MVAL ETF and MGRO ETF: Question & Answer

March 27, 2024

Read Time 3 MIN

- How does Morningstar identify moat companies?

- How are the MGRO and MVAL indices constructed?

- How does Morningstar determine its style score?

- What is the overlap of MGRO and MVAL with MOAT?

- What are the relative sector exposures of MVAL and MGRO?

- How should investors use MGRO and MVAL in relation to MOAT?

- How can investors buy VanEck’s MVAL ETF and MGRO ETF?

Moat investing is based on a simple concept: invest in companies with sustainable competitive advantages. Morningstar builds on this philosophy by seeking out moat stocks trading at attractive valuations relative to their equity research team’s forward-looking estimate of fair value. This approach has stood the test of time, with the live track record for the Morningstar® Wide Moat Focus IndexSM exceeding 15 years.

With the launch of the VanEck Morningstar Wide Moat Growth (MGRO) and VanEck Morningstar Wide Moat Value (MVAL) ETFs, Morningstar’s proven strategy of identifying quality companies trading at attractive valuations is now available for investors seeking targeted growth and value exposure.

How does Morningstar identify moat companies?

Morningstar has identified five attributes that may contribute to a company’s moat: switching costs, intangible assets, network effect, cost leadership and efficient scale. Companies may demonstrate one or a combination of these five sources of moat.

To determine the width of a company’s moat, Morningstar analysts consider the nature of the company’s competitive advantage and how effectively it will persist given the industry in which the company operates. Companies are assigned one of three economic moat ratings: none, narrow or wide. Having a wide moat means Morningstar believes the company can maintain its competitive advantage for at least the next 20 years, and a narrow moat means the company can do this for at least 10 years. A company with no moat either has a competitive advantage that is not sustainable or no advantage, according to Morningstar. (For more on how Morningstar analysts determine a company’s moat rating, read MOAT ETF: Question & Answer.)

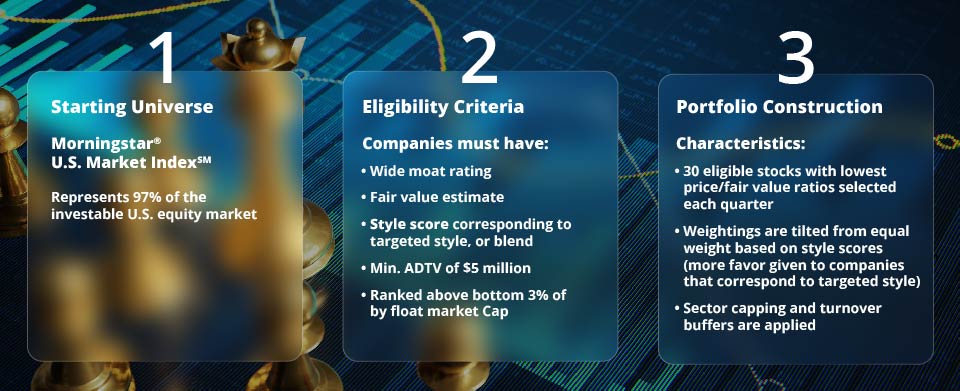

How are the MGRO and MVAL indices constructed?

From a fundamental perspective, MGRO and MVAL use the same rigorous screening process as the VanEck Morningstar Wide Moat ETF (MOAT). Morningstar’s 100 equity analysts follow a consistent, forward-looking research methodology that includes its economic moat rating and fair value estimate based on Morningstar’s proprietary discounted cash flow model. To be eligible for the index, companies must have a wide moat rating and an attractive price-to-fair-value ratio. For MGRO and MVAL, the strategies apply an additional screen to identify stocks with growth and value characteristics, respectively.

Visit the fund page for the fact sheet, holdings, performance and more.

How does Morningstar determine its style score?

Morningstar’s style score aligns with the Morningstar Style Box and informs the eligibility and weighting scheme of MGRO and MVAL.

In MVAL, inputs into the style score include traditional value metrics such as a stock’s historical price-to-book and price-to-sales ratios. MGRO inputs include traditional growth metrics like historical earnings and sales growth. Both MVAL and MGRO also include a forward looking metric to determine the style score (price-to-projected earnings for MVAL and long-term projected earnings growth for MGRO).

What is the overlap of MGRO and MVAL with MOAT?

In general, investors should expect a high overlap between MOAT and the style indices MGRO and MVAL, which select from the same pool of 140 – 150 U.S. wide moat companies.

However, at any point in time, MOAT can have more overlap with one of the two style indices. For example, MOAT’s current value bias results in very high overlap between its index and the MVAL index.

Visit the fund page for the fact sheet, holdings, performance and more.

What are the relative sector exposures of MVAL and MGRO?

Sector exposure will vary due to the active share associated with a concentrated portfolio as well as the impact of the moat and valuation screens. Both indices have dynamic index sector exposure, as companies doing business in various segments of the market have become more or less attractively priced. Historically, MGRO has had more consumer cyclical and technology sector exposure, while MVAL has had more healthcare and financial services exposure.

How should investors use MGRO and MVAL in relation to MOAT?

MGRO and MVAL are intended for investors who have a strategic view on growth and value and want to gain targeted style exposure in their portfolios. Conversely, MOAT allows Morningstar valuation research to influence style exposures over time and should be thought of more as a core equity allocation.

Regardless of the specific reason, investors seeking to allocate to value and/or growth companies should look for a strategy that does more than just provide broad-market exposure. We believe the focused approach of MGRO and MVAL, which selectively identifies companies by considering competition and competitive advantages as well as valuations, may be a better choice.

