What Trump's Presidency Will Mean for Bitcoin

16 January 2025

Trump's presidency could redefine Bitcoin's future with policies on mining, regulation, and a federal reserve. Learn what this means for investors.

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Trump's presidency could redefine Bitcoin's future with policies on mining, regulation, and a federal reserve. Learn what this means for investors.

The reelection of Donald Trump as President of the United States marks a pivotal moment for the cryptocurrency landscape, particularly Bitcoin. With Trump's administration signaling shifts in regulatory priorities, market sentiment, and economic strategies, investors and enthusiasts are bracing for what could be a transformative period. Below, we explore the implications of Trump's presidency for Bitcoin.

Trump's Evolving Stance on Bitcoin

Historically, Trump's views on Bitcoin have ranged from skepticism to cautious optimism. While he once called Bitcoin a threat to the U.S. dollar, recent statements indicate a more nuanced perspective. At the Nashville Bitcoin Conference, Trump floated the idea of creating a federal Bitcoin reserve— but stopped short of proposing any government backed Bitcoin reserve or purchasing additional assets beyond those seized by law enforcement. His administration's pro-business ethos suggests a potential reduction in regulatory friction, fostering a more favorable environment for cryptocurrency innovation.

This shift aligns with recent market movements, where Trump's reelection triggered a surge in memecoins in November 2024, reflecting renewed investor confidence. His pro-crypto cabinet appointments have further fueled optimism about Bitcoin's future in a regulatory-friendly environment.

Regulatory Clarity: A Double-Edged Sword

Trump's presidency could bring significant regulatory changes. Key appointments, such as the newly appointed SEC Chair Paul Atkins, known for his deregulatory stance, may end the "regulation by enforcement" era. This shift could benefit Bitcoin by increasing clarity for institutional investors. However, with greater adoption and legitimization may come heightened scrutiny. Proposed tax reforms and updated reporting requirements for crypto transactions could add complexity for individual investors.

Several ongoing judicial and legislative developments may support mainstream crypto adoption. The U.S. Appeals Court's ruling to overturn Tornado Cash's OFAC sanctions sets a legal precedent for how immutable smart contracts are treated, distinguishing them as non-ownable, uncontrollable, and not considered "property" under OFAC's definitions. On the legislative side, policies like SAB 121—which restricts banks from holding crypto assets off-balance-sheet—are likely to be repealed within a quarter. Furthermore, reworked stablecoin regulations under Sen. Hagerty's Clarity for Payment Stablecoins Act could pave the way for more privacy-friendly versions, enabling state-chartered banks to issue stablecoins without requiring Federal Reserve approval.

In addition, the executive branch's pro-crypto stance under Trump's leadership brings opportunities for growth. Key figures such as Secretary of the Treasury Scott Bessent have publicly stated that "everything is on the table with Bitcoin," while other prominent cabinet members actively hold crypto assets, signaling alignment with the industry's growth potential. Regulatory developments supporting Ethereum and Solana ETPs in 2025 could also enhance liquidity and attract institutional capital to decentralized applications.

Furthermore, the Trump administration has already issued an executive order titled “Strengthening American Leadership in Digital Financial Technology” (“Executive Order”) on 23 January 2025. This order establishes the President’s Working Group on Digital Asset Markets, tasked with developing a federal regulatory framework for digital assets and exploring the potential creation of a national digital asset stockpile. While details on implementation remain unclear, this marks a significant policy shift toward integrating digital assets into national economic strategies.

By issuing these executive orders, Trump's administration aims to position the United States as a global leader in cryptocurrency and blockchain innovation, sending a strong signal to both institutional investors and industry stakeholders.

Economic Policies and Bitcoin’s Market Dynamics

Trump's economic strategies—characterized by fiscal stimulus and trade realignments—could indirectly influence Bitcoin's trajectory. As government spending rises, concerns about inflation and dollar devaluation may push investors toward Bitcoin as a hedge. Historical trends reveal Bitcoin's correlation with political and economic uncertainty, suggesting a potential price surge in the face of these dynamics.

Moreover, Trump's support for domestic energy production aligns with the interests of Bitcoin miners. By encouraging fossil fuel and nuclear energy use, his administration could lower operational costs for U.S.-based mining operations, solidifying America's position as a global mining leader. Additionally, the possibility of regulatory clarity boosting institutional interest may propel Bitcoin adoption even further.

The Vision of a Federal Bitcoin Reserve

One of the most intriguing possibilities under Trump's presidency is establishing a federal Bitcoin reserve. While influential figures like Senator Cynthia Lummis have proposed such a concept, there is currently no official move from the administration to pursue it. However, the recent Executive Order has introduced the idea of a national digital asset stockpile, which could potentially include Bitcoin as part of its reserves.. Advocates argue that this move could solidify Bitcoin's role as a strategic reserve asset, similar to gold. While ambitious, such a plan would face logistical and political challenges, including global market reactions and potential accusations of dollar manipulation.

