Fund Description

The VanEck Morningstar US ESG Wide Moat UCITS ETF invests in US equities with long-term competitive advantages and an attractive valuation.

- Strategy based on a proven and transparent indexing model from Morningstar, the renowned research partner

- Companies with long-term competitive advantages for 20 years or longer (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Based on the concept of economic “Moat“s, a term first coined by Warren Buffett

- Targets companies trading at attractive prices relative to Morningstar’s estimate of fair value

- Excludes companies deriving revenues from Controversial Weapons, Civilian Firearms and Thermal Coal as defined by Sustainalytics

- Screens out companies with higher levels of ESG related risks according to Sustainalytics Estimates

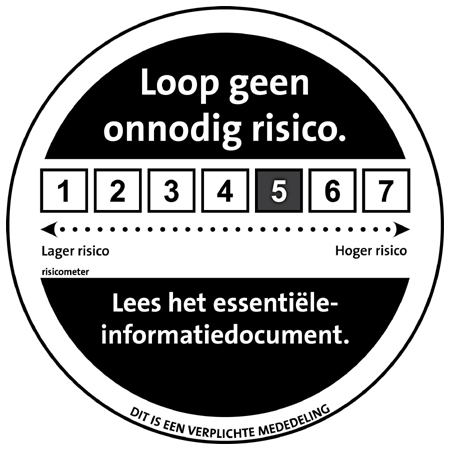

Main Risk Factors: Equity market risk, limited diversification risk. Please refer to the

KID

and the Prospectus for other important information before investing.

As part of its efforts to increase VanEck’s ESG footprint, VanEck Morningstar US ESG Wide Moat UCITS ETF (“the Fund”) changed its underlying index to Morningstar US Sustainability Moat Focus Index that incorporates ESG considerations in the index selection, effective 17 December 2021 EOD. Prior to that, the Fund was called VanEck Morningstar US ESG Wide Moat UCITS ETF and was following Morningstar Wide Moat Focus Index. The new index exhibits improved ESG characteristics1, as well as superior risk-return statistics2. For further details on the Fund and its Index, please see the Index Transition Communication on the Documents page of the Fund.

1Source: Morningstar, Sustainalytics as of 6 October 2021.

2Source: Morningstar, Bloomberg as of 31 October 2021. Returns are calculated in USD on a Net Return basis. The data before 11 February 2021 reflects backtested strategy returns. Past performance is not indicative of future results.

Underlying Index

Morningstar US Sustainability Moat Focus Index (MSUSSMNU)