How can investors buy VanEck’s MVAL ETF and MGRO ETF?

Learn more here: VanEck Morningstar Wide Moat Growth ETF and VanEck Morningstar Wide Moat Value ETF.

To receive more Moat Investing insights, sign up in our subscription center.

Related Topics

Related Insights

April 10, 2024

IMPORTANT DISCLOSURES

Return on Invested Capital (ROIC) – a performance ratio that aims to measure the percentage return that a company earns on invested capital and shows how efficiently a company uses funds to generate income.

Weighted Average Cost of Capital (WACC) – the average rate that a business pays to finance its assets. This is calculated by averaging the rate of all the company’s sources of capital weighted by the proportion of each component.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

The Morningstar® Wide Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Morningstar Wide Moat ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Wide Moat Focus IndexSM is a service mark of Morningstar, Inc.

The Morningstar® Wide Moat Focus IndexSM consists of U.S. companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

Index returns are not representative of fund returns. Investors cannot invest directly in the Index.

An investment in the VanEck Morningstar Wide Moat ETF (MOAT®) may be subject to risks which include, among others, risks related to investing in equity securities, consumer discretionary sector, health care sector, industrials sector, information technology sector, financials sector, medium-capitalization companies, market, operational, high portfolio turnover, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversification and index-related concentration risks, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks.

An investment in the VanEck Morningstar Wide Moat Value ETF (MVAL) may be subject to risks which include, among others, risks related to investing in equity securities, value style investing, financials sector, health care sector, industrials sector, large- and medium-capitalization companies, market, operational, index tracking, authorized participant concentration, new fund, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount and liquidity of fund shares, non-diversified, and index-related concentration risks, all of which may adversely affect the Fund. Large- and medium-capitalization companies may be subject to elevated risks. The Fund’s value strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole. Furthermore, the value companies identified by the Index provider may not operate as expected, and there is no guarantee that the index provider’s proprietary valuation model will perform as intended.

An investment in the VanEck Morningstar Wide Moat Growth ETF (MGRO) may be subject to risks which include, among others, risks related to investing in equity securities, growth style investing, consumer discretionary sector, industrials sector, financials sector, large- and medium-capitalization companies, health care sector, information technology sector, market, operational, index tracking, authorized participant concentration, new fund, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount and liquidity of fund shares, non-diversified, and index-related concentration risk, all of which may adversely affect the Fund. Large- and medium-capitalization companies may be subject to elevated risks. The Fund’s growth strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole. Furthermore, the growth companies identified by the Index provider may not operate as expected, and there is no guarantee that the index provider’s proprietary valuation model will perform as intended.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck ETFs carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck AssociatesCorporation.

Related Funds

IMPORTANT DISCLOSURES

Return on Invested Capital (ROIC) – a performance ratio that aims to measure the percentage return that a company earns on invested capital and shows how efficiently a company uses funds to generate income.

Weighted Average Cost of Capital (WACC) – the average rate that a business pays to finance its assets. This is calculated by averaging the rate of all the company’s sources of capital weighted by the proportion of each component.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its employees.

The Morningstar® Wide Moat Focus IndexSM was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the VanEck Morningstar Wide Moat ETF and bears no liability with respect to that ETF or any security. Morningstar® is a registered trademark of Morningstar, Inc. Morningstar® Wide Moat Focus IndexSM is a service mark of Morningstar, Inc.

The Morningstar® Wide Moat Focus IndexSM consists of U.S. companies identified as having sustainable, competitive advantages and whose stocks are attractively priced, according to Morningstar.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

Index returns are not representative of fund returns. Investors cannot invest directly in the Index.

An investment in the VanEck Morningstar Wide Moat ETF (MOAT®) may be subject to risks which include, among others, risks related to investing in equity securities, consumer discretionary sector, health care sector, industrials sector, information technology sector, financials sector, medium-capitalization companies, market, operational, high portfolio turnover, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversification and index-related concentration risks, all of which may adversely affect the Fund. Medium-capitalization companies may be subject to elevated risks.

An investment in the VanEck Morningstar Wide Moat Value ETF (MVAL) may be subject to risks which include, among others, risks related to investing in equity securities, value style investing, financials sector, health care sector, industrials sector, large- and medium-capitalization companies, market, operational, index tracking, authorized participant concentration, new fund, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount and liquidity of fund shares, non-diversified, and index-related concentration risks, all of which may adversely affect the Fund. Large- and medium-capitalization companies may be subject to elevated risks. The Fund’s value strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole. Furthermore, the value companies identified by the Index provider may not operate as expected, and there is no guarantee that the index provider’s proprietary valuation model will perform as intended.

An investment in the VanEck Morningstar Wide Moat Growth ETF (MGRO) may be subject to risks which include, among others, risks related to investing in equity securities, growth style investing, consumer discretionary sector, industrials sector, financials sector, large- and medium-capitalization companies, health care sector, information technology sector, market, operational, index tracking, authorized participant concentration, new fund, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount and liquidity of fund shares, non-diversified, and index-related concentration risk, all of which may adversely affect the Fund. Large- and medium-capitalization companies may be subject to elevated risks. The Fund’s growth strategy may result in the Fund investing in securities or industry sectors that underperform the market as a whole. Furthermore, the growth companies identified by the Index provider may not operate as expected, and there is no guarantee that the index provider’s proprietary valuation model will perform as intended.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck ETFs carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck AssociatesCorporation.