the cost of data will fall around -10% per year, and by 2030, the cost of an international data plan will be $1.32 per GB. If each traveler purchases a 20GB plan, which costs $26.4, the market for traveler international data plans will be $76B in 2030.

Source: McKinsey as of 8/24/2023.

In 2020, the global MVNO market’s revenue was estimated to be around $63B, growing at roughly 10% each year. Based upon this data, the world’s MVNO businesses will generate $160B in annual revenue. These figures compare to $565B in MNO revenue, which grew at an annual rate of 6.9%.

GIANT Valuation Framework

While the GIANT Protocol has greater ambitions than the mobile data services, MVNO comparisons are currently the best valuation proxies. Typically, these firms average around 5-60% EBITDA margin depending upon the value-added differentiation of services. When firm value is measured on a per-user basis, it similarly varies from $155 to $930 per user. However, public comparisons are hard to find, so we will estimate MNVO multiples based on recent transactions and industry data points. In the recent acquisition of Mint Mobile, it's estimated that Mint had 2-3M subscribers. With an industry average annual revenue per user of around $313.80, Mint would have $627M - $941.4M in yearly revenue. The $1.35B acquisition price implies that Mint is valued around 1.43 - 2.15,x trailing twelve-month sales. As Mint lies between a “Branded Reseller” and an “Intermediate MVNO,” it should have around a 15-25% EBITDA margin, which implies a 6-14x valuation. As Wireless Telecom EV/EBITDA multiples sit around 9x, this would appear to be a reasonable multiple estimate for Mint Mobile. Conversely, considering GIANT’s valuation from an internet marketplace vantage, we find an EV/EBITDA range from 6.1x (Lyft) to 16.9x (Opendoor).

Source: Mobilise Global as of 8/24/2023.

When boiled down, GIANT is a platform for telecom data services providers to list their offers and should trade at a blend of internet platform and MVNO valuations. To be conservative, we will choose an EV/EBITDA of 6x. Since GIANT token holders take 5% of the flow of GIANT platform revenue, we could count that as EBITDA. However, that is not actually EBITDA but rather free cash flow remitted directly to tokenholders. Therefore, before applying the EV multiples to GIANT’s token valuation, we must adjust the multiples to reflect the percentage of EBITDA remitted to shareholders. Since 2015, the ratio of free cashflows to EBITDA for the top 3 wireless carriers was 32.6%.

Consequently, we adjust our EV/EBITDA multiple by ~3x to bring it to 18x TTM free cashflows (FCF) to tokenholders. Furthermore, the average payout ratio of dividends and buybacks to shareholders was roughly 50% of FCF for wireless telecommunication enterprises 2023. Therefore, we will further adjust our enterprise value multiple to around 36x TTM cashflows, as 100% of the cash flows go to token holders, which implies a cashflow yield of 2.77%.

As a result, if GIANT captures just 1% of the global MVNO market and 5% of the international travel data market in the year 2030, its platform’s revenue will be $5.4B. This equates to a $270M in cashflows to tokenholders and, based upon a 36x multiple, would put the value of the Giant protocol around $9.7B in 2030. Today, the token GIANT token does not freely trade on any exchange or DEX as the project is in an early stage of development. As a result, it has no public market price and cannot be bought by investors outside of an OTC deal with an early investor or the GIANT team. Note: VanEck has no position in this company.

GIANT’s Next Steps and Catalysts

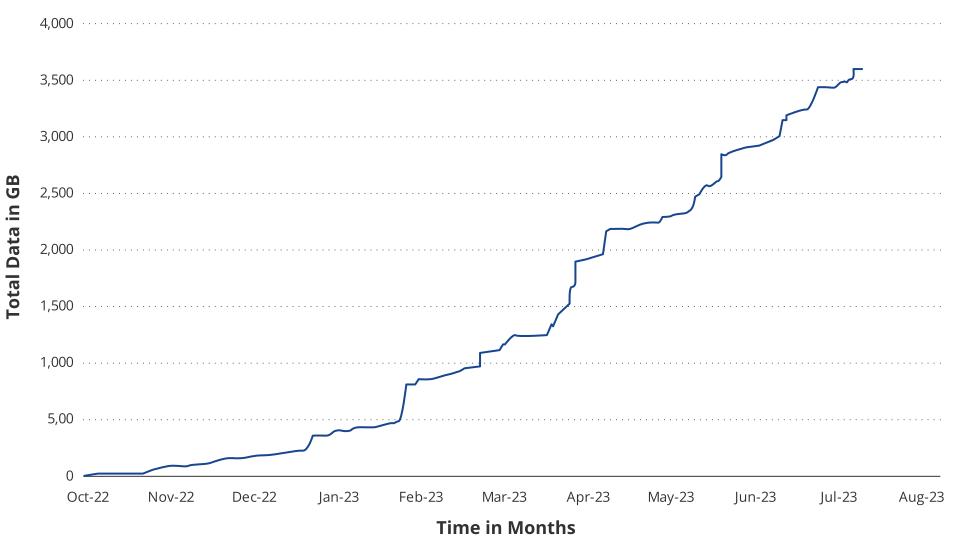

Data Consumed (in GB)

