Nuclear Power Reimagined: Opportunities in Uranium

16 January 2025

Why Nuclear Energy Is on the Rise

Recent geopolitical and economic factors have made nuclear energy increasingly attractive. Being largely carbon-free and operational around the clock, nuclear power offers a stable and sustainable alternative to intermittent renewable energy sources like wind and solar. According to the International Atomic Energy Agency (IAEA), 59 nuclear reactors are currently under construction worldwide, with innovative small modular reactors (SMRs) leading the next phase of nuclear development.

Meanwhile, in the United States, major tech companies such as Microsoft and Amazon have signed long-term agreements to purchase nuclear-generated energy to meet the immense electricity demands of AI data centers and ensure low-carbon operations. In Europe, local governments extended the operational lives of 75 out of 109 reactors initially slated for decommissioning, further driving demand for uranium.

Number of Nuclear Reactors Under Construction by Country (2024)

Source: IAEA

Uranium Prices: A Barometer of Industry Demand

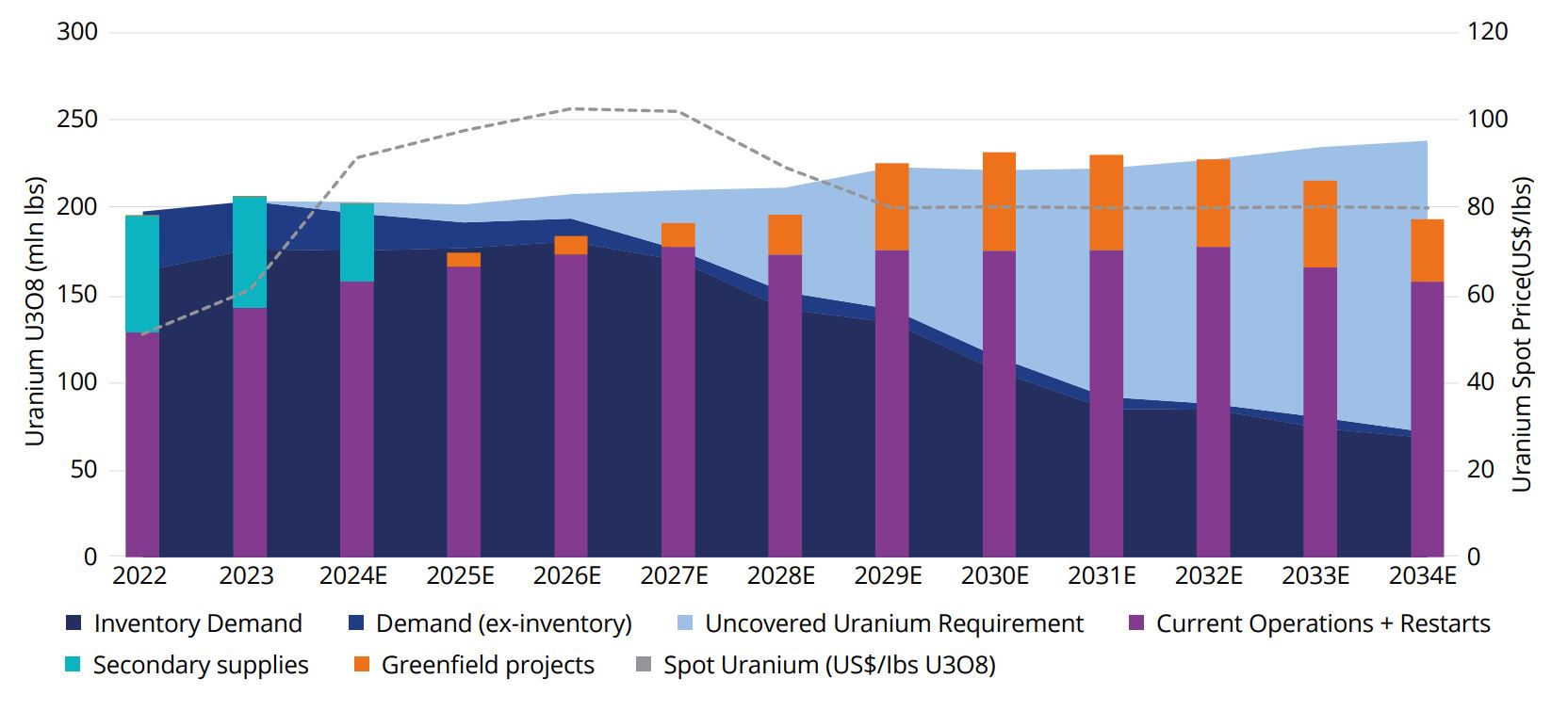

Uranium prices have surged in recent years, reflecting growing demand. Spot prices tripled from 2020 to late 2023 before stabilizing in 2024 at around $80/lb. Following the Fukushima disaster in 2011, uranium prices had experienced a significant decline, driven by global concerns and public sentiment against nuclear energy. However, since the early 2020s, renewed interest in nuclear power has sparked a recovery in prices.

Uranium Price Trends: Spot prices peaked at $100/lb post-2022, reflecting supply disruptions and demand surges.

Source: Cameco

Bridging the Supply Gap

Currently, global uranium demand outpaces primary mining supply. Secondary supplies, including stockpiles and inventories, have helped bridge this gap, but their availability is limited. Looking ahead, mothballed mines, such as Canada’s McArthur River Mine—the world’s largest high-grade uranium mine—are being reopened to address supply deficits. However, developing new mines remains a long-term endeavor, requiring 10–15 years of preparation.

Investment Opportunities in Uranium

The uranium sector’s revival has also reignited investor interest. Key avenues include:

- Uranium Mining Companies: Companies engaged in extraction and processing.

- ETFs: Exchange-traded funds, like VanEck’s Uranium and Nuclear Technologies ETF, which tracks the performance of global uranium miners and nuclear infrastructure companies.

- Physical Uranium Funds: Funds holding uranium as a tangible commodity.

