Reliance Industries’ Ecommerce Ambitions

18 May 2020

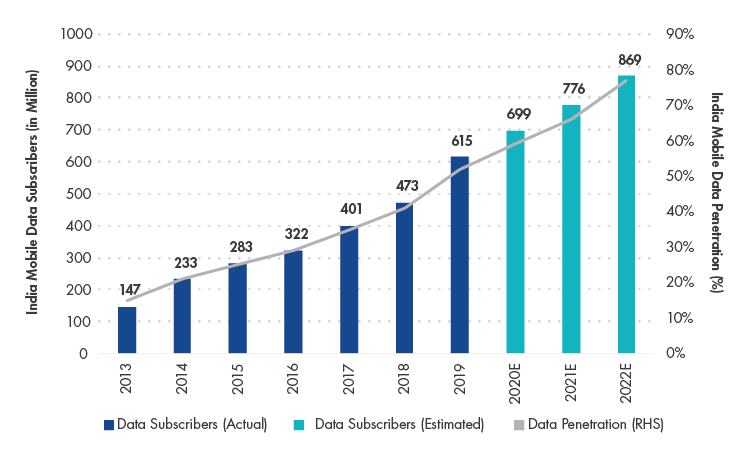

Digitization is taking place globally, with COVID-19 further accelerating this already visible and persistent long-term growth trend. Within digitization, emerging markets—India in particular—house the deepest pools of inefficiency, hosting some of the most exciting and fastest growing companies in the world. Indeed, mobile data penetration in India is estimated to increase to 77% by 2022.

India Mobile Data Penetration Is Estimated to Increase to 77% by 2022

Source: TRAI, Companies, CLSA. As of 29 April 2020.

On 22 April 2020, one of our portfolio companies, Reliance Industries (“RIL”) (1.01% of Strategy net assets as of 31/3/2020), a conglomerate and the largest privately held company in India, and Facebook signed an agreement, with Facebook agreeing to acquire a 9.99% stake in RIL’s wholly-owned subsidiary Jio Platforms (“Jio”) which owns the 4G and Internet businesses for the group. This makes Facebook the largest minority shareholder in the company. Immediately after, leading U.S. venture capital firms Silver Lake and Vista Equity Partners also bought a little over 3% of Jio between them.

Why should investors care? Because this is huge! We have talked about the VanEck Emerging Markets Equity Strategy, its forward-looking investment approach and how different we are from active competition and passive investing. Our investment in RIL further reiterates the Strategy’s forward-looking investment thesis, as emerging markets companies like RIL are front and center in digital disruption—they are likely to be the next generation Amazons, Googles and Apples of the world! Our CEO Jan van Eck also discussed this structural growth trend in his 2020 Market Outlook in the context of digitization in India.

These three important transactions play neatly into our original thesis from Q4 2018, according to which Reliance’s Jio was likely to quickly become India’s largest and, more importantly, lowest cost producer of mobile data. In addition, its dominant scale and pricing power would make it close to impossible to disrupt, in our view. This “customer acquisition funnel” would form the foundation for a dominant digital “platform” similar to Alibaba, Tencent and Amazon. We felt strongly that Reliance would first connect its digital customers not only to its vast retail network but also to any retailer who wanted to sell digitally. This would create a communication and fulfillment interface to dominate ecommerce in India.

The missing pieces of the original thesis were how Jio would create a “social home,” in a way that WeChat is to the Tencent ecosystem, where businesses and consumers could meet and transact and how it would interlink with the country’s B2B supply chain. Through our engagements with Reliance’s management team, we knew that they needed to “learn ecommerce.” These transactions answer the two outstanding questions and further solidify our conviction in the 2018 thesis.