Source: Giant Protocol, GIANT Data Network Data Plan Sales as of 7/09/2023.

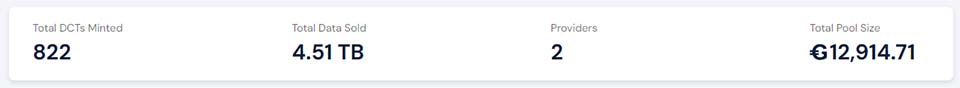

GIANT Protocol is an immature protocol that has marginal revenue on its platform. As of August 24, 2023, there have been 822 DCTs minted, amounting to 4.51TB in data, which corresponds to around $18k in revenue and around $900 to tokenholders. While GIANT’s progress in launching its blockchain and inking a deal with the unicorn MNVO Airalo is commendable, it must take key steps before it can fulfill its promise as an MVNO platform. To do this, the future goals for GIANT should be to smooth the token experience for both consumers and data providers while also targeting high-potential early adopters.

Source: GIANT Protocol, GIANT Protocol Network Statistics as of 8/24/2022.

The greatest obstacle to the mass adoption of GIANT is the inability of data consumers and providers to manage their token exposure. Currently, the GIANT application has no embedded trading method between GIANT tokens and fiat currencies. At the same time, no entity provides GIANT token liquidity through market-making. In fact, GIANT is not listed on any major crypto exchange where users can access fiat on/off-ramps. As a result, there is no public trading price for the GIANT token, and GIANT does not have an informational listing on Coingecko or CoinMarketCap. Additionally, there is neither a blockchain explorer for the GIANT Protocol’s network nor a dashboard to track the GIANT Protocol’s usage. To begin the journey to widespread usership, GIANT needs to have in-app token trading, an entity dedicated to GIANT token liquidity facilitation, several marketplaces to transact the GIANT token, and basic informational tooling.

Beyond token management and liquidity issues, GIANT needs to find its target user base for purchasing data plans. The simplest way for GIANT to achieve greater awareness and uptake is to target the employees of cryptocurrency entities. Besides this being a tech-savvy group of early adopters, people working in crypto travel extensively to conferences and other events across the globe. EthCC, a conference in Paris, had over 5k attendees in 2023. There are dozens of other crypto conferences, with some attracting thousands of international participants. A clear partnership opportunity would also be with Helium, a blockchain-based protocol for providing IoT and cellular data services. Helium has recently launched a $5 unlimited data plan for residents of Miami-Dade County, and adding this plan to GIANT’s platform as part of Helium’s regional expansion strategy would be mutually beneficial.

The best place to follow KPIs for the project is on GIANT's Twitter profile or through GIANT’s website, which lists a few metrics like the total size of data plans sold and the value of the secondary market for DCTs. To track GIANT, we are also monitoring GIANT’s chat application presence on platforms like Discord and Telegram for activity. Important catalysts going forward relate to network activity and the ability to attract new data providers to GIANT’s ecosystem. Partnership announcements, upticks in usership measured by total data purchased, and secondary data sales trading are all important KPIs that will indicate GIANT’s success.