Charting the growth of the sector, valuations of uranium mining companies have rallied significantly. The MarketVector™ Global Uranium and Nuclear Energy Infrastructure Index, a proxy for the industry, rose nearly 40% between February 2023 and October 2024. It is not possible to invest directly in an index and it might not be equivalent to the fund performance. You need to consider the long-term performance.

Nevertheless, the investor should take into account the risks associated with investing in a Nuclear ETF, that are: industry or sector concentration risk, liquidity risks and risk of investing in Natural resources companies.

Source: VanEck. Since Inception (03/02/2023). Performance is shown in USD. Past performance is not a guarantee of future results.

Fueling the Future: Uranium’s Strategic Importance

As nuclear power undergoes a renaissance, driven by technological advancements, geopolitical shifts, and increasing energy demands, uranium stands at the heart of this transformation. For investors, the sector presents compelling opportunities—from participating in the mining boom to investing in innovative technologies shaping the nuclear industry’s future. With global efforts to achieve net-zero emissions accelerating, nuclear energy and uranium are poised to play pivotal roles in the energy transition.

Supply and Demand Forecast (2024–2034): Despite efforts to ramp up Uranium production, a supply gap is expected to persist, emphasizing the need for greenfield projects to close the gap. Spot uranium prices are forecasted to remain elevated, reflecting sustained demand growth and constrained supply chains.

Source: Bloomberg, VanEck analysis. Historical performance is not indicative of future results.

This article is part of a more extensive Whitepaper – for more insight, see our Nuclear Investment publications.

IMPORTANT INFORMATION

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions. This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Uranium and Nuclear Technologies UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company incorporated under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

MarketVector™ Global Uranium and Nuclear Energy Infrastructure Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. It is not possible to invest directly in an index.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations. Investors must be aware that, due to market fluctuations and other factors, the performance of the ETFs may vary over time and should consider a medium/long-term perspective when evaluating the performance of ETFs.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

12 February 2025

07 February 2025

16 January 2025

16 January 2025

15 January 2025