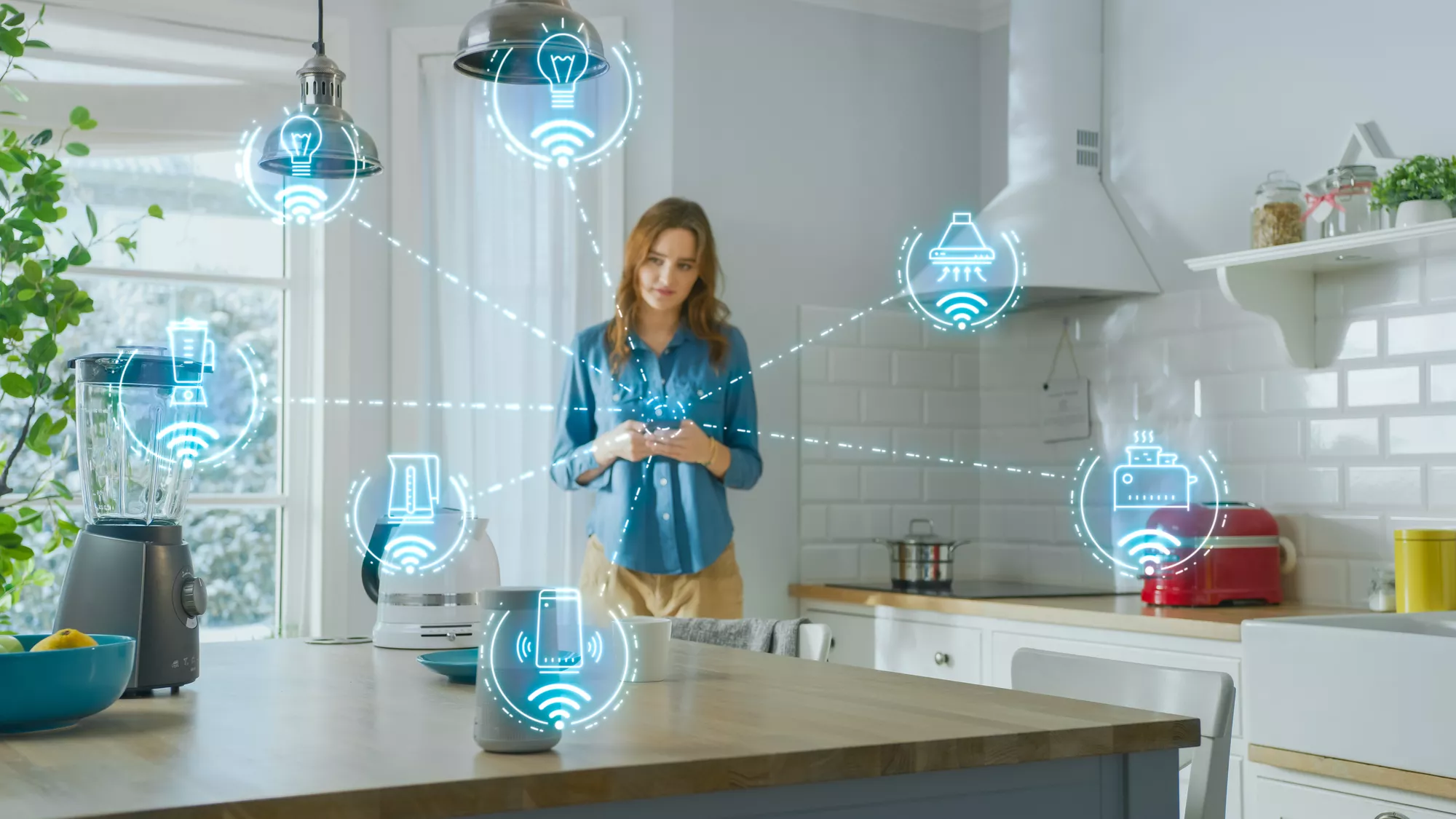

In its ultimate form, a smart home anticipates the needs of its residents. It empowers them to fine-tune their environment to their needs and activities (e.g. working, learning, entertaining, caring, shopping, etc.). Developments in the three areas of technology, consumer behavior and digital business models are supporting this evolution of the smart home, which is now accessible through VanEck's Smart Home ETF.

Smart Home ETF reinforces the evolution of smart home

- Technology: As the function of the home changes, and the house caters to more of our needs, smart technologies (smart grids, communication networks, smart appliances such as smart speakers) support these changes.

- Adapted Behavior: As consumers spend more time living digitally, the way they spend their time and money changes. They work from home, participate in digital entertainment (streaming, gaming) and turn to digital services (such as telehealth).

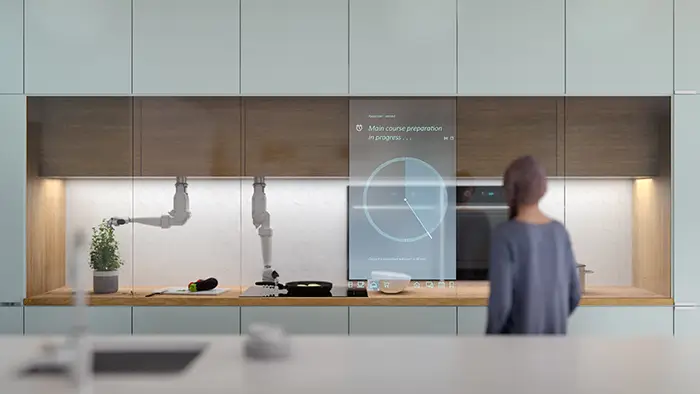

- New Business Models: Increasingly, companies are offering smart home services, using business models backed by digital technology. Products are delivered to the doorstep as part of a (subscription) service within a broader smart home ecosystem.