GIANT’s Contribution to DePIN

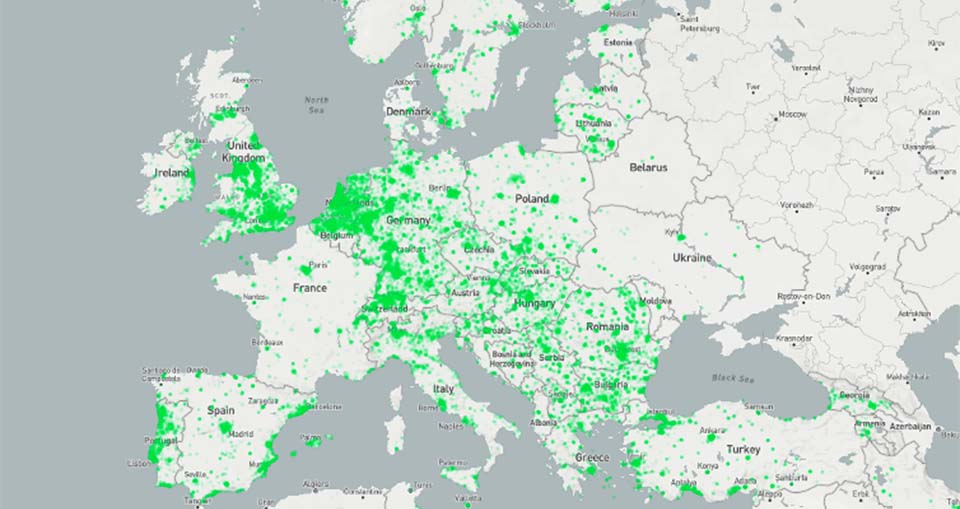

DePIN is a compelling use case for public blockchain because cryptocurrencies can be employed to incentivize the creation of real-world infrastructure for non-blockchain activities. This has typically worked by tying token rewards, whose value increases as the number of participants scales, to hosting and running pieces of infrastructure that power each off-chain use case. The best example of this is Helium, which scaled to over 1M radio transmitters for its IoT data network and 7k hotspots for its 5G mobile network covering thousands of cities across the world. To create this ecosystem of hotspots, Helium focuses its ecosystem rewards on network builders rather than individuals who use the infrastructure. The result for Helium has been that data service providers have spent over $500M buying wireless hotspots but few active users of the network.Helium’s Network Presence in Europe

Source: Helium as of 8/23/23.

Similarly, Hivemapper credits drivers with HONEY tokens, which provide road image mapping data, while DIMO gives crypto to car owners who upload vehicle operating data to the DIMO network. In each of these cases, the principal participant earning the crypto rewards is the network services or data provider. In these DePIN examples, token rewards were not allocated to the end users of the physical infrastructure. In each case, a novel physical infrastructure or a data generation network is created from scratch by promising a share of future network value through token distribution. Essentially, this subsidizes infrastructure costs, translating to end-user services and products that would otherwise be more expensive or impossible to create without the token reward mechanism.

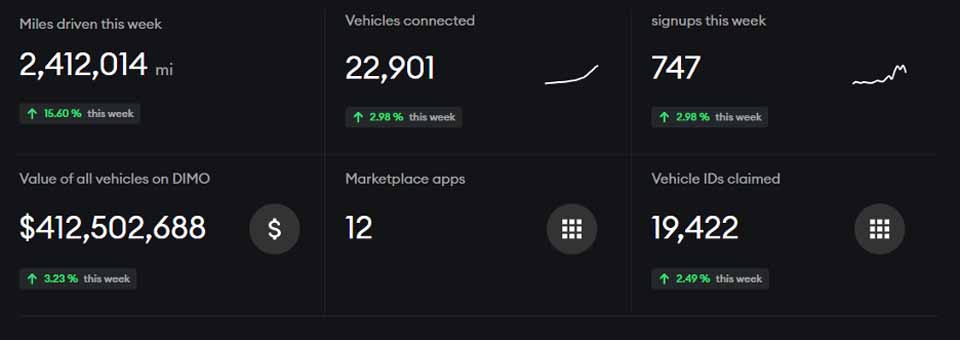

Source: DIMO, Dimo Network Statistics as of 8/22/2023.

By contrast, GIANT’s DePIN strategy distributes token incentives to attract end users and network providers (each data plan’s offeror). This is possible because GIANT is not bootstrapping an entirely new network like Helium but instead seeking to offer a platform for operators to list existing spare data bandwidth. GIANT banks on the premise that many networks overbuild their capacities and would be willing to part with it at a discount. As such, GIANT does not need to spend most of its tokens rewarding infrastructure (COGS). Instead, it drives those tokens to onboarding new users and enhancing existing customer stickiness. GIANT’s secret sauce is to onboard end-users by promising them participation in the rewards of the business services that those users purchase. The consequence of this dynamic is a customer focus that provides incentives for data consumers to remain on the platform and invite others to join it. Effectively, GIANT outsources customer acquisition and retention functions from data services providers and harnesses these functions' effectiveness to the platform's overall success. As a result, GIANT has an interesting approach to customer onboarding that could result in a positive feedback loop driving customers to its platform and its data service providers. It's essential to note that this project is in its nascent stages, and while promising, our assumptions carry a speculative element that warrants cautious optimism.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, subscribe for our Crypto Newsletter

Important Information

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com . Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

22 April 2024

20 April 2024

26 February 2024

26 February 2024