The Reliance/Facebook partnership creates JioMart, an online-to-offline marketplace that connects kirana (small local merchant) stores to households through WhatsApp and where kirana act as the last mile delivery. These merchants operate mostly in the simple provision of groceries. As a category, grocery is an approximately $600B market, of which 80-90% is currently unorganized and operates in the cash economy that represents 70% of India’s overall retail economy. JioMart empowers kirana by bringing incremental customers and better control of the supply chain. JioMart also brings technology that helps to anticipate demand, manage inventory and accept digital payments. Reliance Retail is already the number one offline retailer and offers a wide selection of approximately 50,000 grocery products on JioMart. Reliance’s offline capabilities (approximately) 12,000 stores and 100 plus distribution centers and logistics hubs) make it a one-stop-shop for all kirana needs as a key sourcing partner. Simply put, Reliance, through JioMart, WhatsApp and Reliance Retail provides a full, back-end (sourcing, logistics and storage), as well as front-end, customer interface, together with fulfillment capabilities, and shares a “sticky” pool of approximately 650M customers with WhatsApp and the 4G network Reliance Jio.

This still leaves the question about acquiring complex ecommerce skills. That’s where the Silver Lake and Vista investments play an important role. Silver Lake understands ecommerce intimately through various portfolio investments, including Alibaba, and will provide know-how and execution capabilities in affiliation with WhatsApp and access to Facebook engineers. In addition, Vista’s global digital experience includes investments in ecommerce software services, cloud management, point of sale and online payments solutions for companies and should help to enhance Jio’s capabilities even further.

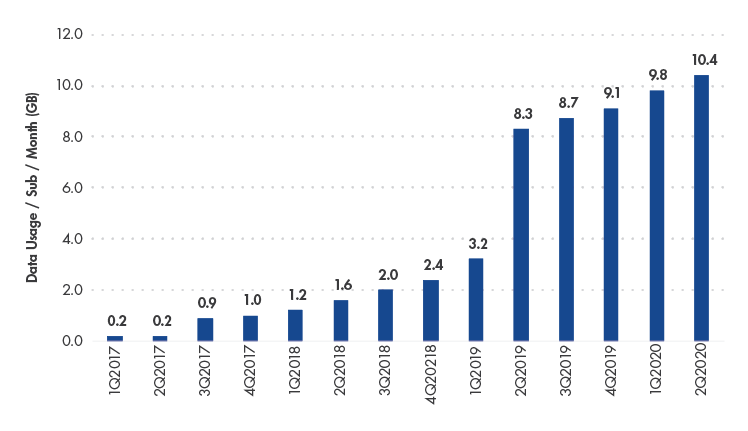

Consistent with Jan van Eck’s 2020 Market Outlook, we can now see swift digital transformation by businesses like Reliance Industries into ecommerce to react to changes in consumer behavior from offline to online. In our opinion, growing data usage acts as a good proxy for the growth potential of mobile data advertising and media monetization. The charts below show the astonishing growth of data consumption and growth in mobile payments.

Growing Data Usage Is a Good Proxy for the Growth Potential of Mobile Data Advertising and Media Monetization

Source: TRAI, CLSA, VanEck. As of 30 April 2020.

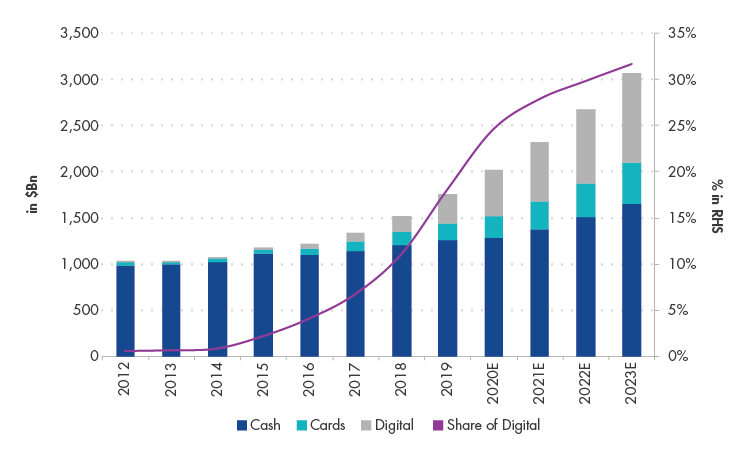

As per the below chart, mobile payments are estimated to represent over 30% of total countrywide transactions within the next three years.

