Smart Homes for Thrifty Households

13 December 2022

Share with a Friend

All fields required where indicated (*)Faced with higher costs of living, households are employing smart home solutions to become more resilient and cut costs. As the gap between in-home and out-of-home experiences becomes easier to bridge, more saving opportunities emerge. For instance, with a home theater and a restaurant-quality homemade meal, we will likely become more selective about our out-of-home activities, saving them for valuable experiences we cannot do at home (yet).

People are struggling

Last October, big data firm IRI found that nearly three-quarters of European consumers are cutting back spending on everyday items.1 Almost two thirds have cut down on essentials (for example by missing meals or reducing heating), with a third using their personal savings or taking out loans to pay bills.

People are spending less on non-essentials

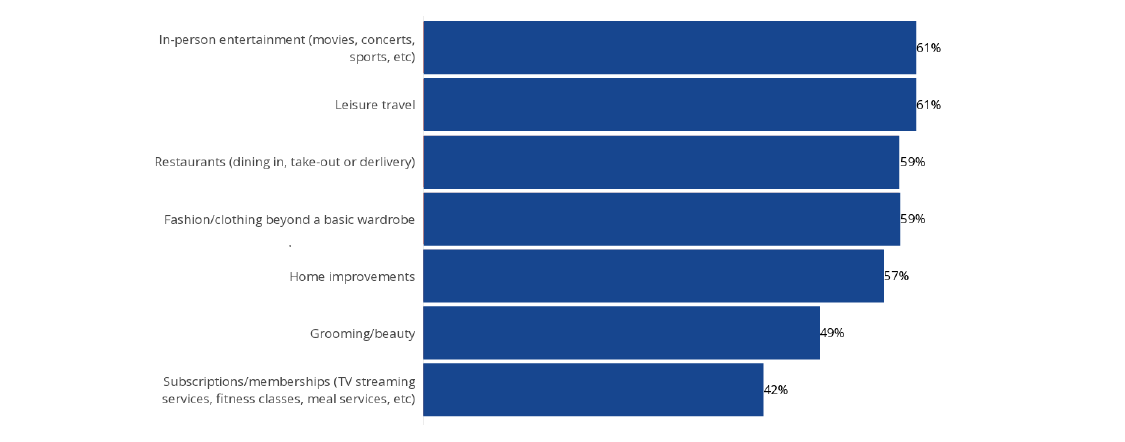

Compared with the beginning of 2022, % spending less on these "non-essentials"

Source: Dynata Global Consumer Trends, Q3 2022.

Similar findings come from Dynata, which found that about half (53%) of the people in 11 researched countries are (slightly) struggling to afford basic needs, while three quarters (73%) are (slightly) struggling to afford non-essential expenses. As the graph below shows, people are spending less on entertainment, leisure travel, clothes, beauty services and home improvements.2

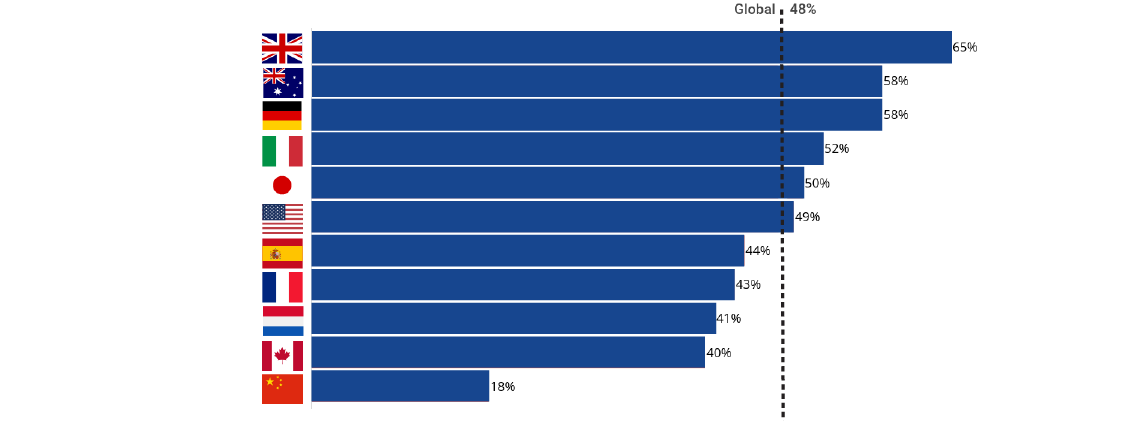

Doing more at home can provide significant cost savings for thrifty households. In our June blog, we described how households have been installing smart home solutions – such as solar panels, energy management systems and heat pumps – to lower their cost of living. While energy is one of the most significant areas for saving money (see graph), now people are also exploring other options.

