Harnessing Growth: WuXi Biologics and the Race for a COVID-19 Vaccine

26 March 2020

In the context of the coronavirus pandemic, healthcare has been the best performing sector in emerging markets this year, benefitting from its defensive and idiosyncratic characteristics. This area remains a key focus within VanEck’s Emerging Markets Equity Strategy, as it is driven by domestic demand, technological advancement and a rising middle class.

WuXi Biologics, a leading Chinese healthcare name, is an example of how pockets of alpha can be found where companies are providing solutions to problems caused by the novel coronavirus outbreak. The company is currently collaborating with Vir Biotechnology and Biogen to develop a vaccine with the potential to be the first to market. They have started developing multiple neutralizing antibodies which are estimated to enter Phase I clinical trials in April 2020.

WuXi is a contract discovery, development and manufacturing organization (“CDDMO”) that provides outsourcing services to biopharma companies globally and has been one of the VanEck Emerging Markets Equity Strategy’s holdings since mid-2019. We believe WuXi’s growth runway extends far beyond the coronavirus.

Pivotal Role of CDDMOs in Structural Growth of Biologics

There are only three companies in the world that are capable of providing a full suite of CDDMO services – and WuXi Biologics is one of them. The structural growth in biopharma over the coming decade will be driven by disruptive innovations such as gene and cell therapies, immunotherapies, bispecific antibodies and antibody drug conjugates. Yet, the industry faces major challenges in the form of rising costs and increasing complexity involved in developing and manufacturing these next generation drugs. Eroom’s law, the observation that drug discovery is becoming slower and more expensive over time, despite improvements in technology, embodies this point nicely – i.e., the cost of developing a new drug doubles roughly every nine years.

CDDMOs represent a meaningful part of the solution as they provide cheaper, faster and, in many cases, more effective outsourcing alternatives for both large and small drug companies. Smaller biopharmas simply do not have the capital or expertise to discover, develop and manufacture next generation drugs all by themselves, while larger biopharmas are on an eternal quest to reduce capex and costs wherever possible. Outsourcing certain R&D functions and manufacturing can be an effective way of taking risk off their balance sheets and allowing for a more asset light approach that enhances ROIs.

In short, outsourcing saves these companies from spending hundreds of millions of dollars to build laboratories or manufacturing facilities before clinical efficacy and safety of a given drug has been proven.

Biologic CDDMO Subsector – An Oligopoly

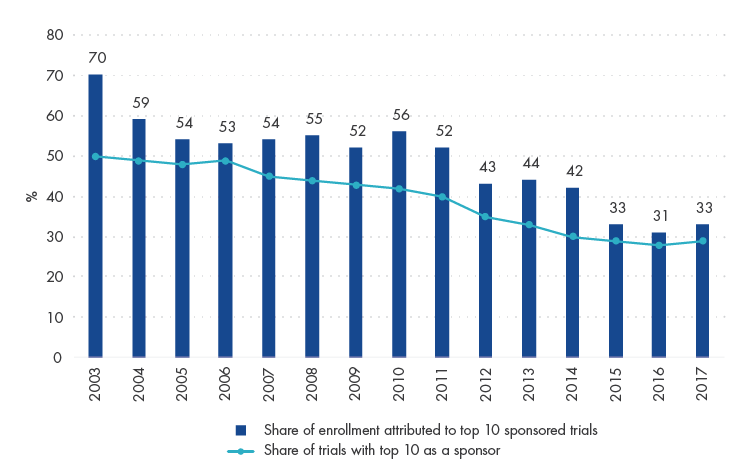

The CDDMO model is well-positioned, considering that growth in biopharma innovation and sales is becoming increasingly dominated by smaller players. The contribution of trials from the top 10 biopharma companies globally has declined from 50% to 27% from 2003 to 2017. In other words, smaller biopharma companies are the ones innovating and successfully converting R&D expenditure into commercially viable drugs.

Share of Trials and Patient Enrollment Contributed by Top 10 Biopharmas Globally

Source: Katarzyna Smietana et al (2019), Bernstein analysis.

There are high barriers to entry in this space, including:

- Strong teams of scientists with deep technical knowledge – Biologic CDDMOs require teams of scientists with multi-disciplinary capabilities.

- IP safe housing – Top CDDMOs handle core IPs such as DNA sequencing and cell banks for some of the most innovative biopharmas in the world. Security protocols must be in place to ensure this valuable IP is not lost at any stage of the development or manufacturing process.

- Regulatory hurdles – CDDMOs must be approved by the U.S. Food and Drug Administration (“FDA”) and European Medicines Agency (“EMA”) to be able to compete globally. Gaining approval is a drawn out process that typically takes five to seven years.

- Capital requirements – Large scale biopharma manufacturing facilities can easily cost north of $500m and can take four to five years to build. Not to mention expensive overheads from staff, equipment maintenance and power.