Mobile Payments Are Estimated to Represent Over 30% of Total Transactions Within the Next Three Years

Source: VanEck, Credit Suisse, RBI. As of 30 April 2020.

We are witnessing the trend towards digitization not only in India but also across many other emerging markets countries. The global pandemic has accelerated growth in certain sectors and industries such as digital, ecommerce, data centers, telemedicine and video gaming, with disruption timelines likely shortening. These trend accelerations play well into our active Emerging Markets Equity Strategy, as, for many years now, we have been primarily focused on these areas of structural growth and invested in future digital winners across all market capitalizations.

Key Highlights—Reliance & Its Jio Platforms

We have been invested in Reliance since Q1 2019. Our high conviction call on Reliance is based on the premise that it will be the biggest winner in India’s evolving digital ecosystem. Its success will stem from the same characteristics that are visible and persistent in other dominant internet platform companies in our portfolio such as Tencent and Alibaba.

Jio is building a highly sticky and digitally connected customer base that will have high disruptive capabilities beyond both telecom and broadband. Reliance is leveraging, and will continue to leverage, Jio’s large user base to penetrate new verticals or entrench itself further into existing markets (Source: CLSA. As of 29/4/2020):

- Communication—Jio accounts for 80% of the industry’s data traffic with more than 340M users and is currently adding over 10M users per month.

- Payments Platform—Jio Payments Bank/Jio Money.

- Offline to Online Retail—12,000 stores and a host of online ecommerce portals.

- Entertainment Hub—Den/Hathaway and Reliance Entertainment. JioTV and JioMusic have more than 150M monthly active users. They are the third andfourth most used entertainment apps in India.

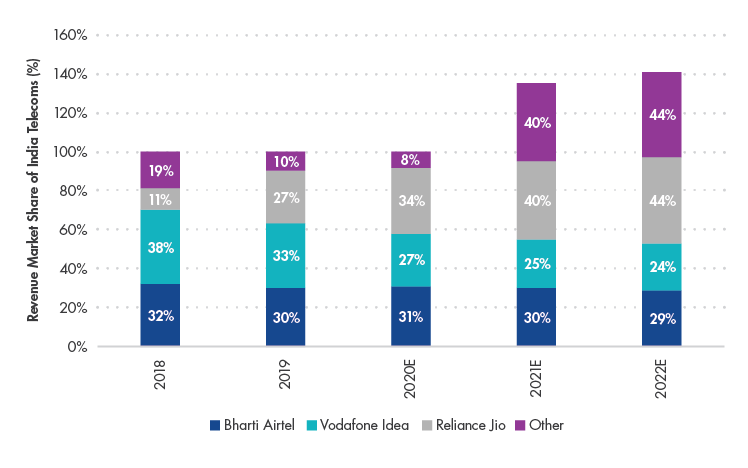

Implications for Telecom Business

Facebook’s messaging app WhatsApp and the potential for monetization are at the heart of this proposed deal with Jio. While Jio is the largest telecom player in India, its partnership with Facebook could potentially be a step towards deepening Jio’s presence in the digital ecosystem, particularly apps. Through its integration with WhatsApp, Jio may leverage its payment bank license and expand its presence in payments. Jio’s market share is expected to reach 44% by 2022.

Reliance Jio's Market Share Is Expected to Reach 44% by 2022

Source: TRAI, Goldman Sachs Investment Research. As of 5 May 2020.

Why Invest in Emerging Markets Equities Now?

Despite the challenging macro backdrop in India, volatile economy and unknown impact of COVID-19, we believe that Reliance trades at a multiple more closely linked to its historic and cyclical petrochemical past, rather than that of its potentially high structural growth digital future. At the same time, future earnings may be underestimated. Not only do we see a very bright future in retail and ecommerce but we are also optimistic about Reliance’s partnership with Microsoft, as it should help the company to build skills and dominate the Cloud in India (replicating Azure in the U.S.), as well as creating huge potential for growth in media and entertainment industries. We would expect that the next strategic partner to join the Reliance digital team might be a major global content provider, possibly leading to another exciting opportunity in the space.

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

08 January 2025

06 August 2024

23 July 2024

05 July 2024

29 May 2024