Semiconductor ETF

VanEck Semiconductor UCITS ETF

Semiconductor ETF

VanEck Semiconductor UCITS ETF

Fund Description

Electrify your portfolio with the VanEck Semiconductor UCITS ETF. Semiconductors are at the heart of today’s tech revolution, yet just a small number of companies make them. Invest in the companies involved in semiconductor production and equipment.

-

NAV$41.82

as of 19 Sep 2024 -

YTD RETURNS25.27%

as of 19 Sep 2024 -

Total Net Assets$2.5 billion

as of 19 Sep 2024 -

Total Expense Ratio0.35%

-

Inception Date01 Dec 2020

-

SFDR ClassificationArticle 8

Overview

Fund Description

Electrify your portfolio with the VanEck Semiconductor UCITS ETF. Semiconductors are at the heart of today’s tech revolution, yet just a small number of companies make them. Invest in the companies involved in semiconductor production and equipment.

- Benefit from the digital revolution

- Europe’s first semiconductor ETF

- Pure play semiconductor stocks, i.e. companies that derive at least 50% of revenues from semiconductors or related activities

- Highly liquid semiconductor stocks, based on market capitalization and trading volume

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.

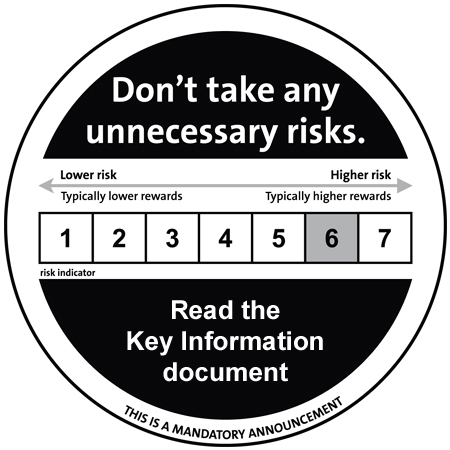

Risk Factors: Liquidity risks, equity market risk, foreign currency risk, risk of investing in the IT industry, industry or sector concentration risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS US Listed Semiconductor 10% Capped ESG Index

Fund Highlights

- Benefit from the digital revolution

- Europe’s first semiconductor ETF

- Pure play semiconductor stocks, i.e. companies that derive at least 50% of revenues from semiconductors or related activities

- Highly liquid semiconductor stocks, based on market capitalization and trading volume

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.

Risk Factors: Liquidity risks, equity market risk, foreign currency risk, risk of investing in the IT industry, industry or sector concentration risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS US Listed Semiconductor 10% Capped ESG Index

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Literature

Index

Index Description

The MVIS® US Listed Semiconductor 10% Capped ESG Index tracks the overall performance of companies involved in semiconductor production and equipment.

Index Key Points

Underlying Index

MVIS® US Listed Semiconductor 10% Capped ESG Index (MVSMCTR)

Index Composition

The modified market cap-weighted index tracks the performance of the largest and most liquid US-listed companies that derive at least 50% of their revenues from semiconductors. The pure-play index contains only companies which are engaged primarily in the production of semiconductors and semiconductor equipment.

Companies initially eligible for inclusion in Index

- Principally engaged in the semiconductor industry, deriving greater than 50% of revenues from it

- Market cap exceeding $150 million

- Three-month average daily turnover greater than $1 million

- Minimum trading volume of 250,000 shares each month over last 6 months

- Individual company weights are capped at 10%

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.