Monthly Market Recap: 2025 is The Year of the Axe (or Maybe Just a Butter Knife)

January 16, 2025

Read Time 4 MIN

Buckle up. Making money in 2025 will be trickier than in 2024. Expect turbulence. And at the center of this brewing storm is one of the most polarizing government initiatives in years: the Department of Government Efficiency Commission (DOGE), spearheaded by none other than Elon Musk and Vivek Ramaswamy. Yes, DOGE isn’t just a meme coin anymore—it’s a federal task force with a $2 trillion axe aimed squarely at government bloat. In theory, I love it.

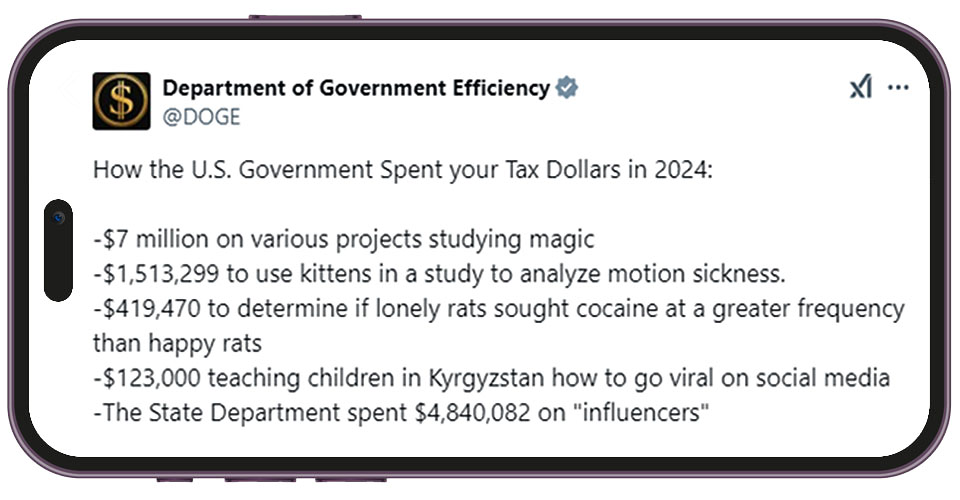

This DOGE post on X is a masterclass in highlighting just how absurd government spending can get:

Source: Twitter/X.

Recommended subscription

It's catchy, but here’s the rub: $2 trillion is about 25% of the federal budget. Cutting that much government spending isn’t just trimming fat—it’s amputating a limb from an economy reliant on government support.

Government spending accounts for a whopping one-third of U.S. GDP. If Department of Government Efficiency (DOGE) goes full Paul Bunyan on the budget, the economy could plunge into a deep recession. And here’s the kicker: recessions increase deficits because Uncle Sam loves printing money during hard times, which worsens inflation. It’s a vicious cycle, folks. This chart sums it up:

Recession Periods and Increase in the Deficit

| Recession Start | Increase in Deficit (%) |

| March 2001 | 6.20 |

| December 2007 | 8.80 |

| February 2020 | 13.20 |

| Average | 9.40 |

Source: VanEck, Federal Reserve Bank of St. Louis as of August 2024.

Sure, there’s plenty of waste to trim, but meaningful cuts would require political courage—a trait in chronically short supply in a system built on avoiding hard decisions. Unless President Trump decides to take one for the team and willingly spark a recession (spoiler: he won’t), these cuts are more bark than bite.

Market Review of December 2024

- Equities: Markets ended 2024 on a sour note. Rising 10-year Treasury yields, up from 4.17% to 4.57% in December, weighed on sentiment, leading the S&P 500 to decline 2.39%. Growth stocks were a bright spot, gaining 1.77%, while value stocks struggled, falling 6.57%. Small caps had an especially tough month, with the Russell 2000 dropping 8.26% as higher interest rates hit smaller businesses the hardest.

- Fixed Income: Higher rates battered bonds, with long-duration Treasuries plunging 6.16%. Credit spreads held steady, and high-yield bonds declined a mere 0.49%. Fixed income is expected to remain challenging space in 2025, offering income and diversification but requiring selectivity in a volatile environment.

- Real Assets: Real assets faced headwinds as oil prices fell amid easing geopolitical tensions and weakening Chinese demand. Gold dropped 1.40%, pressured by higher rates and a strong U.S. dollar. Rate-sensitive assets like REITs and infrastructure also struggled.

- Digital Assets: Bitcoin surged past $100k mid-month before settling at $93k, caught in a broader risk-off rotation as the Federal Reserve signaled fewer rate cuts.

Themes for 2025

1. Inflation’s Second Act:

- Inflation isn’t going anywhere—it’s entrenched, quietly reshaping the economy while policymakers argue over who left the door open.

- Rising yields will squeeze the economy, while excessive government debt keeps the inflation train chugging along.

- Any serious attempt to rein in spending? Forget it. The U.S. economy isn’t just living on fiscal support—it’s built an entire lifestyle around it.

- Expect another crisis within five years, followed by the Federal Reserve’s classic “print-and-pray” strategy, which will kick off another inflation wave.

2. Compounding Technological Advancements:

- We’re in a tech supercycle. Innovations like AI and machine learning are fueling productivity gains, and quantum computing potentially waiting in the wings.

- AI adoption will trickle down to small and medium businesses, boosting efficiency while creating volatility as Wall Street wrestles with reality versus hype. These swings will be buying opportunities for the bold.

3. Gradual Growth in Energy Demand:

- Energy demand is poised for steady growth, driven by the expansion of AI, machine learning, and a rising global middle class.

- Traditional energy sources like natural gas remain vital in the near term. They offer reliability, scalability, and lower emissions than coal.

