Main Risk Factors of a Solana ETN

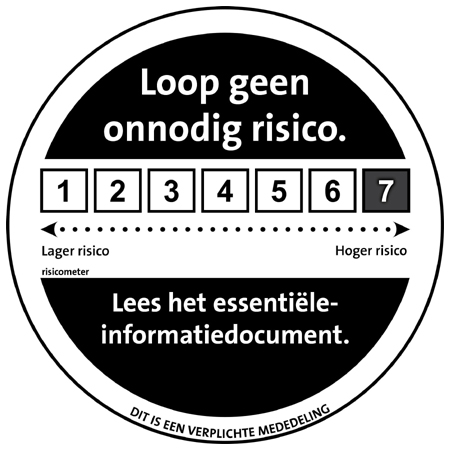

Despite all the hype, digital assets are a highly risky investment. Below are key risk factors that need to be considered before making an investment in Solana ETN.

The trading prices of many digital assets have experienced extreme volatility in recent periods and may well continue to do so. Digital assets were only introduced within the past decade and regulatory clarity remains elusive in many jurisdictions. Digital assets' value depends on such regulation remaining favorable, as well with the technological capabilities, the development of protocol networks, competition from other digital asset networks and from forks. Volatility can be strongly amplified by transactions from speculative investors, hedge funds and other large investors. You may experience losses if you need to sell your Shares at a time when the price of the underlying digital asset is lower than it was when you made your prior investment. Even if you are able to hold Shares for the long-term, your Shares may never generate a profit. This is a risk factor to consider when investing in a Solana ETN.

If the currency of the Product differs from the currency you invest in, your final return depends on the exchange rate between your investment currency and the currency of the Product. This is one of the factors to take into account when considering an investment in a Solana ETN.

Trading venues and systems used by market participants to trade the Digital Asset may be subject to hacking and could result in loss of the Product. That is another factor to take into account before investing in a Solana ETN.

As a later entrant, Solana may struggle if emerging regulation entrenches market position of current leaders or otherwise hinders new development. That is one of the risk factors to consider when investing in a Solana ETN.

If the network model doesn’t attract developers to build dApps and other blockchain projects, then SOL token price will likely struggle. That is another factor to take into consideration before making an investment in a Solana ETN.

Solana is still transitioning to a user-governed protocol and there is still uncertainty regarding the model. That is another factor to take into consideration before investing in Solana ETN.