Semis Drive New Tech Advances

November 02, 2020

Read Time 2 MIN

Semiconductors, also referred to as semis or chips, are used in an extensive range of products in computing, telecommunications, gaming, transportation, military systems, clean energy and healthcare. They are the brains of modern electronics and the drivers of technological innovation. Over the past decade, semis have also been the drivers of the broader technology sector’s upside and the beneficiaries of evolving sources of demand. As future technologies arise, such as the cloud, the internet of things (IoT), artificial intelligence (AI), virtual reality (VR), autonomous driving, wearables, smart technology, drones and advanced wireless networks (5G), we are bullish on the future of the semiconductor industry.

In a risk-off market, indiscriminate selling often fuels share price volatility. Semis were among the stocks hit hardest during the COVID-19 selloff this past March; however, most chip stocks have made a resilient comeback. This is potentially good news for semiconductor stocks and investors seeking outsized returns in what many anticipate to be a challenging and unpredictable market over the near-term.

The global pandemic and ensuing stay-at-home trends are boosting the demand and adoption of products that use chips. For example, certain semiconductor companies, such as Advanced Micro Devices, Inc. (AMD) and Nvidia Corp. (NVDA), are significant players in the booming global video gaming and eSports industry, too.† These chip makers develop and manufacture semiconductor chips that define the graphic experience of the player and are crucial to the gameplay experience.

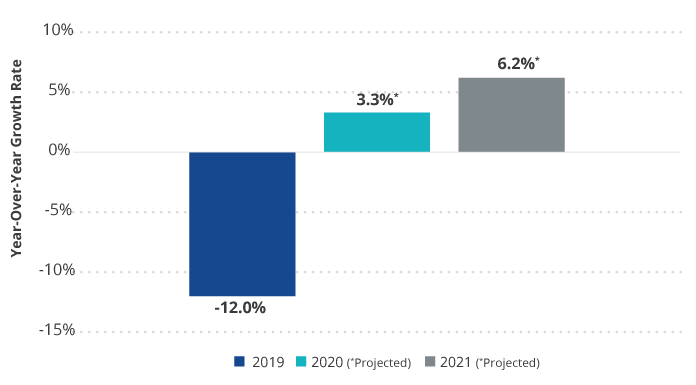

Global Semiconductor Industry Revenue Growth

Source: World Semiconductor Trade Statistics. As of 6/9/2020. Past performance is not a guarantee of future results.*Indicates World Semiconductor Trade Statistics’ forecasted growth.

During periods of high demand, upturns occur and tight supply, or even shortages, lead to higher prices and revenue growth. According to the World Semiconductor Trade Statistics, it is expected that worldwide semiconductor sales will grow by 3.3% this year, totaling $426 billion dollars, and by 6.2% in 2021.

This dynamic industry is expected to continue to grow and innovate as technology becomes more and more pervasive in everyday life. Investors seeking to benefit from this technological acceleration and proliferation can gain exposure to this space through semiconductor exchange-traded funds (ETFs). ETFs can help reduce individual stock risk by providing broad access to a basket of companies, but investors should pay attention to how these baskets are constructed.

VanEck Semiconductor ETF (SMH) seeks to replicate the performance of the MVIS® US Listed Semiconductor 25 Index, which is comprised of the 25 largest and highly liquid U.S. listed semiconductor companies. SMH is a pure-play semiconductor industry ETF, meaning that each company must generate at least 50% of their revenues from the production of semiconductors and/or semiconductor equipment. This fund may be suitable for a variety of investors looking for nuanced tech exposure, either as a long-term strategic holding, or as a short-term tactical approach on our new work-from-home reality.

Follow Us

IMPORTANT DISCLOSURES

† As of October 28, 2020, VanEck Vectors® Semiconductor ETF (SMH®) holds AMD at 4.43% of total Fund net assets and NVDA at 7.73% of total Fund net assets.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/smh/holdings/.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors Semiconductor ETF (SMH) may be subject to risks which include, among others, investing in the semiconductor industry, equity securities, information technology sector, foreign securities, foreign currency, depositary receipts, medium-capitalization companies, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

IMPORTANT DISCLOSURES

† As of October 28, 2020, VanEck Vectors® Semiconductor ETF (SMH®) holds AMD at 4.43% of total Fund net assets and NVDA at 7.73% of total Fund net assets.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in the ETF, please click here: https://www.vaneck.com/etf/equity/smh/holdings/.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the VanEck Vectors Semiconductor ETF (SMH) may be subject to risks which include, among others, investing in the semiconductor industry, equity securities, information technology sector, foreign securities, foreign currency, depositary receipts, medium-capitalization companies, issuer-specific changes, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund's returns. Medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.