Junior Gold Miners ETF

VanEck Junior Gold Miners UCITS ETF

Junior Gold Miners ETF

VanEck Junior Gold Miners UCITS ETF

Fund Description

VanEck Junior Gold Miners UCITS ETF invests in the stocks of small gold miners, some of which are in the early stages of exploration. Junior gold miners bring on new supply and are prime beneficiaries of rising gold demand. Typically they have greater sensitivity to underlying gold price movements than more established, senior gold mining companies.

-

NAV$38.44

as of 04 Jul 2024 -

YTD RETURNS14.90%

as of 04 Jul 2024 -

Total Net Assets$436.3 million

as of 04 Jul 2024 -

Total Expense Ratio0.55%

-

Inception Date25 Mar 2015

-

SFDR ClassificationArticle 6

Overview

Fund Description

VanEck Junior Gold Miners UCITS ETF invests in the stocks of small gold miners, some of which are in the early stages of exploration. Junior gold miners bring on new supply and are prime beneficiaries of rising gold demand. Typically they have greater sensitivity to underlying gold price movements than more established, senior gold mining companies.

- Potential for additional upside as premium takeover targets for larger producers

- Ideal complement to more traditional gold or gold equity allocations

- Only ETF in Europe providing exposure to junior gold miners

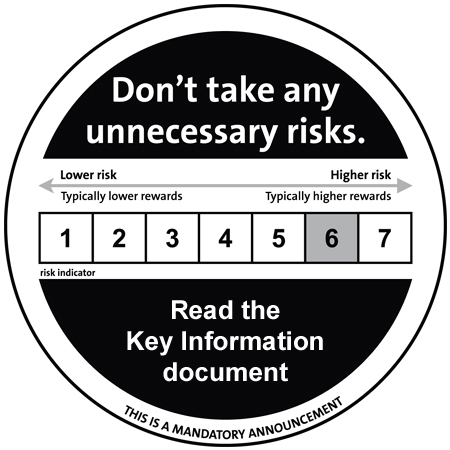

Risk Factors: Risk of investing in natural resources companies, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS Global Junior Gold Miners Index (MVGDXJTR)

Fund Highlights

- Potential for additional upside as premium takeover targets for larger producers

- Ideal complement to more traditional gold or gold equity allocations

- Only ETF in Europe providing exposure to junior gold miners

Risk Factors: Risk of investing in natural resources companies, industry or sector concentration risk, risk of investing in smaller companies. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS Global Junior Gold Miners Index (MVGDXJTR)

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Literature

Index

Index Description

MVIS Global Junior Gold Miners Index is a pure-play, global index, tracking the performance of the most liquid junior companies in the global gold and silver mining industry that generate or intend to generate at least 50% of their revenues from this sector.

Index Key Points

Underlying Index

MVIS Global Junior Gold Miners Index (MVGDXJTR)

Pure Play

Index constituents have to generate at least 50% of their revenues from global gold and silver mining.

Liquid

Demanding liquidity criteria are applied when potential index companies are selected.

Diversified

Capping factors guarantee well-balanced and diversified index exposure, thus preventing large companies from dominating an index

Transparent

Full methodology details, selection and review processes as well as realtime index values and weightings are disclosed on www.mvis-indices.com.