- Over the medium to long term, nuclear power emerges as a compelling solution. With high energy output, zero emissions, and next-generation technology advancements, it offers economic stability and energy independence.

- However, the pace of nuclear adoption may frustrate investors in the short term, creating periodic volatility—but these periods could present attractive entry points for long-term investors.

Playbook in Action for 2025

Navigating 2025 requires a balanced and thoughtful approach across asset classes:

- Equities provide growth opportunities through innovation, particularly in AI. While market volatility is expected, it offers disciplined investors the chance to capitalize on disruption-led growth.

- Real Assets are essential for stability and inflation protection. Gold stands out as both an inflation hedge and a volatility dampener, while natural gas and other traditional energy sources remain critical in meeting immediate energy demands. These assets bridge the gap as investments in nuclear energy—a long-term solution for reliable, zero-emission power—gain momentum.

- Digital Assets like Bitcoin complement traditional real assets, offering a modern hedge against monetary instability and diversification in an increasingly digitized economy. While volatile, Bitcoin’s growing acceptance and institutional adoption reinforce its role in forward-thinking portfolios.

- Fixed Income provides limited excitement in 2025. While nominal yields are attractive, real yields are modest, and a rising rate environment creates challenges. Bonds remain valuable for income generation and diversification in a volatile market.

Final Thoughts

The 2025 investment landscape is defined by innovation, inflation, and energy transitions. Success will depend on allocating capital across these themes to capture growth, preserve value, and build resilience for the future.

To receive more Model Portfolio insights, sign up in our subscription center.

Follow Us

Important Disclosures

Bitcoin (BTC) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included in this blog.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

S&P 500 Index consists of 500 widely held common stocks covering industrial, utility, financial and transportation sector. Russell 2000 Index tracks the small-cap U.S. stock market. MSCI Emerging Markets Index tracks large and mid-cap representation across emerging markets countries. MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. Bloomberg Barclays U.S. Aggregate Bond Index is a broad–based benchmark that measures the investment grade, U.S. dollar–denominated, fixed–rate taxable bond market. The index includes Treasuries, government–related and corporate securities, MBS (agency fixed–rate and hybrid ARM pass–throughs), ABS and CMBS (agency and non–agency). MSCI EAFE Index is an equity index which captures large and mid cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager, or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

There are inherent risks with fixed income investing. These risks may include interest rate, call, credit, market, inflation, government policy, liquidity, or junk bond. When interest rates rise, bond prices fall. This risk is heightened with investments in longer duration fixed-income securities and during periods when prevailing interest rates are low or negative.

Investments in commodities can be very volatile and direct investment in these markets can be very risky, especially for inexperienced investors.

Gold investments are subject to the risks associated with concentrating its assets in the gold industry, which can be significantly affected by international economic, monetary and political developments. Investments in gold may decline in value due to developments specific to the gold industry. Foreign gold security investments involve risks related to adverse political and economic developments unique to a country or a region, currency fluctuations or controls, and the possibility of arbitrary action by foreign governments, or political, economic or social instability. Gold investments are subject to risks associated with investments in U.S. and non-U.S. issuers, commodities and commodity-linked derivatives, commodities and commodity-linked derivatives tax, gold-mining industry, derivatives, emerging market securities, foreign currency transactions, foreign securities, other investment companies, management, market, non-diversification, operational, regulatory, small- and medium-capitalization companies and subsidiary risks.

Digital asset investments are subject to significant risk and may not be suitable for all investors. Digital asset prices are highly volatile, and the value of digital assets, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.

Intelligently-designed exposure across asset classes for diversified portfolios

Important Disclosures

Bitcoin (BTC) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included in this blog.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

S&P 500 Index consists of 500 widely held common stocks covering industrial, utility, financial and transportation sector. Russell 2000 Index tracks the small-cap U.S. stock market. MSCI Emerging Markets Index tracks large and mid-cap representation across emerging markets countries. MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. Bloomberg Barclays U.S. Aggregate Bond Index is a broad–based benchmark that measures the investment grade, U.S. dollar–denominated, fixed–rate taxable bond market. The index includes Treasuries, government–related and corporate securities, MBS (agency fixed–rate and hybrid ARM pass–throughs), ABS and CMBS (agency and non–agency). MSCI EAFE Index is an equity index which captures large and mid cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager, or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

There are inherent risks with fixed income investing. These risks may include interest rate, call, credit, market, inflation, government policy, liquidity, or junk bond. When interest rates rise, bond prices fall. This risk is heightened with investments in longer duration fixed-income securities and during periods when prevailing interest rates are low or negative.

Investments in commodities can be very volatile and direct investment in these markets can be very risky, especially for inexperienced investors.

Gold investments are subject to the risks associated with concentrating its assets in the gold industry, which can be significantly affected by international economic, monetary and political developments. Investments in gold may decline in value due to developments specific to the gold industry. Foreign gold security investments involve risks related to adverse political and economic developments unique to a country or a region, currency fluctuations or controls, and the possibility of arbitrary action by foreign governments, or political, economic or social instability. Gold investments are subject to risks associated with investments in U.S. and non-U.S. issuers, commodities and commodity-linked derivatives, commodities and commodity-linked derivatives tax, gold-mining industry, derivatives, emerging market securities, foreign currency transactions, foreign securities, other investment companies, management, market, non-diversification, operational, regulatory, small- and medium-capitalization companies and subsidiary risks.

Digital asset investments are subject to significant risk and may not be suitable for all investors. Digital asset prices are highly volatile, and the value of digital assets, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

© Van Eck Associates Corporation.