People are struggling to pay their energy bills

% Struggling to afford energy/utilities now

Source: Dynabyte Global Consumer Trens, Q3 2022.

People are creating new moments in home

Moreover, these home-based behaviors are increasingly becoming a good alternative for the conventional way of doing things. IRI1 notes that people are creating new occasions and moments for familiar everyday products, such as packed lunches at work and specialty coffees or pre-mixed drinks at home.

Instead of eating out or ordering in, people preparing more meals at home to save money. Smart home solutions, such as meal kit delivery services, recipe apps, or streamed cooking content (e.g. Cheflix) can make it easier to create restaurant-style meals at home. In addition, more can be saved by reducing food waste, an area that several smart fridges are already helping with by checking expiry dates.

Our homes offer a valuable alternative

Normally during recessions, people do not stop doing things altogether; instead they look for cheaper alternatives or go out less often. In the past, they would go to the movies instead of a concert. Today, they might prefer to play the newest games or watch popular films on the home entertainment system. With an implied cost per hour of $0.49, video games or streaming are less expensive than movie theaters ($5), theme parks ($12.50), sports events ($16.67), or concerts ($33.33).3

Some experiences, however, are still best experienced in real life. For instance, the experience gap between a real concert and a virtual one is still significant. The question is, though, will that remain the case? While the global live-music industry has seen a 5% compound annual growth rate in 2022 – on par with the growth between 2007 and 20194 and despite several high-profile cancellations – not everybody will be able to pay out an average $108 per ticket5.

This makes a reasonable case for virtual concerts, and several artists (including Ariana Grande, Justin Bieber, and Marshmello) are already experimenting with it.6

The examples from food, drink and entertainment show that our homes can offer a valuable alternative in the relative choices we have to make when deciding where to spend our money. This does not mean we will no longer go out, but by doing more in the home, and making full use of the technology inside it, we can become more resilient to deal with the tough times ahead.

1 https://www.iriworldwide.com/nl-nl/insights/news/demand-signals-2

2 Dynata Global Consumer Trends – Staying ahead of the downturn Q3 2022

3 Bernstein, US Media Roadshow, May 2018

4 https://www.billboard.com/pro/touring-recession-music-fans-buy-concert-tickets/

5 https://news.pollstar.com/2022/06/24/concert-industry-roars-back-pollstar-2022-mid-year-report/

6 https://www.hypebot.com/hypebot/2022/11/10-superstars-that-have-performed-in-the-metaverse.html

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from Dasym Managed Accounts B.V. with registered address at Flevolaan 41 A, 1411 KC Naarden, the Netherlands (DMA), DMA is an investment company incorporated under Dutch law and regulated by the Dutch Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). The information prepared by DMA is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. The views and opinions expressed in this presentation are those of the author(s) but not necessarily those of DMA. DMA and its associated and affiliated companies (together “Dasym”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Dasym makes no representation or warranty, express or implied, as to the accuracy or completeness of any of the information contained in this blog. Dasym undertakes no responsibility to update the information prepared by it and contained in this blog.

This information is published by VanEck (Europe) GmbH. VanEck (Europe) GmbH, with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin). The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Smart Home Active UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, engaged Dasym Managed Accounts B.V., an investment company regulated by the Dutch Financial Service Supervisory Authority (AFM), as the investment advisor for the Fund. The Fund is registered with the Central Bank of Ireland and actively managed. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the following local information agents:

UK - Facilities Agent: Computershare Investor Services PLC

Austria - Facility Agent: Erste Bank der oesterreichischen Sparkassen AG

Germany - Facility Agent: VanEck (Europe) GmbH

Spain - Facility Agent: VanEck (Europe) GmbH

Sweden - Paying Agent: Skandinaviska Enskilda Banken AB (publ)

France - Facility Agent: VanEck (Europe) GmbH

Portugal - Paying Agent: BEST – Banco Eletrónico de Serviço Total, S.A.

Luxembourg - Facility Agent: VanEck (Europe) GmbH

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Discrete performance shows 12-month performance to the most recent quarter-end for each of the last 10 years where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 months period and so on.

Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Dasym and VanEck.

© VanEck (Europe) GmbH / Dasym Managed Accounts B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

12 March 2024

09 February 2024

16 January 2024

08 December 2023