Semiconductor ETF

VanEck Semiconductor UCITS ETF

Semiconductor ETF

VanEck Semiconductor UCITS ETF

Fund Description

Electrify your portfolio with the VanEck Semiconductor UCITS ETF. Semiconductors are at the heart of today’s tech revolution, yet just a small number of companies make them. Invest in the companies involved in semiconductor production and equipment.

-

NAV$39.09

as of 03 May 2024 -

YTD RETURNS17.10%

as of 03 May 2024 -

Total Net Assets$1.8 billion

as of 03 May 2024 -

Total Expense Ratio0.35%

-

Inception Date01 Dec 2020

-

SFDR ClassificationArticle 8

Overview

Fund Description

Electrify your portfolio with the VanEck Semiconductor UCITS ETF. Semiconductors are at the heart of today’s tech revolution, yet just a small number of companies make them. Invest in the companies involved in semiconductor production and equipment.

- Benefit from the digital revolution

- Europe’s first semiconductor ETF

- Pure play semiconductor stocks, i.e. companies that derive at least 50% of revenues from semiconductors or related activities

- Highly liquid semiconductor stocks, based on market capitalization and trading volume

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.

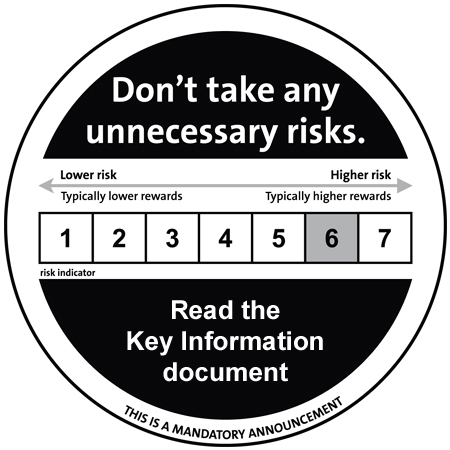

Risk Factors: Liquidity risks, equity market risk, foreign currency risk, risk of investing in the IT industry, industry or sector concentration risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS US Listed Semiconductor 10% Capped ESG Index

Fund Highlights

- Benefit from the digital revolution

- Europe’s first semiconductor ETF

- Pure play semiconductor stocks, i.e. companies that derive at least 50% of revenues from semiconductors or related activities

- Highly liquid semiconductor stocks, based on market capitalization and trading volume

- Excludes companies that severely violate UN Global Compact Principles or derive any revenue from Controversial Weapons according to ISS data.

- Excludes companies that derive more than 5% of their revenue from sectors including, but not limited to Thermal Coal, Fossil Fuels, Oil Sands, Nuclear Power, Civilian Firearms, Military Equipment and Tobacco.

Risk Factors: Liquidity risks, equity market risk, foreign currency risk, risk of investing in the IT industry, industry or sector concentration risk. Please refer to the

and the Prospectus for other important information before investing.

Underlying Index

MVIS US Listed Semiconductor 10% Capped ESG Index