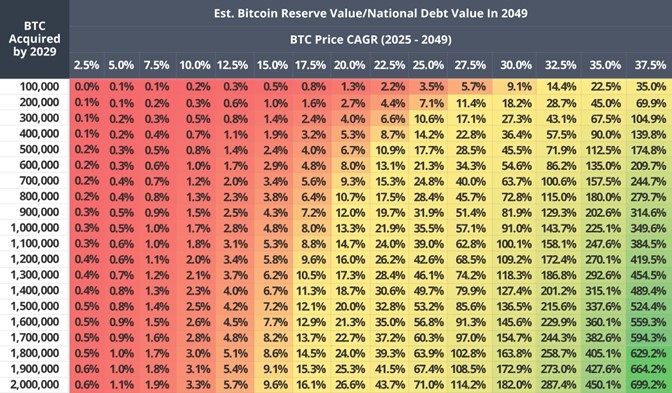

We highlight that if the U.S. Treasury were to acquire Bitcoin as part of its digital assets stockpile, this may have an impact to offset national debt significantly. According to projections, if the U.S. acquires 1 million BTC by 2029 and Bitcoin grows at a compound annual growth rate (CAGR) of 25%, Bitcoin could represent 35.5% of the national debt by 2049. This strategy assumes Bitcoin acquisition at $200,000 per coin and a deceleration of debt growth from its recent CAGR of 7% to 5%. Emphasizing this assumption ensures transparency in the calculation methodology. However, it is crucial to clarify that these projections are purely theoretical and do not reflect current policy decisions.

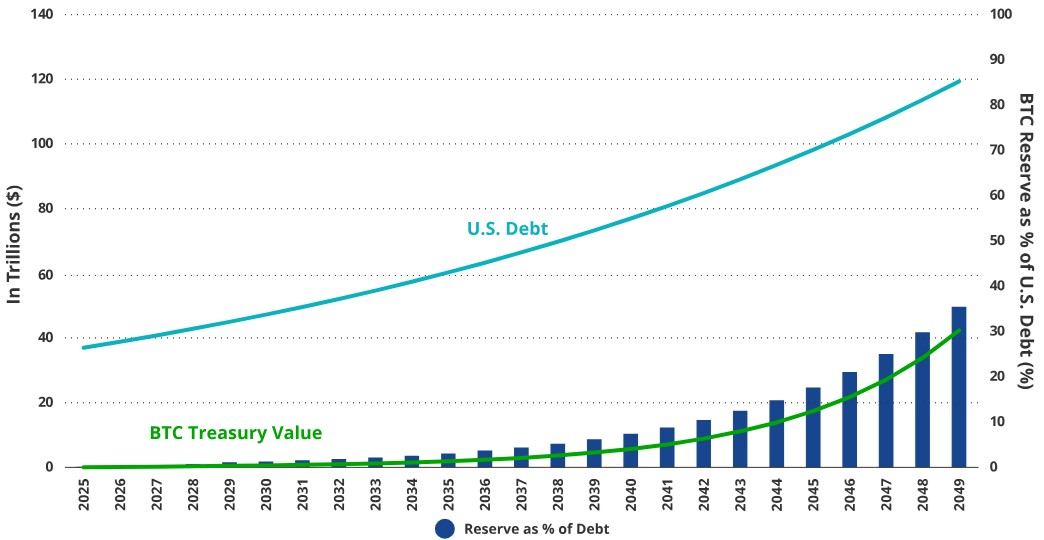

In a more optimistic scenario, with Bitcoin's value reaching $42 million per coin by 2049, a U.S. Bitcoin reserve could represent 36% of the projected $119 trillion national debt. Such a reserve would also comprise 18% of global financial assets, demonstrating Bitcoin's increasing importance in global finance. The accompanying graph highlights the trajectory of the U.S. national debt versus Bitcoin's reserve value, underscoring the substantial fiscal benefits this strategy could offer.

Bitcoin Reserve Value Vs. U.S. National Debt in 2049

Est. U.S. Debt vs BTC Reserve Growth

Source: VanEck research as of December 2024. Past performance is no guarantee of future results. Any information, valuation scenarios, or price targets/projections presented on Bitcoin are not intended as financial advice, a recommendation to buy or sell Bitcoin, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance of Bitcoin; actual future performance is unknown and may differ significantly from the projections herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, are for illustrative purposes only, and are those of the author(s), but not necessarily those of VanEck or its other employees. Please conduct your own research and draw your own conclusions.

Investor Strategies in the Trump Era

For Bitcoin investors, Trump's presidency presents both opportunities and risks. Key strategies to consider include:

- Hedging Against Volatility: As Bitcoin reacts to macroeconomic shifts, maintaining a diversified portfolio with measured Bitcoin exposure can mitigate risks.

- Mining Investments: Investors may explore opportunities in Bitcoin mining operations, particularly in regions benefiting from favorable energy policies.

- Monitoring Regulatory Developments: Staying informed about changes in crypto tax laws and reporting requirements will be crucial for compliance and optimization.

- Tracking Market Sentiment: As we highlighted in our 2025 crypto predictions piece, monitoring metrics like search trends, app rankings, and institutional flows can provide critical insights into market dynamics.

A Balanced Outlook

Trump’s presidency introduces a complex mix of potential catalysts and headwinds for Bitcoin. While pro-business policies and regulatory clarity could drive adoption, the associated risks of centralization and overregulation remain. Bitcoin’s decentralized ethos will continue to be tested as it navigates this new political era.

The Trump administration may prioritize U.S. leadership in blockchain technology, potentially leveraging public-private partnerships to accelerate innovation in the sector.

For investors, the key lies in balancing optimism with caution. By understanding the broader implications of Trump’s policies, preparing for market volatility, and leveraging insights from industry leaders, Bitcoin holders can position themselves to thrive in this evolving landscape.

Links to third party websites are provided as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. By clicking on the link to a non-VanEck webpage, you acknowledge that you are entering a third-party website subject to its own terms and conditions. VanEck disclaims responsibility for content, legality of access or suitability of the third-party websites.

To receive more Digital Assets insights, sign up to our Newsletter.

Important information

For informational and advertising purposes only.

This information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck assumes no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

14 March 2025

27 November 2024

05 November 2024

11 October 2024