Main Risk Factors of a Genomics ETF

The Fund’s assets may be concentrated in one or more particular sectors or industries. The Fund may be subject to the risk that economic, political or other conditions that have a negative effect on the relevant sectors or industries will negatively impact the Fund's performance to a greater extent than if the Fund’s assets were invested in a wider variety of sectors or industries.

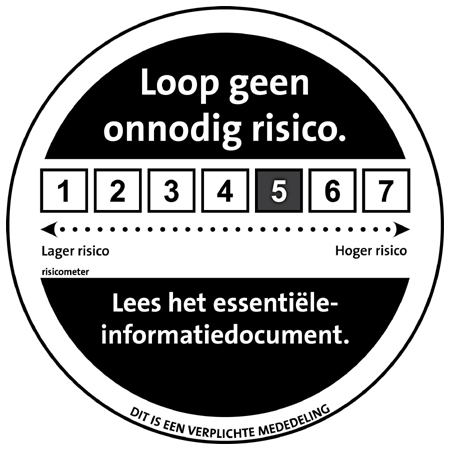

The prices of the securities in the Fund are subject to the risks associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.

Exists when a particular financial instrument is difficult to purchase or sell. If the relevant market is illiquid, it may not be possible to initiate a transaction or liquidate a position at an advantageous or reasonable price, or at all.