WuXi Biologics – China’s CDDMO Champion

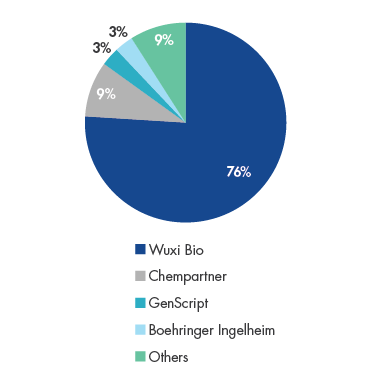

WuXi has emerged as China’s dominant CDDMO with over 75% market share. The company has a global footprint with the largest team of scientists among any of its peers at 2,000+ strong, resulting from their access to China’s deep talent pool of STEM1 graduates. One of the key value propositions to clients is their speed in developing biologics and bringing them to market. Since WuXi’s inception in 2014, 100% of client projects have been delivered, highlighting their execution prowess.

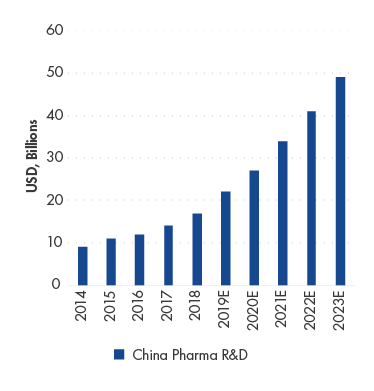

China Pharma Research & Development (“R&D”) spending CAGR is estimated to increase by 23.2% in 2018-2023 E

Source: F&S, Company Data, UBS.

Wuxi Bio’s China Biologics Outsourcing Market Share in 2018

Source: F&S, Company Data, UBS.

We often view our portfolio companies as partners, and WuXi is no exception. During the course of 2019, members of our Emerging Markets Equity Team engaged with WuXi’s company management several times, including a site visit to their headquarters in Shanghai. Our frequent engagements have allowed us to develop a deeper understanding of the company’s business activity and to build high conviction investment thesis for this name.

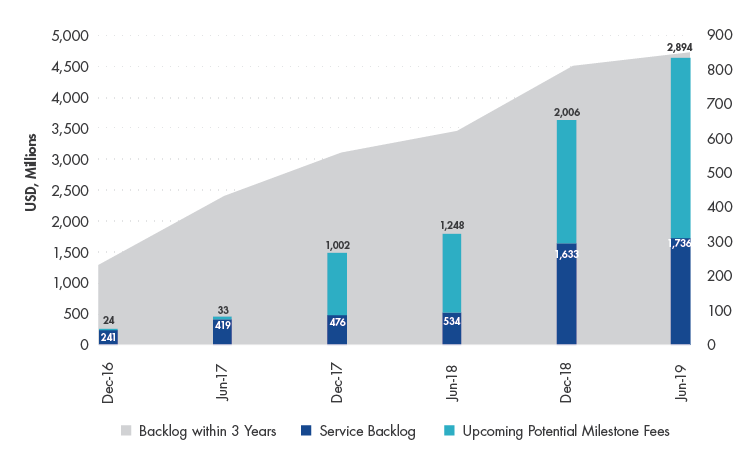

WuXi’s services are in extremely high demand. Not only is there backlog in orders ~10x greater than their full year revenue for 2019, the company is also growing at a faster pace, allowing for a high level of predictability when it comes to estimating its long-term growth trajectory. Despite WuXi’s seemingly lofty valuation, our Investment Team believes that WuXi is attractively valued. We model the company’s revenue increasing 10x before 2030 and, consequently, are comfortable taking a five+ year view.

WuXi's Backlog in Orders grew 159.8% between June 2018-2019

Source: Company Data.

WuXi Biologics can be viewed as a non-binary way of gaining exposure to the biopharma sector, as CDDMO stocks do not have the same level of volatility that is typically associated with biopharma globally – akin to an index.

Although the prospects for a COVID-19 vaccine are encouraging but uncertain, the long-term growth prospects for WuXi remain clear. The constantly evolving landscape of the pharmaceutical industry through CDDMOs as well as the individual expertise that WuXi provides relative to its peers speak to the strong structural growth trajectory of the company, independent of the potential development and launch of a vaccine.

WuXi Biologics, along with Ping An Good Doctor and BeiGene, are some of the stock names that further showcase our Investment Team’s extensive on-the-ground research, global perspective and level of company engagement that form the basis for the VanEck Emerging Market Equity Strategy’s approach to stock selection, allowing us to uncover exceptional growth companies in emerging market countries around the world.

1STEM is an educational program developed to prepare primary and secondary students for college and graduate study in the fields of science, technology, engineering, and mathematics (“STEM”).

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

08 January 2025

06 August 2024

23 July 2024

05 July 2024

29 May 2024